Highlights:

- The Dogecoin price surged 1% to $0.20, despite a 34% could soon test in trading volume.

- DOGE volume and open interest slip 34% and 1% respectively, showing a cautious mood among investors.

- DOGE’s recent rebound could see the bulls retest the $0.28 levels if $0.2098 barrier gives way.

The Dogecoin price has rebounded from the $0.19 mark, currently up 1.14% to $0.20. The recent rebound comes as various traders and whales have scooped up millions of DOGE, resulting in a price bounce back. However, its daily trading volume has decreased by 34% to $1.37 billion, indicating a decline in investor confidence. DOGE is now down a whopping 16% in the past week, despite the 22% rise over the past month.

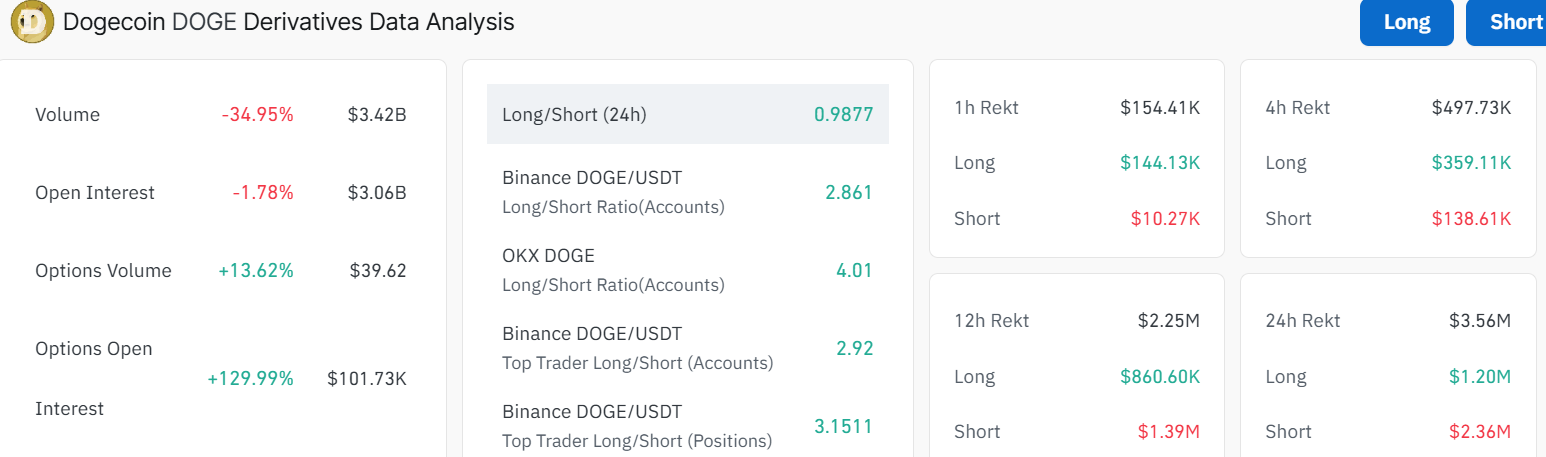

Meanwhile, the market activity of Dogecoin is undergoing a significant shift in trading volume and open interest levels. The total trading volume has declined by 34.95% to 3.42 billion. On the other hand, the open interest has decreased by 1.78% to $3.06 billion. This decline means that some investors are cautious. However, the options open interest in Dogecoin is up 129.99% to $39.62. This suggests that investors remain optimistic about the future of Dogecoin, despite the short-term decrease in volume.

Dogecoin (DOGE/USDT) 24-hour long-to-short ratio is now 0.9877, as most traders are long-term, meaning that they are more optimistic in the market. The liquidation data of the token indicates significant volatility, with liquidations reaching as high as $3.56 million within a 24-hour period.

Out of this, there were long positions amounting to $1.20 million and short positions with a liquidation that rose to $2.36 million. This imbalance suggests that the market remains more bullish about the potential of Dogecoin. Moreover, the long traders are not at a significant risk compared to short traders.

Dogecoin Price Rebounds to $0.20 as Bulls Target Higher Levels

A quick glance at the daily chart reveals that the Dogecoin price is showing signs of a rebound, with the bulls targeting higher levels. The price recently dipped into a support zone between $0.166 and $0.186 before bouncing back from the lower end, with a solid push toward $0.2013

The critical support zone around $0.1950, aligning with the 50-day SMA, holds strong, as the bulls target the immediate resistance at the 200-day SMA ($0.2098). If the bulls overcome this level soon, a bullish breakout towards $0.28 could be imminent.

The RSI (Relative Strength Index) at 44.12 sits just below neutral, recovering from oversold levels hit on 2 August. This suggests DOGE’s price has room to surge towards the upside. Meanwhile, the MACD remains bearish, contradicting the price action forecast.

DOGE Bulls Target $0.28 Mark Soon

A quick zoom-out view reveals that the price action since June has shown a steady climb from the $0.1421 low, with a 34% pullback in late July. Now, with traders piling in, the Dogecoin price could soon test resistance around $0.287 if the $0.20 barrier is broken. However, if support at $0.19 cracks, a slide back to $0.18-$0.16 could occur. Nevertheless, if the volume surges, this rebound might gain momentum. Moreover, if Bitcoin and the market hold steady in the long term, DOGE could ride the wave to $0.35 by the end of August, especially if another meme coin season begins.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.