Highlights:

- Bitcoin ETFs see $2.2B inflows in two days, led by BlackRock’s IBIT.

- Spot ETFs bought 10,000 BTC on Thursday, far outpacing the daily mined supply of 450.

- Bitcoin hits $118,856 ATH as crypto market cap climbs to $3.65 trillion.

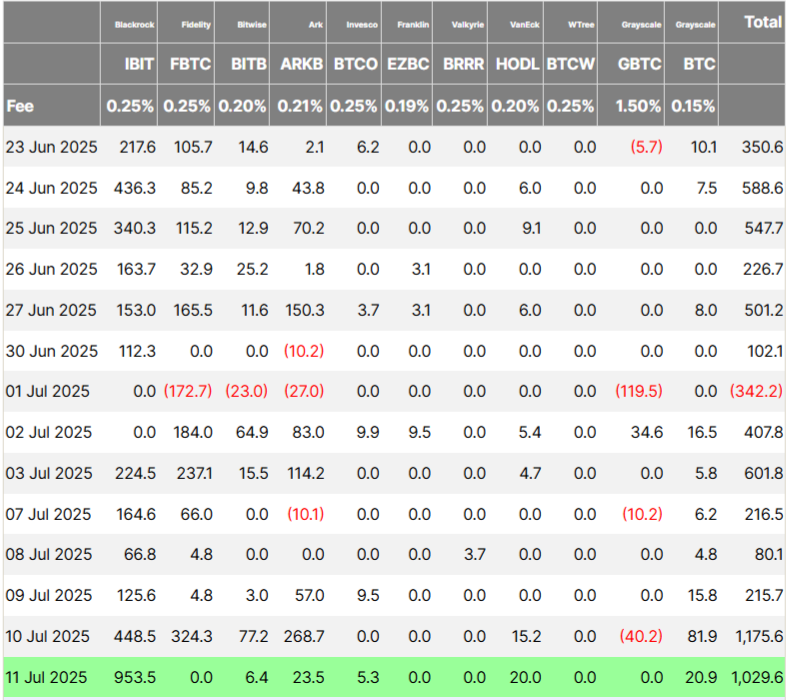

According to data from Farside, the US-based spot Bitcoin Exchange-Traded Funds (ETFs) brought in $1.03 billion on Friday, just after recording $1.17 billion in inflows the previous day. BlackRock’s iShares Bitcoin Trust (IBIT) topped the list with $953.5 million in net inflows. ARK 21Shares Bitcoin ETF (ARKB) came next, adding $23.5 million. Grayscale Bitcoin Mini Trust ETF (BTC) ranked third, drawing $20.9 million, while VanEck Bitcoin ETF (HODL) recorded $20 million.

Bitwise Bitcoin ETF (BITB) and Invesco Galaxy Bitcoin ETF (BTCO) also recorded small inflows. In contrast, Fidelity’s FBTC, Franklin’s EZBC, Grayscale’s GBTC, Valkyrie’s BRRR, and WisdomTree’s BTCW all reported no net inflows for the day.

Spot Bitcoin ETFs See Historic Inflows

Nate Geraci, president of NovaDius Wealth Management, said on X that since BTC ETFs started in January last year, there have only been seven days with over $1 billion in inflows. Two of those high-inflow days occurred back-to-back this week. The last time this happened was on January 17, with $1.07 billion coming in.

Another $1+bil into spot bitcoin ETFs…

*$2.7bil* for the week.

Since Jan 2024 launch, there have been 7 days of inflows > $1bil.

2 of those are in past 2 days.

— Nate Geraci (@NateGeraci) July 12, 2025

Spot Bitcoin ETFs saw a $1.17 billion inflow on Thursday, marking their second-largest daily total since they launched. The highest was $1.37 billion on November 7, shortly after Donald Trump won the U.S. presidential election. Matt Hougan, the chief investment officer at Bitwise Invest, spoke about the trend on Friday. He said that even though only 450 new Bitcoins were created that day, spot ETFs bought about 10,000. This shows big investors are buying much more Bitcoin than is being produced.

The bitcoin network produces ~450 new bitcoin a day. Yesterday, ETFs bought ~10,000.

