Highlights:

- XRP price slips 4% to $2.90, despite the trading volume soaring 19%.

- Crypto analyst says XRP is ready for a bounce, as a buy signal emerges.

- Bulls aim to rebound above $3 as $2.45 long-term support holds.

The XRP price has been rollercoasting, sliding below $3, now down 4% to $2.90.Despite the fall, the trading volume has spiked 19%, showing that the market activity has risen and investor confidence is building. Meanwhile, the cross-border payment token is swimming in the red zone, down 12% over the past week and 18% over the past month.

The XRP market has recently experienced a radical change in its dynamics due to a major selling pressure from whales. According to a popular analyst, Ali Martinez, the whales have sold about 470 million XRP in the past 10 days. Such a significant sell has sent a set of tremors through the market in both short-term and long-term fluctuations.

470 million $XRP sold by whales in the last 10 days! pic.twitter.com/Zc24I9omjg

— Ali (@ali_charts) August 20, 2025

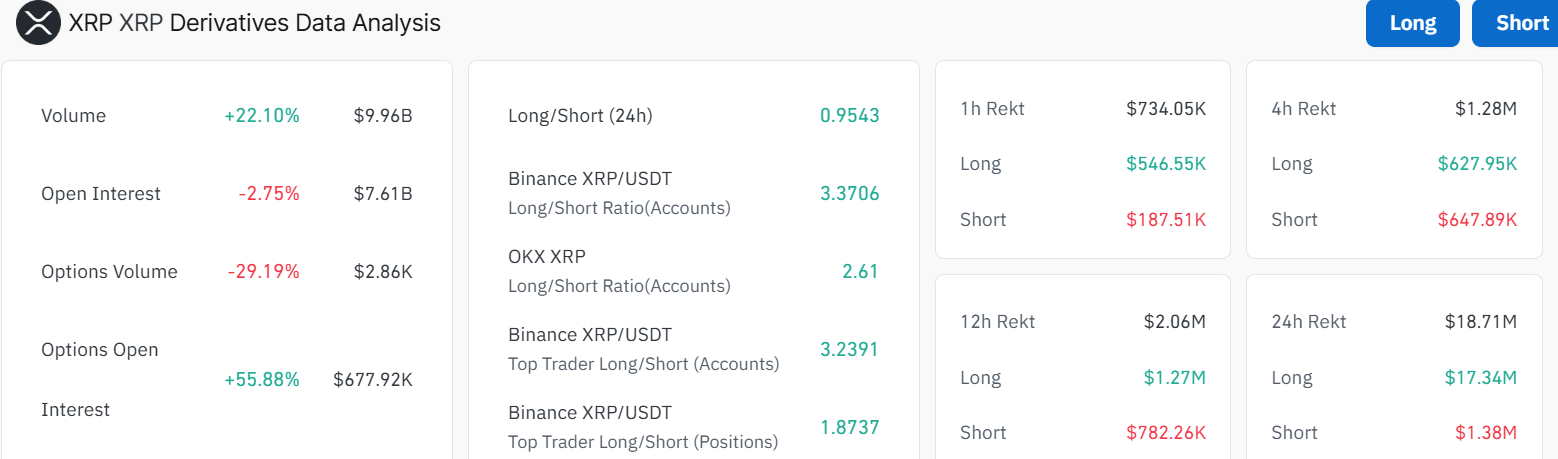

When whales sell such high amounts of XRP, it is likely to create panic, and smaller retail investors will follow in the same footsteps. This results in a fall in price, which can in turn be an opportunity for the investors waiting to buy at a low price. Notably, the derivatives data in the case of XRP is revealing because even traders constitute a divided opinion. The long/short ratio is equal to 0.95 in a 24-hour period, which suggests a rather balanced market where bulls and bears are equally strong.

The volume of derivatives has grown by 22.10% to 9.96 billion. This adds to the growth in activity in the XRP market. Open interest has, however, decreased by 2.75% to $7.61B. The lower open interest could be an indication that fewer traders are taking new positions, but are still active in the existing contracts. The options open interest has soared by 55.88% which may suggest that more traders are hedging their trades or expecting volatility to prevail in the future.

XRP Price Eyes a Breakout Above a Falling Wedge Pattern

The XRP price action is showing bearish signals. The XRP/USD chart shows a recent drop below $3, as the altcoin breaches the 50-day SMA ($2.97) support zone to $2.90. However, the 200-day SMA (Simple Moving Average) at ($2.45) suggests the XRP price is still in a longer-term trend.

However, the recent drop below the support-turned-resistance at $2.97 is a classic sign of bear pressure. Digging into the indicators, the RSI (Relative Strength Index) at 43.11 is a bearish trajectory. This means there could be more sideways action before any big move.

On the other hand, the MACD shows a bearish crossover as well that took place on July 24, with the MACD line (blue) breaking below the signal line (orange).

Can the Bulls Rebound Above $3 Soon?

If the XRP price holds above $2.97, there could be a push toward $3 again. However, a drop below the current levels, $2.97, might signal a retreat to the 200 SMA ($2.45) for support. The XRP price still has room to move. According to Ali Martinez, the altcoin now signals a buy signal, showing a potential bounce back.

$XRP looks ready to bounce! After perfectly timing the top, the signal now says BUY. pic.twitter.com/NBbQuXd7RG

— Ali (@ali_charts) August 20, 2025

Short-term, traders could aim for $3, but in the long-term, $4 could be in play if the volume holds. Cautious investors may wait for a dip to the 200SMA. With no overbought signals yet, the XRP rally may just be beginning.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.