Highlights:

- Dogecoin price slips 4% to $0.22 despite the trading volume surging 75%.

- Coinglass data shows mixed signals as volume spikes 71%, despite the OI dropping 6%.

- DOGE technical indicators uphold a bearish grip, as bulls struggle to regain momentum.

The Dogecoin price is swimming in the red today, slipping 4.83% to $0.22. Despite the fall, the trading volume has risen 75% to $3.04 billion, suggesting growing market activity. The crypto decline comes as the market faces a substantial correction, with major assets in the red zone. Further, the on-chain and derivatives data highlight bearish sentiment, with DOGE holders realizing losses and rising short bets among traders.

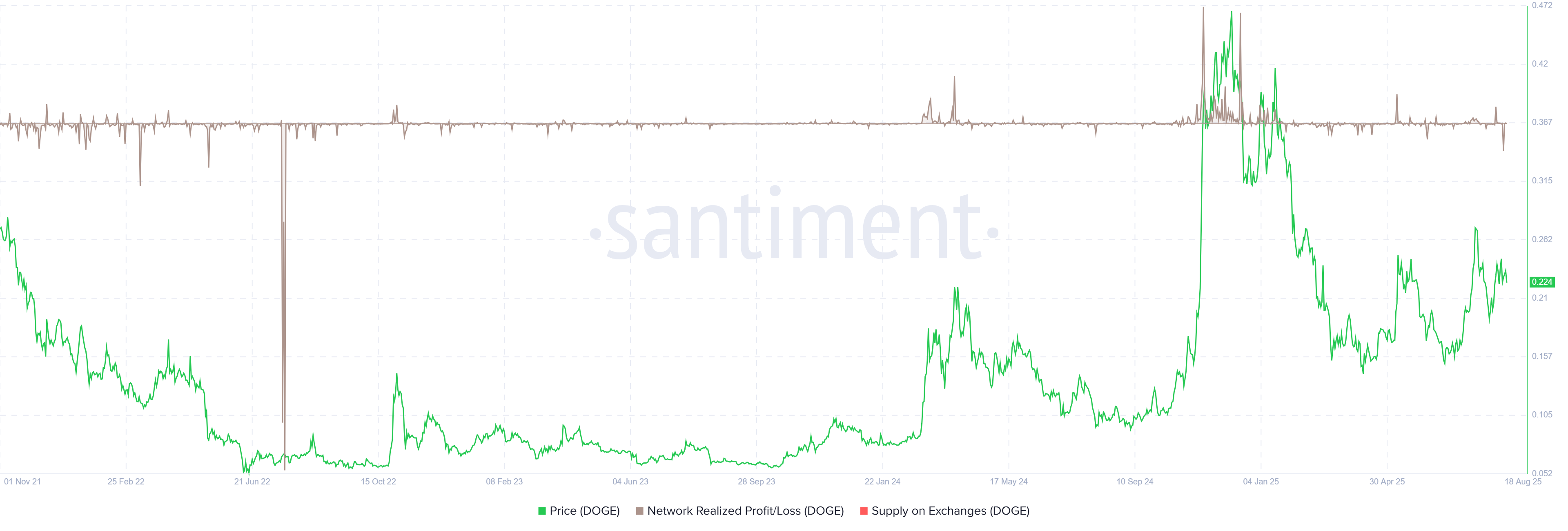

Meanwhile, the Network Realized Profit/Loss (NPL) indicator of Santiment calculates a daily ROI of the network, using the volume of coins transacted on-chain. In very simple terms, it is utilized to gauge the market’s pain. When a coin experiences a violent spike in its NPL, it shows that those who possess the coin are, on average, making a large profit out of selling their bags. Conversely, heavily dipped markets are good indicators of the availability of losses averaged by coin holders, which can be a sign of a panic sell-off and investor surrender.

In the case of Dogecoin, the NPL indicator moved between 2.68 million on Thursday and -271.41 million on Friday, the lowest during the period since the time in July 2022. Such a bearish reversal shows that they are average, losing money, and incurring purchasing pressure.

