Highlights:

Peter Schiff, a well-known economist and vocal Bitcoin skeptic, forecasts that BTC could drop to around $75,000. This level is below the average cost held by Michael Saylor’s Strategy. He recommends that investors consider selling now and buying back later at lower levels.

Schiff recommends selling Bitcoin immediately and repurchasing at cheaper levels to prevent potential losses. He has long cautioned that Bitcoin has no real value, is extremely unstable, and cannot serve as a dependable store of wealth like gold. He believes Bitcoin’s price surges are largely speculative and detached from fundamental factors.

Bitcoin just dropped below $109K, down 13% from its high less than two weeks ago. Given all the hype and corporate buying, this weakness should be cause for concern. At a minimum, a decline to about $75K is in play, just below $MSTR's average cost. Sell now and buy back lower.

— Peter Schiff (@PeterSchiff) August 26, 2025

Michael Saylor’s Strategy, previously known as MicroStrategy, has been accumulating Bitcoin since 2020. On Monday, the firm purchased 3,081 BTC for $356.9 million, paying an average of $115,829 per coin. Strategy now holds a total of 632,457 BTC, valued at $69.58 billion, according to Bitcoin Treasuries data. “At a minimum, a decline to about $75K is in play, just below $MSTR’s average cost,” Schiff said.

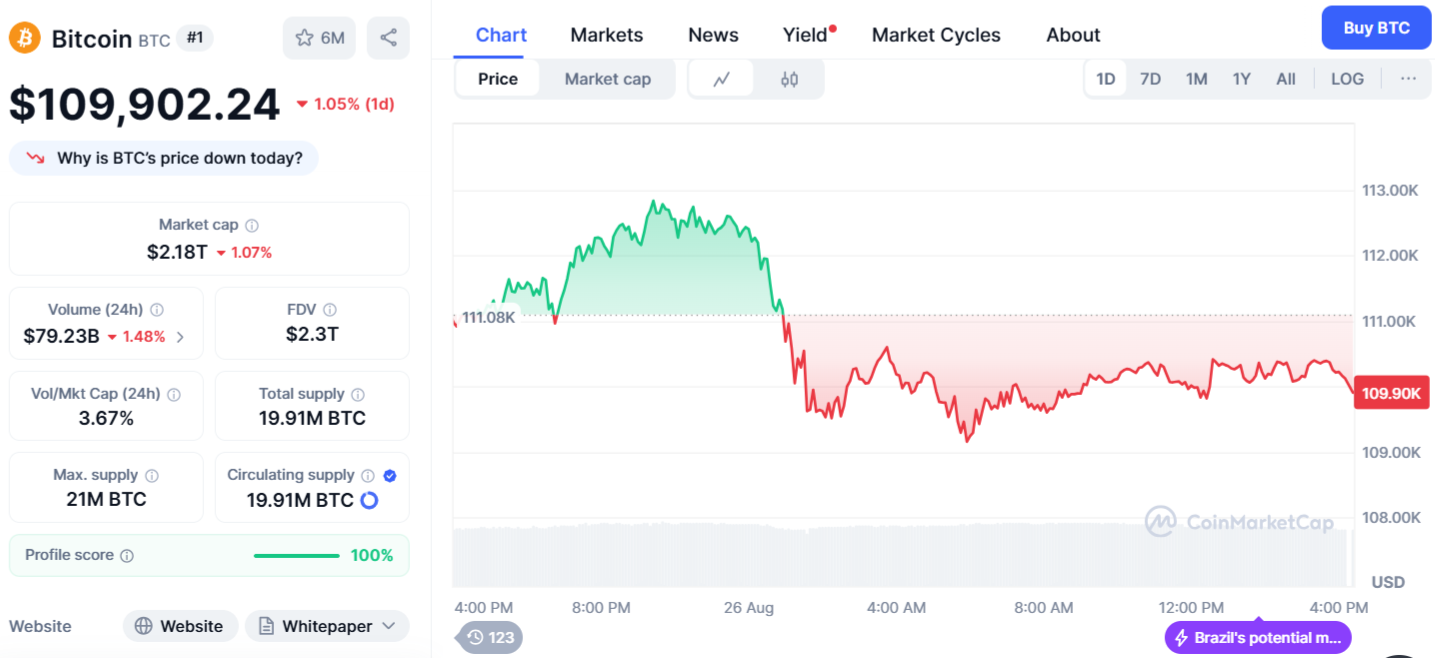

Bitcoin Falls Below $110K

The prediction comes as Bitcoin dropped below $110,000 for the first time in over six weeks as traders booked profits amid broader market uncertainty. According to CoinMarketCap, the cryptocurrency was trading at $109,902, down 1.05% in the past 24 hours. This marks Bitcoin’s lowest level since July 9, the data shows. Bitcoin’s recent drop follows a short rally last Friday, sparked by Federal Reserve Chair Jerome Powell hinting at a possible interest rate cut at Jackson Hole. The market had been building anticipation ahead of the September FOMC meeting.

