Highlights:

- The BTC price aims to overcome the $115K resistance as it increases by 0.5% today.

- A buy signal has emerged in the BTC market, signalling potential upside.

- BTC open interest and the Long/short ratio indicate investor optimism and a potential price rebound.

The Bitcoin price commenced the week in recovery mode, currently up 0.5% to $110,123. Accompanying the price outlook is its daily trading volume, which has soared 12% to $64.34 billion, indicating growing investor optimism. Meanwhile, the recent market action of Bitcoin represents an interesting trend in the ongoing bull cycle.

According to crypto analyst Axel Adler Jr., the current downtrend in Bitcoin’s price is nearing the -12.8% mark relative to its all-time high (ATH). During normal bull markets, Bitcoin typically experiences lows of between -10% and -18% following local peaks. More profound corrections have tended to go deeper to -20% or -30%.

The current BTC drawdown is −12.8% from the ATH.

In this bull cycle, pullbacks after local peaks have mostly clustered in the −10% to −18% range, while deeper corrections have typically extended to −20% to −30%. At −12.8%, we’re closer to the moderate zone, consistent… pic.twitter.com/Z2deM91HRp

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 2, 2025

A pressure score of 30% indicates that the market remains vulnerable to adverse market shocks. This level of pressure indicates that leveraged long positions are also at risk, primarily due to the market registering some minor downturns. Once these market roles start to unwind, this may lead to some downward price action, providing insight into how Bitcoin may experience choppy sideways price action, as noted in the second chart.

Derivative pressure remains elevated – baseline: pullback via long de-leveraging.

Pressure Score at 30% sits in the upper band, keeping the market vulnerable to downside jolts. The orange cluster markers on price favor continued chop lower/sideways as longs are de-leveraged on… pic.twitter.com/XZLAzAhHFI

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) September 2, 2025

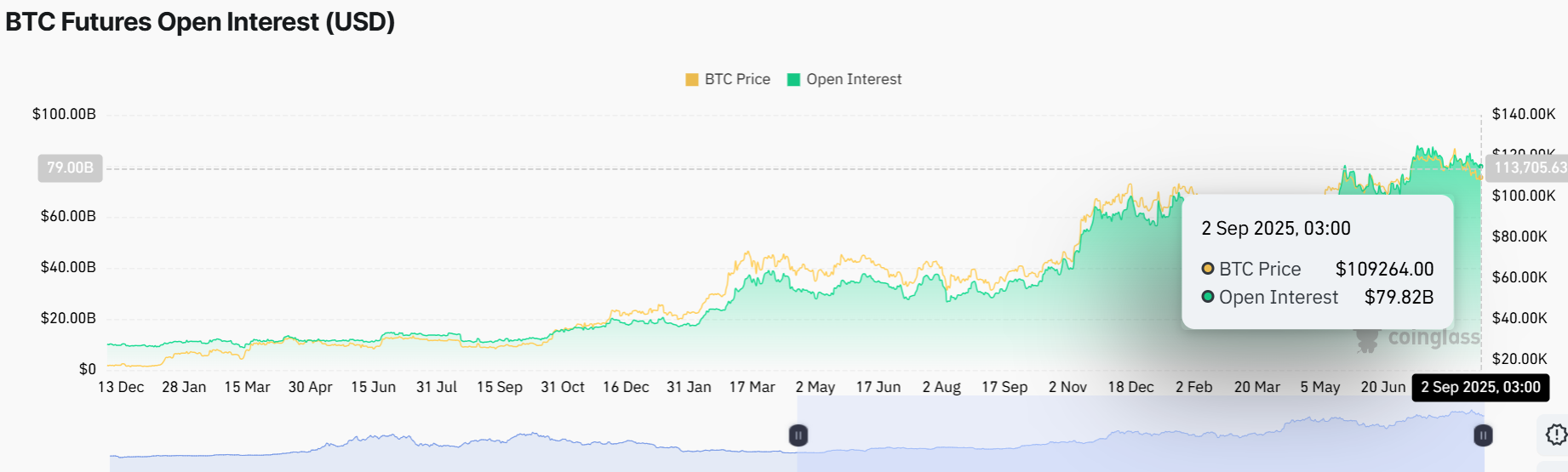

Open Interest and Derivative Pressure in the BTC Market

Additional market data suggest a strong correlation between the price action of Bitcoin and open interest in the futures markets. The open interest is steady at $79.82B. Should the OI stabilize in the next few days, then it will be a positive sign that Bitcoin prices will rise.