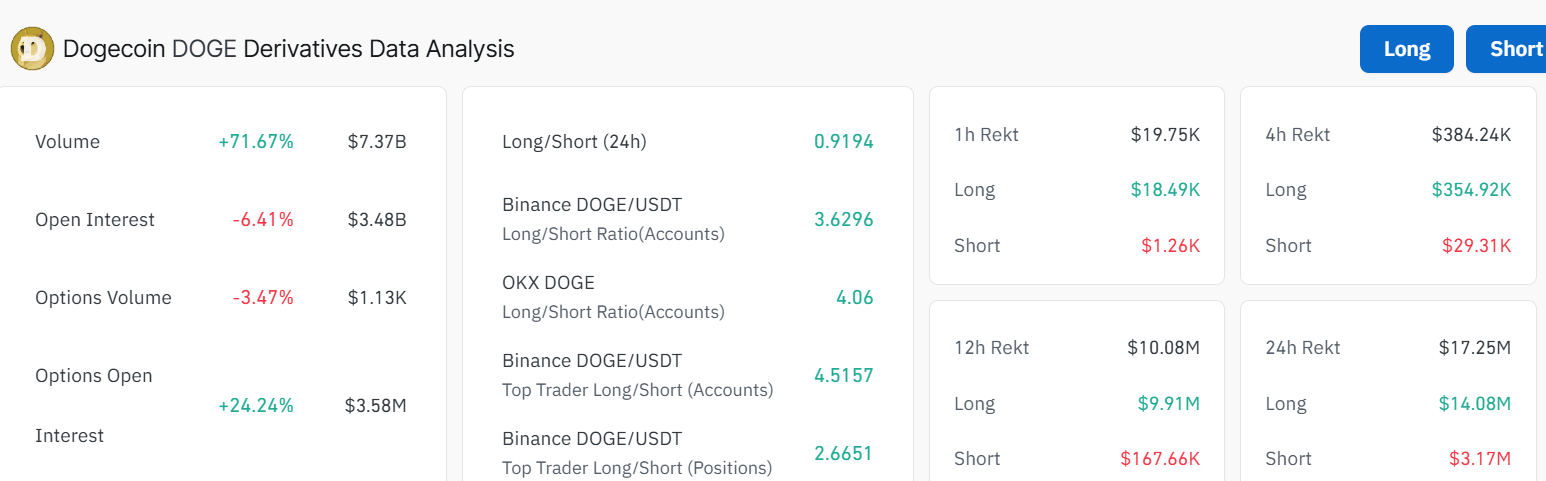

DOGE Derivatives Markets Show Mixed Signals

Dogecoin price has recorded high activity in derivative markets in addition to its trading volume. Current data on DOGE derivatives analysis shows that there has been a 71.67% increment in volume to $7.37 billion. In spite of this growth, the platform has seen the open interest decline marginally by 6.41% to $348 billion. This is an indication that although there is an increased involvement in the market, there is still the feeling of caution with traders before larger positioning.

The long-to-short ratio also sits around 0.91. A ratio below one suggests bearish sentiment in the market as traders are betting that Dogecoin’s price will fall.

Dogecoin Price Consolidates in a Triangle

The 1-day chart shows DOGE riding a bearish wave, with the price bouncing between a high of $0.24 and a low of $0.22. The 200 SMA (Simple Moving Average), sitting at $0.2288, acts like a solid resistance level, and the price is trading just below it. The 50 SMA at $0.2324 is also cushioning he bulls against further upside, hinting that the bulls need to overcome these zones.

The Relative Strength Index (RSI) is hovering at 40.46, below the 50-mean level, signalling some bearish grip. The Moving Average Convergence Divergence (MACD) is also bearish as the MACD line crossed below the signal line on August 14. This combination of bullish RSI and MACD suggests DOGE need more buying pressure to commence a rally to the upside.

If the current bearish momentum holds, Dogecoin price might continue the downward movement towards $0.20. Conversely, if the bulls take control and the current consolidation acts as an accumulation, the meme coin may break out soon. According to a popular analyst, Ali Martinez, Dogecoin price may see a 30% breakout.

Dogecoin $DOGE consolidates in a triangle. A 30% breakout could follow! pic.twitter.com/aCruh88NHu

— Ali (@ali_charts) August 17, 2025

In the meantime, the bulls need to regain ground above the 50-day and 200-day SMAs to ignite a bullish rally.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.