Highlights:

- Bitcoin hits new record above $122K as crypto market cap jumps to $3.81T.

- Massive $688 million crypto liquidation wipes out 120K traders across major exchanges.

- Bitcoin rally fueled by ETF inflows, strong accumulation, and hopes for regulatory clarity ahead.

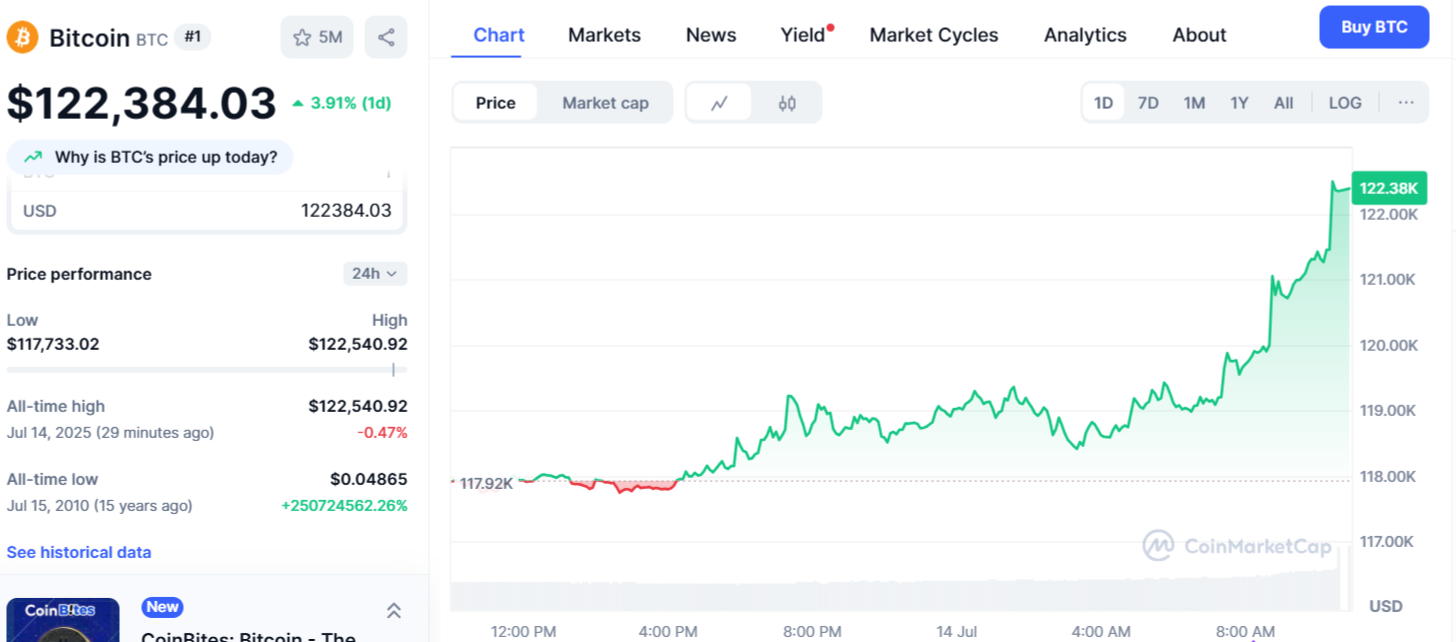

Bitcoin price surged to a fresh all-time high of $122,540 on Sunday night, surpassing the $119,000 level earlier in the day, as per data from CoinMarketCap. At the time of writing, Bitcoin was trading around $122,384, marking a 3.91% increase in the past 24 hours. Strong overall market momentum has lifted many major cryptocurrencies. In the previous 24 hours, the total crypto market value rose 3.7%, hitting $3.81 trillion.

Bitcoin Rally Strengthens as Institutions Pour In and Regulatory Clarity Nears

Bitcoin’s recent surge concludes a strong week of consistent upward movement, fueled by several key market drivers. Among them are bullish on-chain signals, a noticeable uptick in institutional involvement, and rising confidence that the regulatory outlook for crypto is becoming more favorable.

Data from Glassnode highlights that long-term investors are now acquiring more Bitcoin than the amount being introduced into circulation by miners. Specifically, wallets with holdings under 100 BTC have been accumulating at a rate of approximately 19,300 BTC per month, outpacing the monthly miner issuance of 13,400 BTC.

Looking at accumulation by wallet size: Shrimps, Crabs, and Fish – wallets with <100 $BTC – are accumulating ~19.3k BTC/month, while miner issuance stands at 13.4k BTC/month.

Persistent net absorption across a wide base of holders is creating measurable supply-side tightening. pic.twitter.com/ajut5hlpqv— glassnode (@glassnode) July 12, 2025

Institutional demand is also playing a key role in the price surge. Farside Investors reported that U.S. spot Bitcoin ETFs attracted over $2.7 billion in net inflows this week. Notably, both Thursday and Friday saw daily inflows surpassing $1 billion. BlackRock’s iShares Bitcoin Trust (IBIT) led the surge, accounting for more than $1.7 billion of the total inflows within seven days. On Thursday, IBIT hit a record $83 billion in assets under management. The ETF has tripled in size in just 200 trading days—a milestone that took the gold ETF GLD over 15 years to reach. IBIT now holds more than 700,000 BTC, exceeding the holdings of its closest competitor, Strategy, by nearly 100,000 BTC.

