Highlights:

- The XRP price has soared 3% to $3.01 in a day.

- Crypto analyst predicts further downside as the token fails to break above $3.10.

- Technical indicators signal further downside as the bears target $2.80.

XRP price has surged 3% in a day to $3.01 mark, despite its trading volume slipping 12% to $6.42 billion. Recently, the XRP price surged towards $3.07, indicating a bullish momentum. However, the cross-border payment token was rejected and declined to $2.97 before regaining $3.01.

Meanwhile, a well-known analyst, Ali Martinez, has predicted a potential drop in XRP Price. According to Ali, as “XRP failed to break above $3.10, the token could retrace to $2.83 mark.”

$XRP failed to break $3.10 and could retrace to $2.83! pic.twitter.com/1FyAErJ5yc

— Ali (@ali_charts) August 27, 2025

As we continue to monitor the trend of XRP, the following are important levels that traders and investors should watchresistance at 3.10 and support at 2.83.

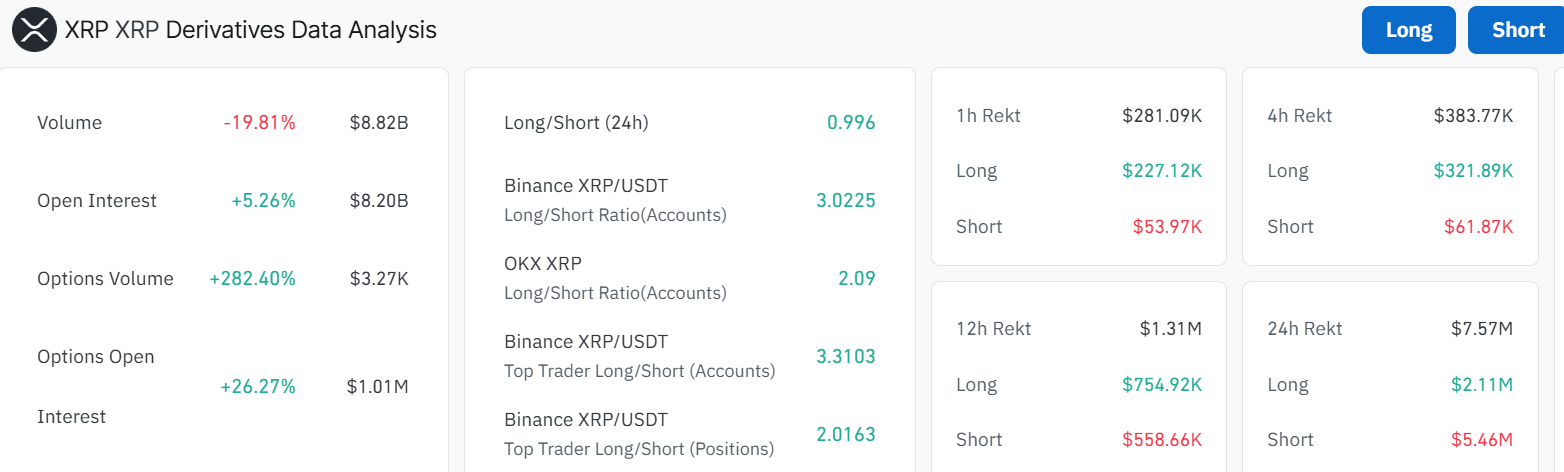

The recent XRP derivatives data give a conflicting picture of trader sentiment. Open interest is also on the rise, with XRP gaining 5.26% to $8.20 billion, a sign of increased interest in the asset despite recent setbacks in its performance. Furthermore, the volume of options traded in XRP has increased by more than 280%, indicating a growing interest among traders in using options contracts.

Nonetheless, there is a minor drop of 19.81% in volume to $8.82 billion, indicating a calming down of the total market rush of XRP. Despite this, the number of open positions remains high, as evidenced by the rising options open interest. This suggests that immediate trading may have decreased, but the long-term XRP community sentiment remains largely unaffected.

Based on the long and short ratios of XRP on various platforms, we can conclude that the sentiment is slightly bullish. The long-to-short ratio on Binance XRP/USDT stands at 3.0225, indicating that more traders are Long than short. This may signal optimism about the possibility of a breakout, though the inability to cross the resistance line at 3.10 levels indicates short-term caution.

XRP Price Faces Rejection at $3.07 as the Bears Push for Rejection

The 1-day chart timeframe shows that the XRP price is trading well within a symmetrical triangle. However, the immediate resistance at $3.07 cushions the buyers against further upward movement. However, with the support at $2.47 intact, the bulls may gain the strength and prevent further downside.

The Relative Strength Index is below the 50-mean level at 48.89. This shows some neutral-to-bearish sentiment. However, if the bulls show momentum, a spike above the 50-mean level will invalidate the bearish grip. The MACD shows a sell signal. This cautions traders of a further downside, as the orange signal has crossed above the blue MACD line, entering positive territory.

What’s Next for XRP?

In the short term, the chart screams caution. The recent rejection and bearish technical indicators signal potential downside. Nevertheless, for risk-taking investors, a dip to the $2.80-$2.84 range could be a good entry point. Over the next few days, traders could expect a consolidation between $3.00 and $2.84 as traders figure out the next move.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.