Highlights:

- The Avalanche price is building up for a massive rally, currently up 10% to $28.

- AVAX funding rate steadies, hinting at growing investor optimism.

- The bullish technicals hint at 42% gains as bulls take control.

The Avalanche price is maintaining a steady momentum, rising 10% to $28.45. Accompanying the price movement is its daily trading volume, which is up 60% to $1.38 billion, showing growing investor optimism. Further, the AVAX token is experiencing an era of increasing optimism in the cryptocurrency market. Its technical signals are encouraging, as the project has broken out beyond the most important resistance points.

As noted in the recent charts, AVAX has been on an upward trend, and it is after several unsuccessful attempts to overcome key resistance trendlines. Recent price development, however, indicates that AVAX can be on the verge of a major upswing. According to crypto analyst CryptoBull 360, the Avalanche price has soared, and it might hit the $45 or even $50 mark should the bullish trend persist.

🚀💎 #AVAX gearing up for a MONSTER rally! After multiple failed tests, it’s finally breaking out above trendline resistance 📈

🔥 If bulls hold this zone, $45–$50+ is on the cards 💰⚡ Volume surging = momentum is REAL! 🐂👀$AVAX #AVAXUSDT pic.twitter.com/vCWz7rVFH5

— CryptoBull_360 (@CryptoBull_360) September 10, 2025

The chart accompanying it indicates that the Avalanche price has pushed above the resistance level, thus indicating a breakout that could see the price soaring to new heights. In addition, the share volatility, along with the positive price movement, suggests that the market mood is improving. This will be a crucial aspect of the success of this rally because the bulls need to preserve the price above the breakout point.

AVAX Market Sentiment and Technical Outlook

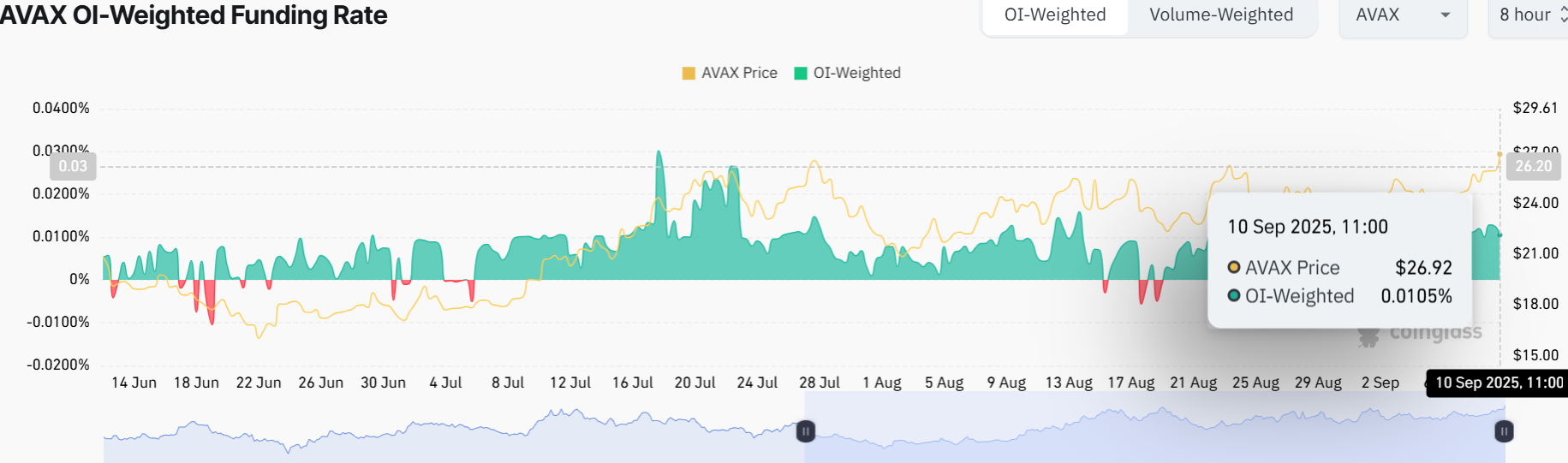

The recent AVAX performance has been significant, as the market sentiment portrays positive momentum, as demonstrated by the OI-Weighted Funding Rate chart. The rate of funding, which is the cost of keeping long or short positions in the derivatives markets, has been increasing steadily. This indicates a greater commitment from traders betting on the price increase to rise even higher.

With the AVAX funding rate at 0.0105%, this high increase in the funding rate of funds indicates the bullish thesis. In other words, the traders will be more willing to keep a long position as the price rises. Additionally, the AVAX/USD daily chart shows a breakout above the rising channel. This indicates that the bulls have put their best foot forward, aiming for more gains. Further, the immediate support zones at $24 and $21 tilt the odds towards the bulls.

The technical indicators, including the Relative Strength Index (RSI) at 67.31, are nearing overbought territory. This cautions traders not to get too greedy yet. Meanwhile, the Moving Average Convergence Divergence (MACD) is showing increasing green bars in size. Further, the MACD line (blue) is going parabolic above the signal line (orange), hinting at bullish momentum.

Avalanche Price May Jump 42% Soon

Looking at the technical indicators, it seems Avalanche price is entering into an overdrive zone that could push it higher into the RSI overbought zone before a pullback. This could take the AVAX price to $32-$36 resistance mark.

Volume is also solid, up 60%, signaling that AVAX may continue higher until buyers get exhausted and profit-taking kicks in. The 10% pump and breakout suggest that Avalanche’s price could push toward $40, marking 42% gains, if bulls hold the line. If early profiteerin kicks in, a drop towards $24 support zone may also be imminent. In the meantime, traders should keep an eye on the RSI to evade the bull trap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.