BREAKING: Bitcoin ETF, $IBIT, has reached a record $76 BILLION in assets under management.

Total assets have TRIPLED over the last ~200 trading days, per ZeroHedge.

By comparison, it took the largest gold ETF, $GLD, over 15 years to reach the same milestone.$IBIT's Bitcoin… pic.twitter.com/CkRjkJiTUY

— The Kobeissi Letter (@KobeissiLetter) July 10, 2025

Optimism is rising as “Crypto Week” could bring big changes for the crypto market. Lawmakers will discuss three important bills. These include rules for stablecoins (GENIUS Act), support for blockchain systems, and clear roles for crypto regulators (CLARITY Act). Many believe this could finally bring clear laws for digital assets.

🚨NEW: Chairman @RepFrenchHill, @HouseAgGOP Chairman @CongressmanGT, and House Leadership announced that the week of July 14th will be “Crypto Week,” where the CLARITY Act, Anti-CBDC Surveillance State Act, and GENIUS Act will be considered. @SpeakerJohnson @SteveScalise… pic.twitter.com/vIUoGaoSy1

— Financial Services GOP (@FinancialCmte) July 3, 2025

Over $680B in Crypto Liquidated as Traders Face Massive Losses

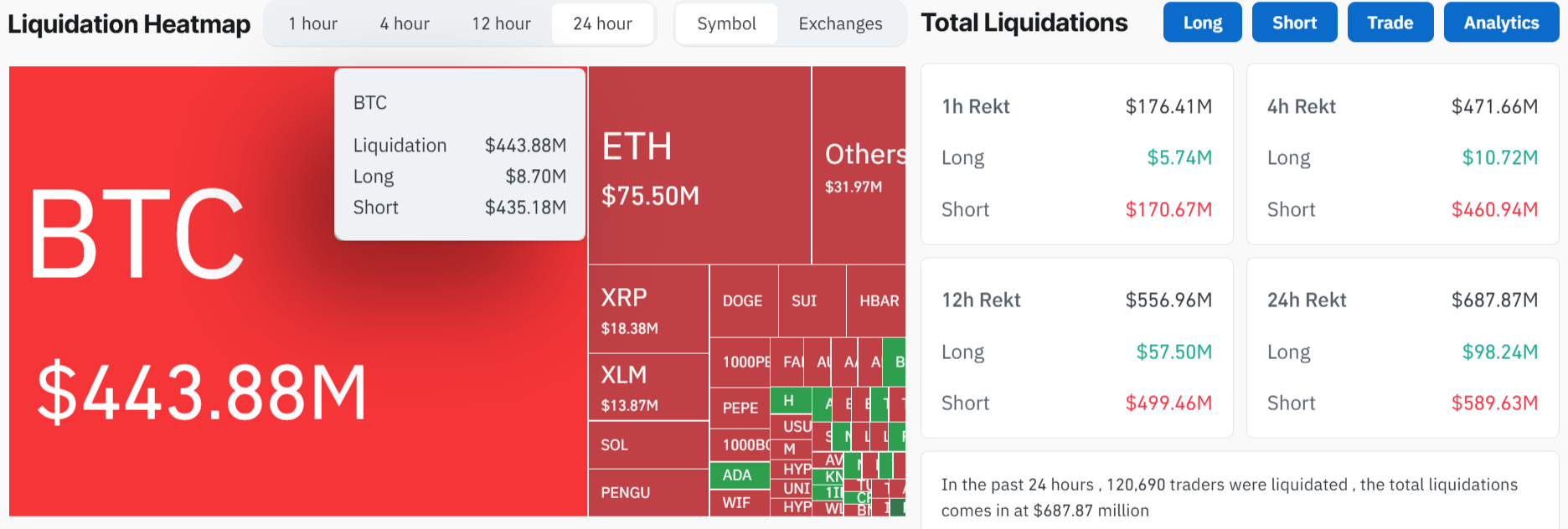

According to cryptocurrency analytics firm CoinGlass, $687.87 million in crypto was liquidated within the last 24 hours. This included $98.24 million in long positions and $589.63 million in short positions. This widespread liquidation activity has affected 120,690 traders. Most liquidations happened on ByBit and Binance, with $216.95 million and $206.62 million, respectively. Bitcoin saw liquidations totaling $433.88 million, with $8.70 million from long positions and $435.18 million from short positions.

Ethereum recorded liquidations amounting to $75.50 million, comprising $23.27 million from long positions and $52.23 million from short positions. Dogecoin and Solana saw the liquidation of $8.57 million and $9.95 million, respectively, in the past 24 hours. Significant liquidations hit both XLM and XRP, with $13.87 million and $18.38 million wiped out, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.