Highlights:

- The price of Aerodrome Finance surges 4% in a week to $1.32.

- Coinbase introduces deRWA tokens in the AERO market.

- Bulls target $1.46 level, if $1.34 resistance gives way in the short term.

Aerodrome Finance price has pumped 4% in a week, to $1.32, with Base integration fueling the surge. Is daily reading volume is up 20% to $142 million, signalling an increase in investor confidence. Meanwhile, Coinbase is a company that has been progressively developing its role in the cryptocurrency market with the increase in the variety of its services. The introduction of the deRWA (digital Real-World Asset) tokens can be seen as a decisive step on the path of growth.

Coinbase is evolving into the “Everything Exchange” and it’s going to happen faster than you think.

Today is a huge moment — a first of its kind deRWA launching on @AerodromeFi that has gained instant distribution to 100m @coinbase users.

Just the beginning. 🛫 https://t.co/rMBf0L0CgP

— alexander (@wagmiAlexander) August 20, 2025

This first time appeared on the AerodromeFi platform, which has already attracted enormous attention due to its collaboration with Coinbase. Access to more than 100 million Coinbase users also means that deRWA tokens will now be thrust into a wide distribution across the Ethereum Virtual Machine (EVM) environment.

Besides, the launch is a confirmation of the increased popularity of real-world assets set on a blockchain. The smooth inclusion of the deRWA tokens within the Coinbase DEX, wallets, and AerodromeFi platform characterizes a futuristic thinking of scaling the decentralized environment. Its infrastructure is ready to facilitate users to new inventions and to be able to integrate with other platforms such as BitgetWallet and MorphoLabs. This is an indication that soon all real-world assets will transition into this blockchain environment.

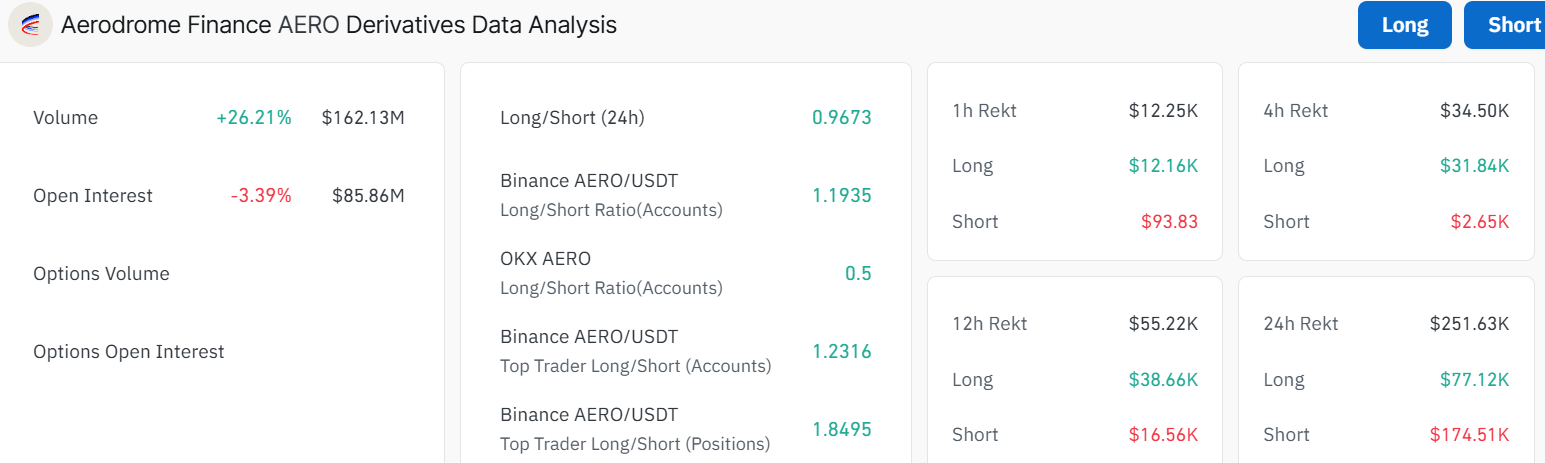

The developments of Coinbase are accompanied by the momentum of the Aerodrome Finance (AERO) token in the derivatives market. Aerodrome volume has increased by 26.21%. This indicates immense interest in the services offered by the platform. Nonetheless, the open interest has declined by a small fraction of 3.39% amounting to $85.86 million.

Another factor that demonstrates the good potential of Aerodrome is its positive long/short ratio. The long/short ratio on 24-hour contracts sitting at Aerodrome is 0.9673.

Aerodrome Finance Price Moves Into Consolidation

The 4-hour chart shows the Aerodrome Finance price consolidating at the $1.21 and $1.46 levels. Now the price is targeting a breakout above the pattern, as it might act as an accumulation period. The technical analysis shows there is still more upside potential for this token. If this momentum holds, AERO could test the next resistance at $1.46.

The Relative Strength Index (RSI) is at 49.85. However, if the bulls gain strength, there is still room to run before a pullback. This suggests the bulls are still in control, though a dip could be on the horizon if the $1.34 resistance proves too strong.

On the other hand, the Moving Average Convergence Divergence (MACD) has made a bullish crossover above the orange signal line. This calls for traders to buy more AERO tokens as it’s a green light for extended gains.

Is It Too Late to Buy AERO?

In the meantime, traders might expect a further surge to $1.46 if the $1.34 resistance breaks. If the bulls keep showing their strength, the Aerodrome Finance price could eye a target of $1.70 by late September. Conversely, if the $1.34 resistance proves too strong, a drop towards $1.21 could be imminent.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.