Highlights:

- Ethereum briefly reached a new all-time high of $4,880, gaining over 15%.

- Ether ETFs and corporate treasuries fueled Ethereum’s rise with massive institutional inflows.

- BTC’s market dominance fell below 60%, which signals investors rotating capital into ETH.

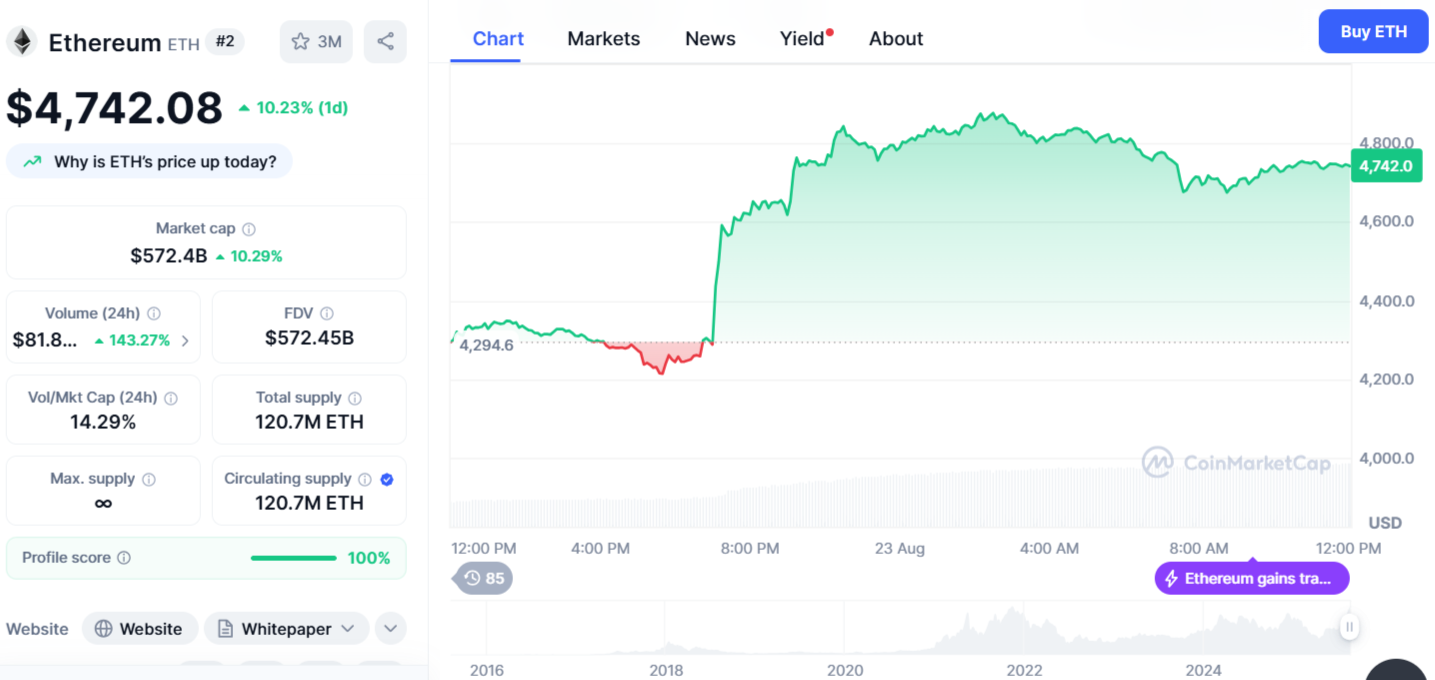

On Friday, Ethereum’s price briefly reached a new all-time high of $4,880.19, surpassing its prior record of $4,878.26 from November 2021. It later eased slightly to around $4,872 at the time of publication, gaining over 15% for the day, according to CoinMarketCap.

Ethereum’s price saw a strong rally after remarks from Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium, where he hinted that a rate cut could be on the table in September. Earlier in August, Ether surpassed the $4,000 mark over the weekend of August 9, the first time since December, and then moved past $4,500 on August 12. In 2025, ETH has experienced significant growth, rising more than 40% year-to-date and outperforming Bitcoin’s gains.

BREAKING: $ETH reaches new all-time high of $4,880 pic.twitter.com/HpBoqYUVZP

— Watcher.Guru (@WatcherGuru) August 22, 2025

Ethereum Price Gains Momentum from ETFs and Corporate Adoption

Ether markets are gaining strength from fresh capital flowing into U.S.-based ETFs. On August 21, these funds received $287.60 million after experiencing four consecutive days of outflows. By Friday, Ether ETFs collectively held more than $12.12 billion in assets.

Corporate adoption of Ethereum treasuries has also fueled its rise. In the past month, firms such as BitMine, Bit Digital, BTCS, SharpLink, and GameSquare purchased around $1.6 billion worth of ETH. Data from StrategicETHReserve.xyz shows that corporate holdings of Ethereum have climbed past $29.75 billion. Ray Youssef, CEO of finance app NoOnes, notes that Ether is increasingly seen not just as a speculative token, but as a utility-rich reserve asset.

Nate Geraci, President of NovaDius Wealth Management, said on X that spot Ethereum ETFs were underestimated because many traditional investors didn’t understand Ether. He noted that Bitcoin has a simple story as “digital gold,” but Ether takes more time to understand. Now, with Ether being called the “backbone of future financial markets,” more investors are starting to pay attention.

Feel like spot eth ETFs were severely underestimated simply b/c tradfi investors didn’t understand eth…

Btc had nice clean narrative, “digital gold”.

Eth takes more time for investors to understand.

Now they’re hearing “backbone of future financial markets” & it’s resonating.

— Nate Geraci (@NateGeraci) August 12, 2025

Ether Rises as Bitcoin Market Dominance Falls

Ethereum price latest rally has come alongside a noticeable drop in BTC’s market control. By Wednesday, Bitcoin’s share of the overall crypto market slipped under 60% for the first time in four months. This is down from its yearly peak of 66% when BTC was valued at $115,722. This shift suggests that investors are reallocating capital into altcoins, particularly major ones like Ether, in pursuit of higher returns. Flows into Ether-focused funds also highlight growing market optimism around ETH.

Over the past 24 hours, Bitcoin surged over 3%, reaching around $116,000 at press time. Other major-cap altcoins mirrored he move. Binance Coin (BNB) set a fresh all-time high of $900 after climbing over 7%, while Solana, XRP, and Dogecoin recorded double-digit increases.

On Saturday, overall crypto market sentiment turned back to “Greed” as prices continued to surge. The Crypto Fear & Greed Index, which tracks overall cryptocurrency market sentiment, rose to a “Greed” score of 60 on Saturday. That marked a ten-point increase from Friday’s “Neutral” level of 50, following a brief dip into Fear earlier in the week.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.