Highlights:

- Gemini files S-1 with the SEC to go public on Nasdaq under ticker GEMI.

- The company reports rising losses, and cash reserves decline sharply due to high operating costs.

- Winklevoss twins keep full voting power through Class B shares following the IPO.

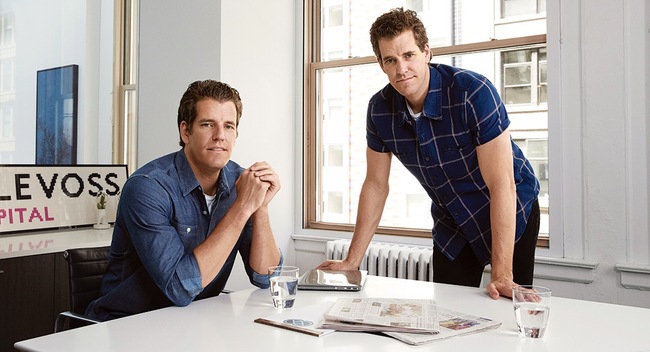

Gemini, the cryptocurrency exchange founded by billionaire twins Cameron and Tyler Winklevoss, submitted an S-1 registration with the US Securities and Exchange Commission (SEC) as part of its plans to go public on the Nasdaq Global Select Market. The IPO was expected, and the new filing confirms key financial and operational details. The company plans to list on Nasdaq as GEMI, but the offering size and price are not disclosed. Big banks like Goldman Sachs, Morgan Stanley, and Citigroup will help manage the sale.

After the IPO, Gemini will have two types of shares: Class A with one vote each, and Class B with ten votes each. The Winklevoss twins will keep all Class B shares, giving them most of the voting power. This makes the crypto firm a “controlled company” under Nasdaq rules.

Gemini must be desperate for an IPO as these are some terrible results given crypto market growth the past year. Must just be losing market share pic.twitter.com/jKvwAC4Sn8

— guleid (@riddle245) August 15, 2025

Gemini’s Losses Grow as It Plans IPO During Crypto Boom

Even with a positive outlook, Gemini’s S-1 shows growing losses. Last year, Gemini earned $142.2 million in revenue while posting a net loss of $158.5 million. By mid-2025, losses escalated to $282.5 million, while revenue fell to $67.9 million. Liquidity is under pressure. Cash reserves fell from $341.5 million at the end of last year to $161.9 million by mid-2025. This decline reflects the effect of ongoing losses and high operating costs.

Founded in 2014, Gemini manages more than $18 billion in assets. In the first half of 2025, about 65.5% of its revenue came from trading fees. Gemini offers a cryptocurrency trading platform, a U.S. dollar-pegged stablecoin, crypto staking options, a rewards credit card, and specialized services for institutional clients, including custody and over-the-counter trading. Cameron Winklevoss acts as president, and Tyler Winklevoss serves as CEO. Each twin holds a net worth of $7.5 billion and is the only shareholder owning 5% or more of the company.

The surge in crypto IPOs coincides with the Trump administration’s active backing of the sector and the introduction of new cryptocurrency regulations. In June, the stablecoin company Circle completed a $1.2 billion IPO, with its shares jumping 168% on the first day. This week, crypto exchange Bullish made an impressive market debut, with shares soaring 83.8% on the first day to close at $68. The rally lifted the company’s market value to over $10 billion.

The NYSE welcomes @Bullish, the digital asset exchange, to celebrate its IPO! $BLSH@CoinDesk | @ThomasFarley https://t.co/83XyhdrM3l

— NYSE 🏛 (@NYSE) August 13, 2025

Winklevoss Firm Settles Case and Invests in Bitcoin Mining Company

In January, Gemini discontinued certain programs and paid $5 million to resolve a Commodity Futures Trading Commission case, without admitting or denying any wrongdoing. The Winklevoss twins, famous for their legal battle with Facebook’s Mark Zuckerberg, attended President Trump’s signing of the stablecoin legislation in July. Bloomberg noted that they also invested in American Bitcoin Corp., a mining firm connected to Trump’s sons.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.