Highlights:

- Kraken suspends Monero deposits after Qubic exceeds 50% of the network hashrate.

- Qubic reorganized six blocks during its network control.

- Monero developers question the legitimacy of Qubic’s claimed attack.

Kraken has suspended Monero deposits following the privacy-oriented blockchain being hit by security issues. The crypto exchange confirmed that one mining pool exceeded 50% of the overall hashrate of the network. This marks a critical point in the proof-of-work network in regard to decentralization and safety.

On August 14, Qubic, a mining pool connected to an AI-focused blockchain, announced that it had gained a majority stake in the hashrate of Monero. The group claimed responsibility for reorganizing the six blocks, which implied that the group had the capacity to alter the blockchain history temporarily.

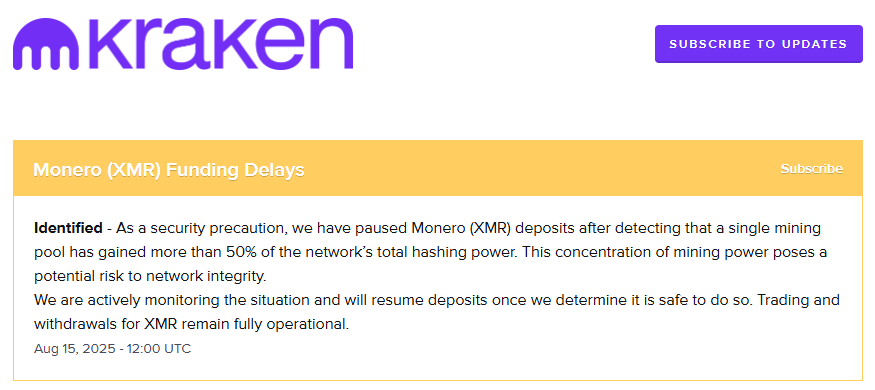

In a statement, Kraken explained:

“Out of security, we have halted Monero (XMR) deposits after observing a single mining pool had gained over 50% of the total hashes on the network.”

However, Monero trading and withdrawal are still available. Kraken pointed out that they would resume deposits as soon as the integrity of the network was confirmed.

Qubic’s Bold Move Raises Questions

Qubic started redirecting its mining towards Monero at the end of June. In the beginning, it was only the seventh-largest miner. However, Qubic restrengthened itself following an August 4 recovery after being attacked by a Distributed Denial of Service (DDoS).

The founder of Qubic, Sergey Ivancheglo, alleged that the pool mined a total of 80% of the Monero blocks within a duration of two hours. This resulted in the creation of approximately 750 XMR and 7 million XTM. They also made claims about the reorganization of 6 blocks and the orphaning of another 60 blocks.

Although Qubic made these claims, Monero developers downplayed the significance of the event. According to Luke Parker, a lead developer, the reorganization is not enough to demonstrate a successful 51% attack. He stated that the attacker might have been fortunate to have high hash power at the opportune time.

A 6 re-org does not mean a '51% attack' was successful. In that case, we'd see unbounded-depth re-orgs/no blocks mined by any other mining pool (assuming the adversary censors other mining pools, as this one does).

It does mean an adversary with a high amount of hash got lucky.

— Luke Parker (@kayabaNerve) August 12, 2025

In response, Qubic stated they reached 2.6 gigahashes per second (GH/s), more than 50% of the estimated 6.00 GH/s on the network. They also stated that the episode demonstrates the vulnerability of less distributed mining blockchains.

Impact on the Monero Community

The Monero network has already grappled with several problems, such as a flooding attack in March 2024. However, this becomes the first major crack in its consensus mechanism. With Kraken suspending Monero deposits, the center of attention has turned to mining concentration.

In addition, the Monero community quickly responded to Qubic’s takeover claims. Some members questioned the data, while others attempted to push miners toward smaller pools. The attack and response highlight a growing concern about mining centralization in smaller proof-of-work blockchains. Qubic is reported to still have significant control over the hashrate as per Mining Pool Stats. Kraken continues to monitor the health of the network and reiterated that it would just provide deposit services when safety is assured.

Regardless of the attack and ongoing controversy, the market performance of Monero has been resilient. Over the past 24 hours, XMR has surged by 9% to trade at $265. However, the token has declined by 20% on the weekly chart. Its market cap and trading stand at $4.90 billion and $90 billion, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.