Highlights:

- BNB price soars 2% to $852, as trading volumes spike 20%.

- Crypto analyst remains optimistic and bullish on BNB as it holds almost 40% of the entire CEX.

- Bullish momentum could spike a rally towards $1000 soon.

The BNB price has spiked out to an ATH of $882, before cooling off to $851, still up 2%. Its trading volume is notably up 20% to $3.53 billion, indicating heightened market activity. Meanwhile, according to a crypto analyst, Ali Martinez, in July 2025, the trading volume of the spot market on the Binance platform increased by a spectacular 61% month-on-month to $698 billion. Such a surge not only reflects the unrivalled position of Binance but also consolidates its status as the largest player in the crypto arena. Currently, it captures almost 40% of the total centralized exchange (CEX) market share.

Maybe I’m just looking for reasons to be bullish on $BNB, but hear me out!

In July, Binance did $698 billion in spot volume, up 61% in a month, and now holds almost 40% of the entire CEX market. That’s over 4.5x the next exchange.

Scale like that means deeper books, better… pic.twitter.com/FHpYgb1J2c

— Ali (@ali_charts) August 20, 2025

The exchange has surpassed its nearest rivals in size to the point where it trades more than four times as many shares as the second-largest exchange. This phenomenal result has helped boost the rest of the CEX market, which traded a total of $1.8 trillion worth of trading volume during July 2025.

One of the key benefits that traders can access with the scale advantage of Binance is deeper liquidity, better execution, and more limited slippage. The latter are needed by large institutional players, which require consistent and efficient trading conditions.

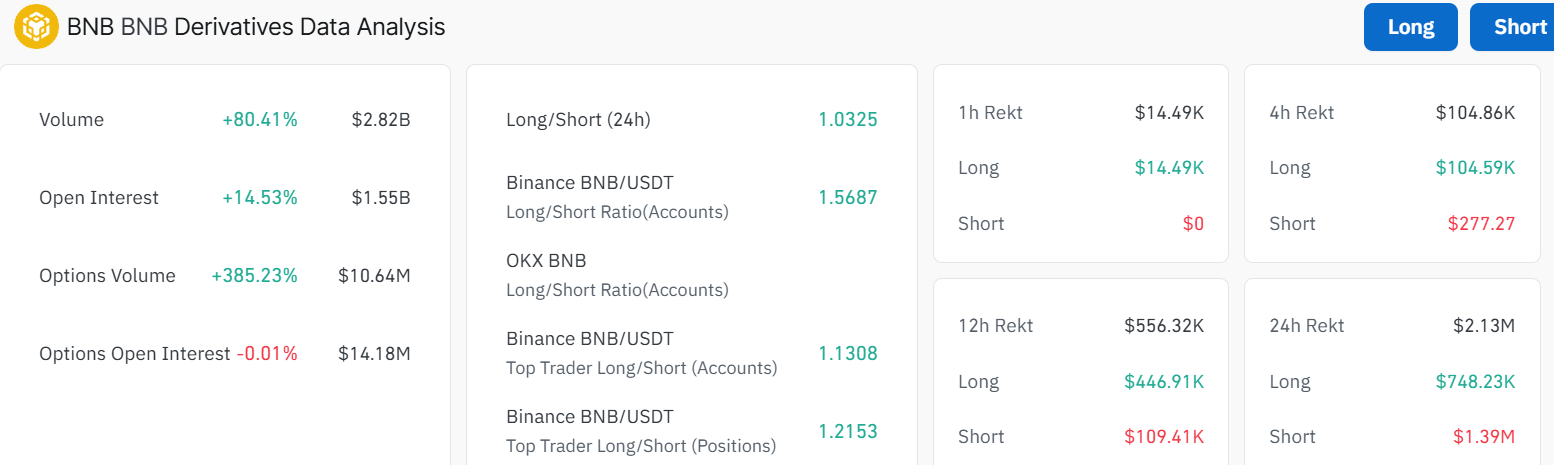

The expansion is not limited to spot trading alone. The BNB derivatives market on Binance is also experiencing massive growth. The volume of BNB in the derivatives has risen by 80.41%, to $2.82 billion, and the value of the options volume has soared by 385.23% to 10.64 million. The total open interest on these products has grown by 14.53% and stands at 1.55 billion. This reaffirms the growing bullishness over the Binance token and derivatives market.

The investor sentiment is also leaning towards a bullish direction, as the long/short ratios show. The long-to-short position ratio sits at 1.03, tilting the odds towards the buyers. Also, the market can be observed to have characteristic signs of short squeezes with reported over short liquidations of $1.39 million within 24 hours. This tendency confirms that traders are increasingly placing more bets that the price of BNB will surge soon.

BNB Price Shows Classic Strength

The BNB/USDT daily chart shows price action trading above the 50 Simple Moving Average (SMA) ($753) and the 200 SMA ($655), a classic sign of strength. BNB shows a breakout above a key resistance zone around $850. The Relative Strength Index (RSI) is at 63.75, not overbought yet, but almost there, leaving some room for more gains.

The Moving Average Convergence Divergence (MACD) is showing bullish momentum with the MACD line crossing above the signal line. The histogram is turning green as well, a sign of increasing bullish momentum

BNB Poised for a Rally to $1000 Soon

There are several supports at $655 (200 SMA) and $753 (50 SMA), which have held strong, and traders are betting on a dovish outcome, which could lead to more volatility. In the short term, BNB price might test the $882 all-time high (ATH) again soon, especially if volume spikes. Long-term, if it breaks past the ATH, the crypto might soar to the $1,000 target by September.

However, an overextension could pull the BNB price back to $825. The RSI nearing 70 is a heads-up to stay sharp. Market sentiment on X is turning optimistic, with traders hyping BNB’s utility on Binance. No major red flags yet, but volatility is the name of the game.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.