Highlights:

- Bitcoin price surges 2% to $121 310, as its daily trading volume soars 29%.

- BTC’s new addresses have hit their highest in a year, as 364,126 addresses are created daily.

- Crypto analyst predicts a rally to $133,000 if $112,000 zone holds, according to pricing bands.

Bitcoin price has shown remarkable strength, surpassing the 120K mark, currently up 2% to $121,310. The daily trading volume has notably soared 29% to $79.02 billion, indicating heightened market activity. Meanwhile, there is a tremendous increase in the number of new Bitcoin addresses opened, and there are 364,126 new addresses created per day.

364,126 new Bitcoin $BTC addresses created daily, the highest in a year! pic.twitter.com/GJTzrT3Yo9

— Ali (@ali_charts) August 11, 2025

This is the most significant number of new Bitcoin addresses created within one year. According to the chart posted by Ali Martinez, the trend has witnessed a huge bulk starting around late July, and it keeps increasing as the month of August goes by.

Bitcoin Price Targets $130,000 After Breaking Above $120,000

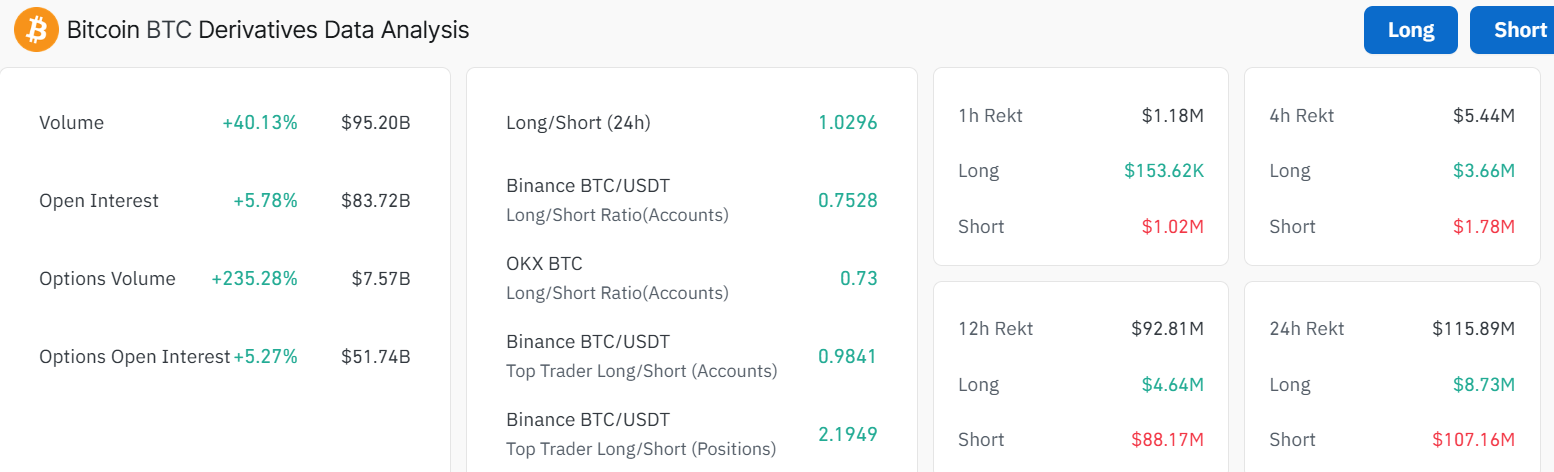

On the other hand, the Bitcoin derivatives market demonstrates that the trading volume and open interests have increased drastically. The overall 40.13% jump in volume to $95.20 billion indicates increased investor confidence. There has also been an increase in the open interest of 5.78% to $83.72 billion. This shows that there is a growth in the number of participants in leveraged trade and the futures contracts. In addition, the volume of options has soared 235.28% demonstrating a huge rise in the act of speculating in the market.

Long to short positions are also an important market sentiment reading. The position of long-to-short during the last 24 hours has reached 1.03, which means a rather even market that is occupied by bullish and bearish traders. What is more, there is considerable volatility in the market according to liquidation data. An amount of liquidations worth $115.89 million has been performed in the past 24 hours. Most of them show a greater tendency towards short positions ($107.16 million).

The low liquidation price is evidence of the price volatility that Bitcoin has undergone recently. Since the market is still volatile, these liquidation initiatives present a situation where the traders might require an adjustment to overcome the fluctuations in prices.

A quick look at the daily chart timeframe, Bitcoin price has rebounded in the consolidation channel. Currently, the BTC price is trading at 121,310, about 1.26% from BTC’s ATH at $123,231. The bulls are notably having the upper hand, as they have established strong support at $114,163(50-day SMA) and $99,830(200-day SMA).

The Relative Strength Index (RSI)notably shows strong bullish sentiment, as it sits at 65.06. This shows intense buying pressure in the market, but yet to be overbought.

Is $133,000 Next for BTC?

BTC has maintained strong momentum, moving past $120,000 and now trading around $121,310. The move has been supported by strong buying pressure and the fact that the price is well above the 50-day and 200-day moving averages, two important indicators of trend strength. If BTC breaks through the $123K resistance level, it could pave the way for a push toward 130,000. Meanwhile, crypto analyst Ali Martinez has noted that if BTC holds above $112,000, it could rally to $133,000 according to pricing bands.

$133,000 is next for Bitcoin $BTC if it holds $112,000, according to the Pricing Bands. pic.twitter.com/Jp6x6IvoT4

— Ali (@ali_charts) August 10, 2025

On the other hand, if the rally loses steam, the nearest support lies around $119,635 with a stronger floor at $116,877. These levels could act as buying zones if the price dips.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.