Highlights:

- Metaplanet has disclosed plans to raise $881 million to finance the company’s BTC expansion project.

- The company intends to use $44 million from the expected net proceeds to cater to Bitcoin-related expenses.

- Metaplanet will use $837 million to purchase BTC between September and October 2025.

On August 27, Japanese crypto investment firm Metaplanet announced a new fundraising program aimed at expanding its Bitcoin treasury. According to a shared document from Metaplanet, the company plans to issue new shares via an international offering.

The Japanese firm expects net proceeds of around $881 million from the share sales. Metaplanet will purchase more BTC with $837 million between September and October 2025. The remaining $44 million will fund the company’s Bitcoin-related operations.

*Notice Regarding Issuance of New Shares by way of International Offering* pic.twitter.com/wvvepNrXpH

— Metaplanet Inc. (@Metaplanet_JP) August 27, 2025

Metaplanet’s fundraising program forms part of its long-term goal of accumulating over 210,000 BTC by the end of 2027. Notably, the company had earlier aimed to acquire 10,000 BTC before the end of this year. However, it exceeded the goal, resulting in a bigger target. On August 25, Metaplanet announced an $11.78 million Bitcoin purchase, adding 103 BTC to its treasury. This increased the investment firm’s BTC holdings to about 18,991 BTC, valued at approximately $1.94 billion.

Nature of Metaplanet’s New Shares

The investment firm plans to issue 555 million new shares, sold in units of 100. The shares will come from two sources highlighted in Metaplanet’s announcement.

The investment firm stated:

“180 million shares of common stock of the company to be underwritten and purchased by the Underwriters, plus an additional 375 million shares of common stock of the company, which may also be underwritten and purchased by the Underwriters.”

Metaplanet also set share pricing between September 9 and September 11, 2025. This will follow the provisions in Article 25 of the Japan Securities Dealers Association (JSDA). The investment firm will offer the shares only in markets outside Japan. Offering sales in the United States will be restricted to qualified institutional buyers as defined under Rule 144A of the U.S. Securities Act of 1933.

Metaplanet also noted that it has no plans to pay underwriting fees to the Underwriters. Payment dates will be between September 16 and 18, 2025, depending on the pricing date. Delivery date will be on the business day following the payment date.

Metaplanet, a Japanese listed company, plans to raise ¥130.334 billion ($881 million) through an international share offering. The funds will be used to purchase ¥123.818 billion ($837 million) in Bitcoin between September and October 2025 and allocate ¥6.516 billion ($44…

