Highlights:

- The Hedera price soars 7% to $0.27 as the trading volume increases by 117%.

- Hedera’s price chart reveals a parabolic curve, signaling a dominant bullish trend.

- Recently, the US House approved three key bills that could reshape the digital asset industry.

Hedera price has experienced a significant increase over the last 24 hours, rising 7% to $0.27. Its daily traded volumes have tracked the price movement higher by 117% to $1.76 billion. On 17 July 2025, the U.S. House voted on three groundbreaking laws. They include the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance State Act. This move, led by House Republicans, aligns with U.S. President Trump’s aspiration to make ownership of cryptocurrencies a cornerstone of the U.S. economy.

I just signed the landmark legislation passed today by House Republicans to strengthen American crypto innovation.

The CLARITY Act, GENIUS Act, and Anti-CBDC Surveillance State Act deliver on President Trump’s vision to make crypto a core pillar of the U.S. economy and ensure… pic.twitter.com/rnJgq3KaV2

— Speaker Mike Johnson (@SpeakerJohnson) July 17, 2025

The introduced bill can ensure that the cryptocurrency market becomes a hub of innovation. These laws are intended to regulate cryptocurrencies. Notably, they must also address the issue of central bank digital currencies (CBDCs) and the monitoring of digital currencies that have begun to operate. It is a milestone in the field of crypto regulation.

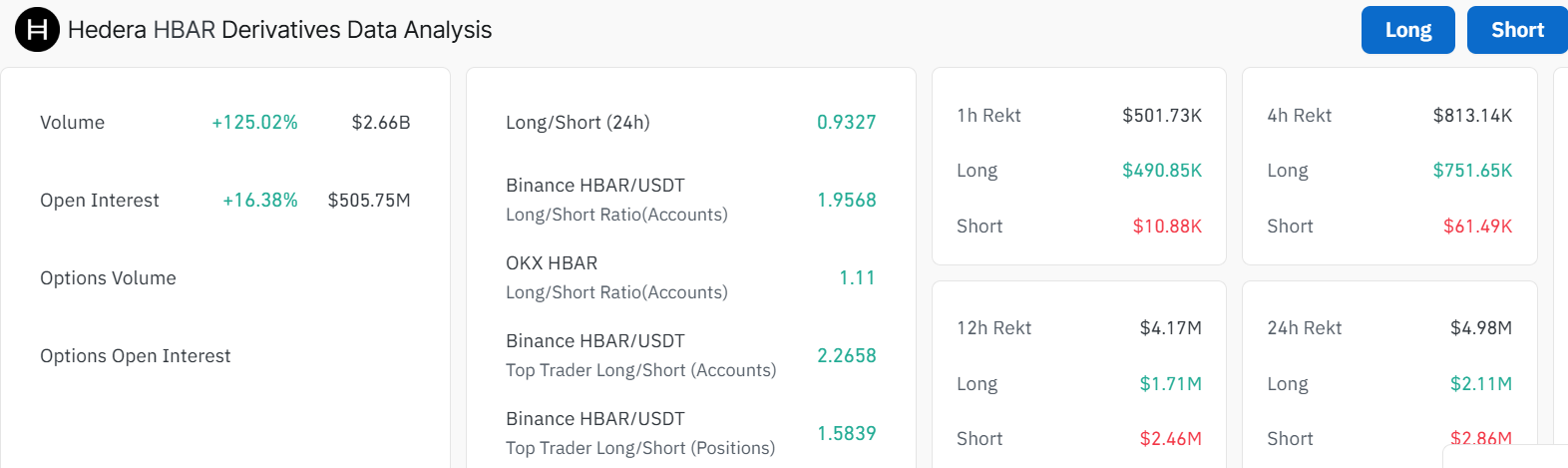

On the other hand, the volume of derivatives increased by 125.02% to 2.66 billion. Such development demonstrates the optimism of investors and traders who believe in the future of Hedera in the global blockchain space.

The open interest has also grown by 16.38% to $505.75 million. This development indicates that traders are increasingly forming their positions based on future prices. The magnitude of its long-to-short ratio is 0.93. Statistics, however, are more in favour of the long positions.

Hedera Price Bursts out in a Parabolic Curve

The chart of price on the daily time frame shows a strong parabolic curve pattern with a bullish trend. The bulls are taking full rein, as they have flipped the 50-day MA (0.1706) and the 200-day MA (0.2085) as immediate support zones. As long as such support grounds do not crumble and market confidence is maintained, the Hedera price has a chance of experiencing another bullish momentum and reaching even higher.

Moreover, the Relative Strength Index (RSI) shows that the asset is in the overbought mode, as it is currently reading 81.23. Although the price is yet to record high growth, this might be an indication that there is grounds to allow the asset to retrace in the near term. The MACD indicator is significant in keeping a buy signal, which requires traders to purchase more HBAR tokens. This is being expressed through the blue MACD line, as it has crossed above the orange signal line.

Is HBAR Going to Gain 49% by the Close of Q3?

Moving forward, the altcoin season hype, driven by optimism in the broader market, may bring the price of Hedera to the $0.34-$0.40 range by the end of Q3. These market cycles reveal that HBAR may perform well, as the 200 SMA on the 1-day chart serves as a powerful support zone.

Nevertheless, the overbought RSI suggests that sellers may experience a minor correction. In such a case, the bears may drive the Hedera price to the final support range at $0.26. Any break below this level shall invalidate the bullish outlook. In the meantime, the next quarter is expected to drive the Hedera price $0.34. However, once the price carves out with conviction, $0.40 to $0.50 should be plausible by Q4 2025.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.