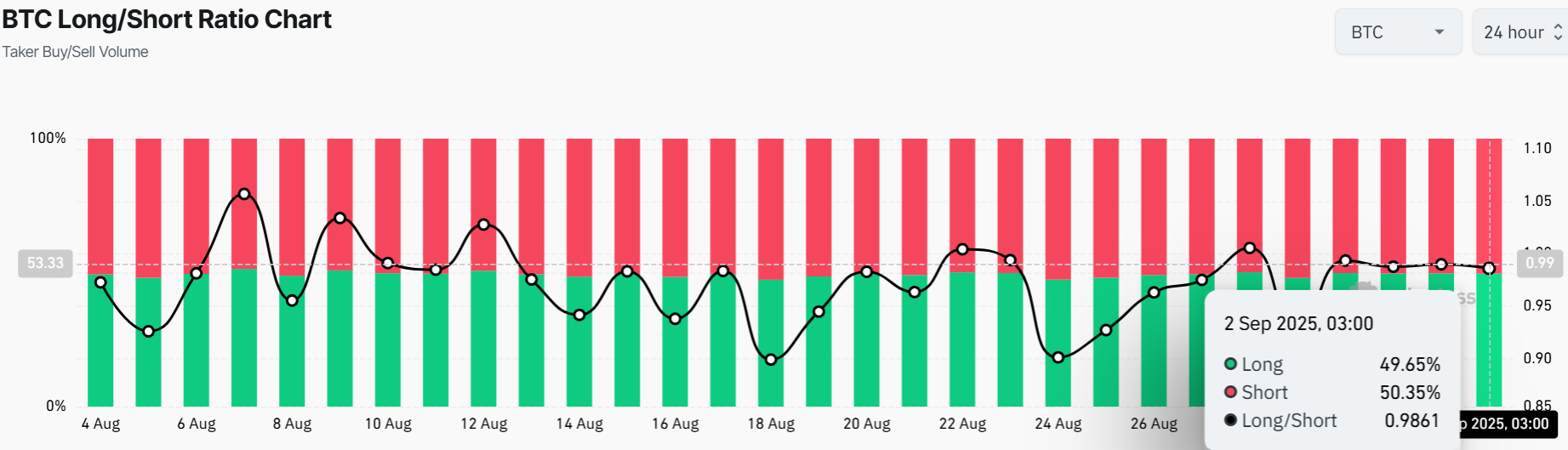

On the other hand, the market is nearly balanced with 49.65% long and 50.35% short as per the latest data. This balance implies that the market is uncertain about the direction of Bitcoin in the short term. The close-to-1 value of the ratio indicates that traders are hedging their bets, waiting to see a breakout or a breakdown.

Bitcoin Price Poised for a Rally Towards $120K and Above

The BTC/USD 1-day chart action indicates that the altcoin is poised for a rebound, as a buy signal emerges. Moreover, strong support at $107K, gives the bulls strength to push further. Meanwhile, the immediate resistance at $115,753 cushions the bulls against further upside. If the BTC price breaks above this level, a rally towards $120K and beyond is imminent.

Technical indicators, including the RSI, indicate a potential rebound, as it currently sits at 42.84 and is trending upward. BTC’s trading volume has increased by over 12% in the last 24 hours, supporting the current breakout move. If the bulls overcome the $115,753 resistance, Bitcoin price could pump towards $120K and beyond in the short term. Moreover, a buy signal has emerged in the BTC market, according to Ali Martinez, calling for more buy orders in the BTC market.

Buy signal on Bitcoin $BTC daily chart per the TD Sequential indicator! pic.twitter.com/DOqfBimaOF

— Ali (@ali_charts) September 2, 2025

However, if the resistance level proves too strong, BTC may consolidate or move towards the downside. In such a case, the $107,000 key support will serve as a safety net.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.