— Wu Blockchain (@WuBlockchain) August 27, 2025

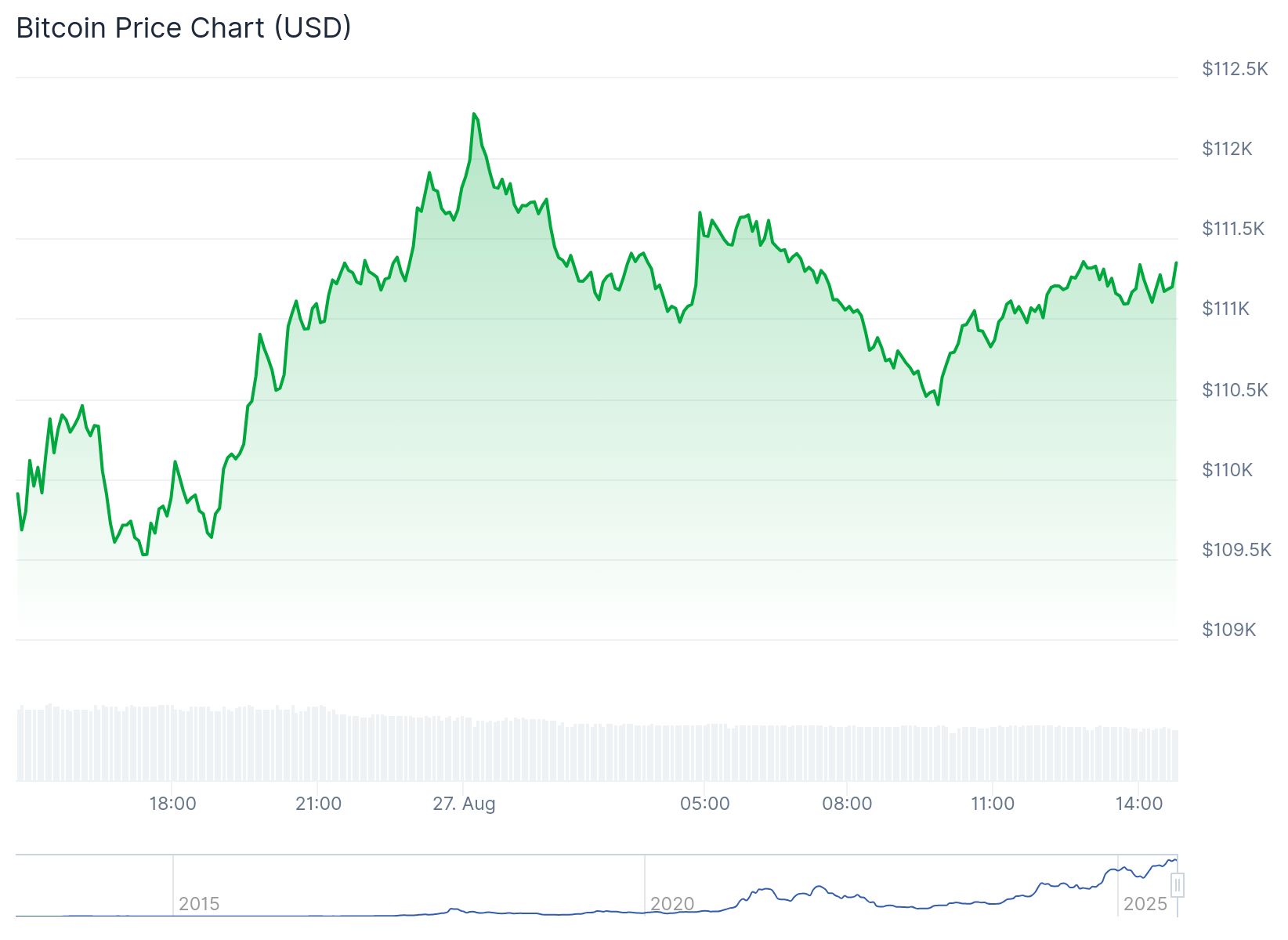

BTC Price Recovers Slightly as Metaplanet’s Plans to Raise $881M

After dropping below $110,000 yesterday, Bitcoin has recovered slightly with a 0.9% upswing in the past 24 hours. The flagship crypto is changing hands at $111,240 and has oscillated between $109,526 and $112,279.

Bitcoin’s longer-term price performance remains in the red as the token continues to struggle to reclaim previous highs. For context, BTC is down 2.2% 7-day-to-date, 7.8% 14-day-to-date, and 6.4% month-to-date. Following its slight recovery, BTC’s market capitalisation reached $2.215 trillion, while its 24-hour trading volume was $37.4 billion. Meanwhile, considering BTC’s current price, Metaplanet will purchase about 7,520 BTC with $837 million.

Institutions and Sovereign Nations Embrace Bitcoin Strategic Reserve

On August 26, Crypto2community reported that French semiconductor company Sequans has launched $200 million worth of share sales to expand the company’s Bitcoin strategic treasury. The move will drive Sequans’ long-term goal of owning at least 100,000 BTC by 2030. The semiconductor firm has already acquired 3,170 BTC, valued at about $349 million.

Separately, on-chain crypto transactions tracker Arkham Intelligence disclosed that the United Arab Emirates (UAE) government owns over $700 million worth of BTC obtained from mining. Additionally, the Philippines recently passed a new bill pushing for a national strategic Bitcoin reserve. The country hopes to accumulate 10,000 BTC within five years.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.