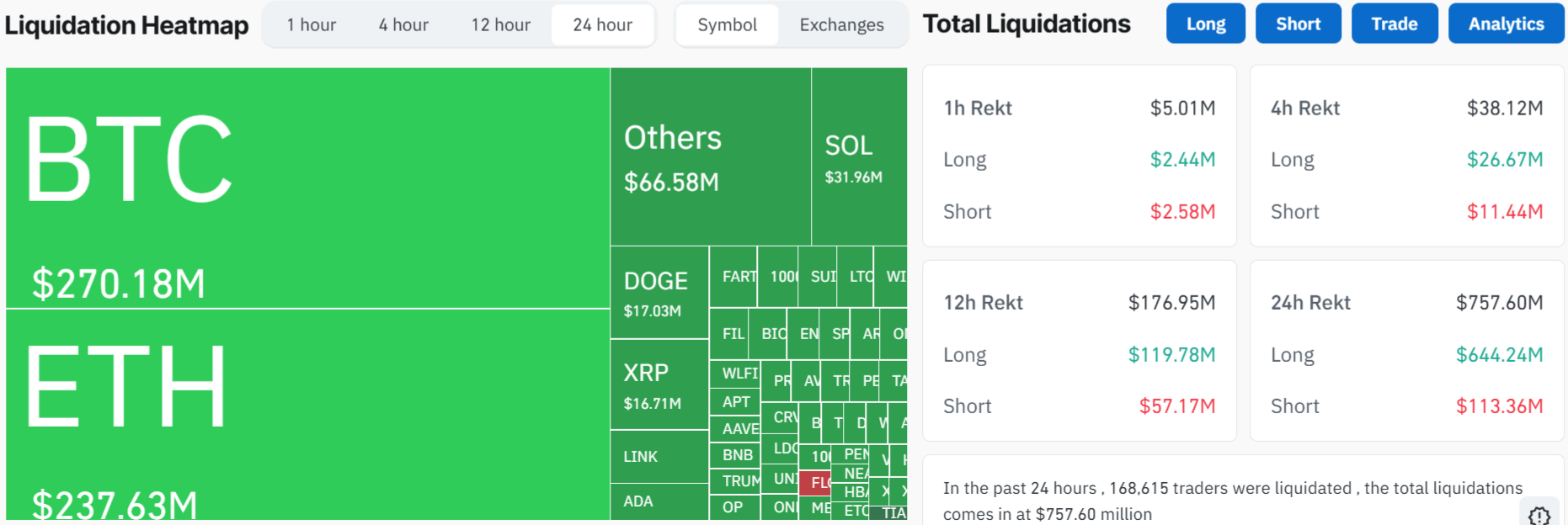

Crypto Liquidations Hit $757.60M, BTC and ETH Lead Losses

Cryptocurrency analytics firm CoinGlass reports that $757.60 million in crypto was liquidated in the past 24 hours. This included $644.24 million in long positions and $113.36 million in short positions, impacting 168,615 traders. Most of the liquidations occurred on ByBit and Binance, totaling $238.20 million and $172.46 million, respectively.

Bitcoin alone accounted for $270.18 million in liquidations, with $222.65 million from long positions and $47.54 million from short positions. Ethereum faced $273.63 million in liquidations, including $195.01 million from long positions and $42.62 million from short positions. Dogecoin and Solana saw liquidations of $17.03 million and $31.96 million, respectively, over the past 24 hours. Significant losses also hit LINK and XRP, with $9.77 million and $16.71 million liquidated, respectively.

Bitcoin ETFs See $219M Inflows After Longest Outflow Streak in Months

On Monday, Santiment revealed that Bitcoin ETFs faced outflows for six straight days, marking their longest decline in months. The firm said these withdrawals might be from small traders fearing a market peak.

📉 Bitcoin ETF's are on their longest outflow streak (6 market days) since the tariff fears peaked back in early April. Increasingly, there are cases to be made that these inflows & outflows are retail-driven, and not just institutional-driven like they were early on.

😱 Large… pic.twitter.com/bM6t19gfgM

— Santiment (@santimentfeed) August 26, 2025

However, sentiment seemed to change on August 26. As per data from SoSoValue, Bitcoin ETFs saw $219 million in inflows. All BTC funds saw inflows, with none recording any outflows. Fidelity’s FBTC topped inflows with $65 million, followed by BlackRock’s IBIT at $63.38 million. The surge indicates both institutional and retail investors are preparing for a potential BTC rebound.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.