Highlights:

- Avalon Labs has boosted its ecosystem with the completion of its $1.88 million AVL tokens buyback and burn.

- The company purchased 13.95 million AVL at $0.1347 per token in its most recent purchase.

- Avalon Labs reported that it has permanently eliminated 37% of its circulating pool since the burns operation began.

Avalon Labs has completed a massive $1.88 million buyback and burn of its native AVL token. The team behind the project announced the move in a tweet on September 10. According to the X post, the move is targeted towards creating sustainable and long-term value for Avalon’s ecosystem and community members.

Avalon Labs’ buyback and burn initiative commenced in June 2025, following the company’s deposit of 1.88 million USDT into Bybit. The company used the deposited funds to buy back AVL at an average cost of $0.1347 per token. In its most recent buyback, Avalon Labs purchased 13.95 million AVL tokens, which it permanently eliminated from the token’s supply pool.

We’re pleased to announce the successful completion of a $1.88 million AVL token buyback and burn, reinforcing our long-term commitment to creating sustainable value for our community and ecosystem.

As part of this program, Avalon Labs deposited 1.88 million USDT into Bybit… pic.twitter.com/ADzrrfjfaM

— Avalon Labs (@avalonfinance_) September 10, 2025

In June 2025, Avalon Labs burned 80 million AVL tokens, bringing the total number of burned tokens since the operation began to 93,955,164. Overall, the company has permanently removed about 37% of its native AVL tokens from circulation.

Avalon Labs stated:

“We remain committed to advancing our mission of building the leading on-chain capital market for Bitcoin, and will continue to explore sustainable mechanisms to strengthen the Avalon ecosystem.”

Remarkably, Avalon Labs noted that the initiative was fully funded with proceeds from its monthly protocol revenue, highlighting strong and consistent platform patronage. “This initiative underscores our dedication to aligning protocol growth with community interests, while enhancing long-term value for AVL holders,” The company added.

Possible Implications as Avalon Labs Completes $1.88M AVL Token Buyback

Avalon Labs has undoubtedly attracted market participants’ attention with its impressive burn and buyback record. Analysts on X have spoken highly of the project and its positive influence on AVL’s price action.

This is bullish for $AVL

Nearly 14M $AVL burned and 37% of supply already gone…

up and to the right!— Daddy Shill 🤚 (@Shill_Me_Daddy) September 10, 2025

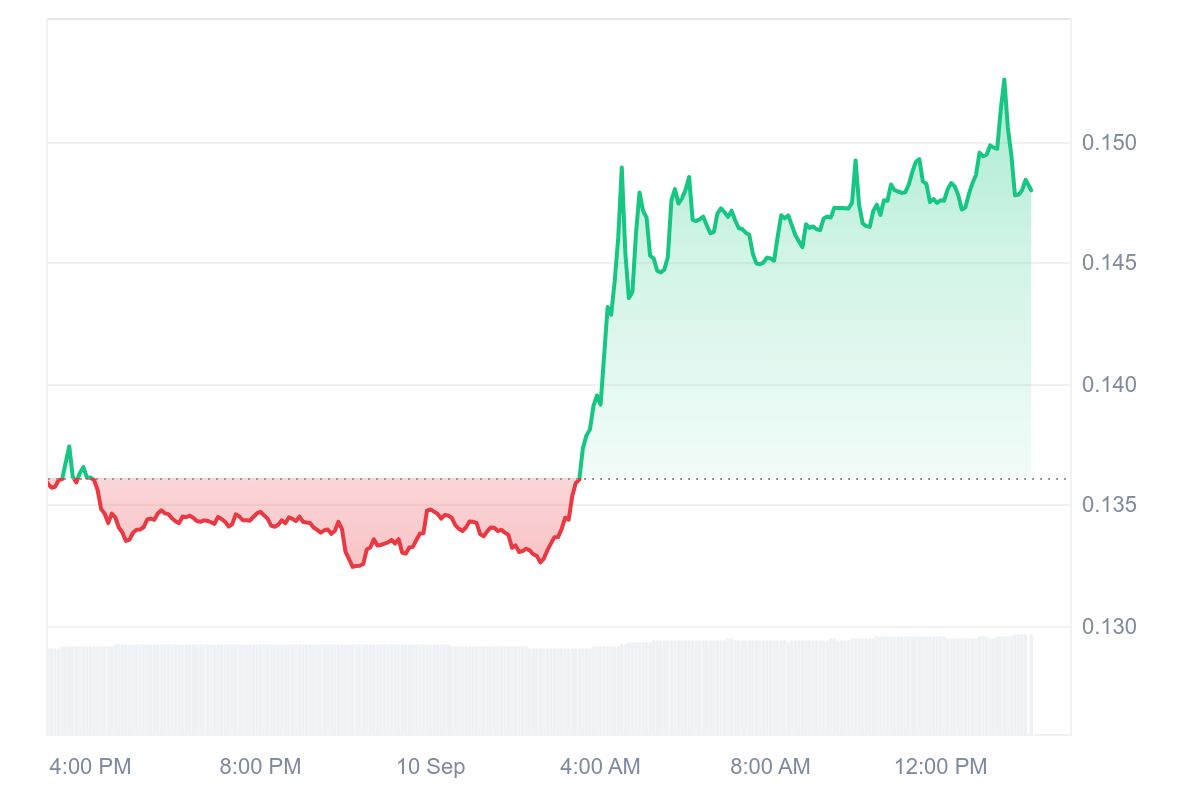

At the time of writing, AVL is changing hands at about $0.1504 following a 10.8% upswing in the past 24 hours, with price extremes fluctuating between $0.1324 and $0.1521. Its 7-day-to-date and 14-day-to-date data reflected increments of about 18.7% and 10%, respectively. However, the token is down 1% month-to-date.

On Coincodex, AVL’s 24-hour trading has increased to $22.3 million with a $24.18 million market capitalisation. The token’s volatility is high at 6.52% with a bullish sentiment and a neutral “Fear & Greed Index.” Notably, risk assessment showed significant risks.

For context, AVL is trading below its 200-day simple moving average (SMA) of $0.195. It is 80% below its all-time high (ATH) of $0.758 attained in March 2025. Additionally, less than 16% of the AVL total supply is in circulation, suggesting that the token’s price could suffer significant declines if the locked tokens are released too rapidly. Moreover, AVL is a relatively new token that started trading in February 2025. Hence, its risk profile has some upsides. These include 18 profitable days in the past 30 days and a high liquidity based on the token’s market cap.

Investment Firms Show Growing Interest in Buyback Programs

On September 9, Crypto2Community reported that SharpLink Gaming, the world’s second-largest Ethereum (ETH) treasury firm, initiated a massive $1.5 billion share buyback. The company believes market participants undervalue its common stock and hopes to restore value with the buyback program.

The Ethereum holding company has already repurchased 939,000 shares and plans to purchase more using available cash and other operational proceeds. In December 2024, CleanSpark, a leading Bitcoin mining firm, announced the completion of a $145 million stock buyback for 11.76 million shares. The Bitcoin mining firm noted that the move aligns with its strategy of increasing shareholders’ value.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.