— Matt Hougan (@Matt_Hougan) July 11, 2025

Bitcoin Hits New All-Time High Above $118K

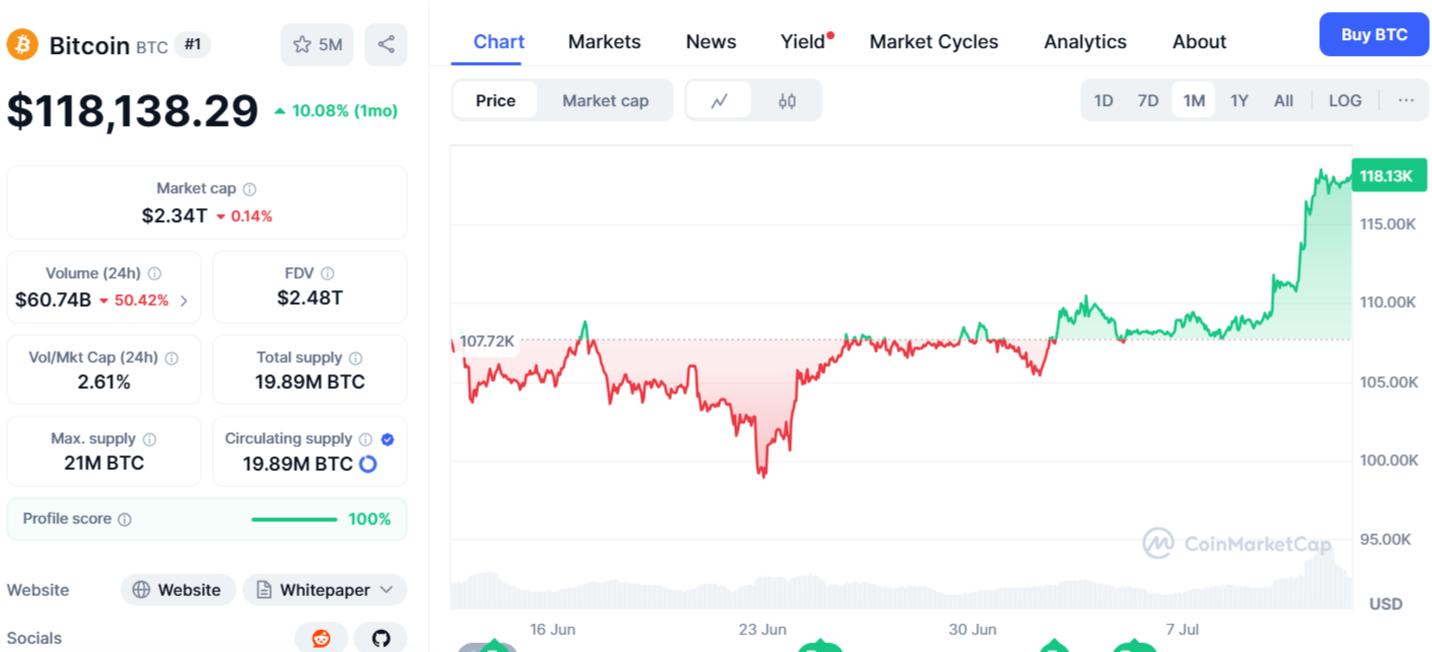

Bitcoin hit a new all-time high of $118,856 yesterday, as shown by CoinMarketCap data. The surge was driven by rising interest from institutional investors and positive signs within the crypto space. At the time of writing, Bitcoin had gained 10.08% over the past 24 hours, trading at $118,138. The strong upward trend also lifted other leading cryptocurrencies. The overall crypto market cap rose by 0.22% in the last 24 hours, reaching $3.69 trillion.

Institutional Demand and Regulation Fuel Bullish Outlook for Bitcoin

An increasing number of companies are adopting Bitcoin as a strategic reserve asset, with notable players like Metaplanet and Strategy (formerly MicroStrategy) leading the way. As of June 30, Strategy held 597,325 BTC, setting a strong example for other publicly traded firms. In the second quarter of 2025 alone, public companies acquired 131,000 BTC, marking an 18% rise in corporate Bitcoin holdings. This brought the total Bitcoin held on company balance sheets to more than 847,000 BTC by the end of the quarter. The growing demand from institutions is also contributing to upward pressure on Bitcoin’s price.

Cardano founder Charles Hoskinson has once again backed his bold $250,000 Bitcoin price prediction, as BTC continues to hit fresh highs. He believes that upcoming regulatory developments in the U.S. could act as a major catalyst for the next bull run. In a recent post on X, Hoskinson pointed to the GENIUS and CLARITY Acts—two key pieces of proposed legislation. He believes these laws could open the door for large-scale institutional investment and significantly accelerate mainstream adoption of digital assets.

Remember I said the gigachad bullrun is coming. We are going to see 250k bitcoin and trillions enter the space for the alts. Genius and Clarity acts will be the catalyst. pic.twitter.com/YnCgQDkPjE

— Charles Hoskinson (@IOHK_Charles) July 11, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.