Highlights:

- Bitcoin hits new all-time high of over $118,000 as institutional demand surges.

- $1.26 billion in crypto liquidated, mostly from short positions on major exchanges.

- Spot Bitcoin ETFs recorded $1.18 billion in inflows, with BlackRock and Fidelity leading the way.

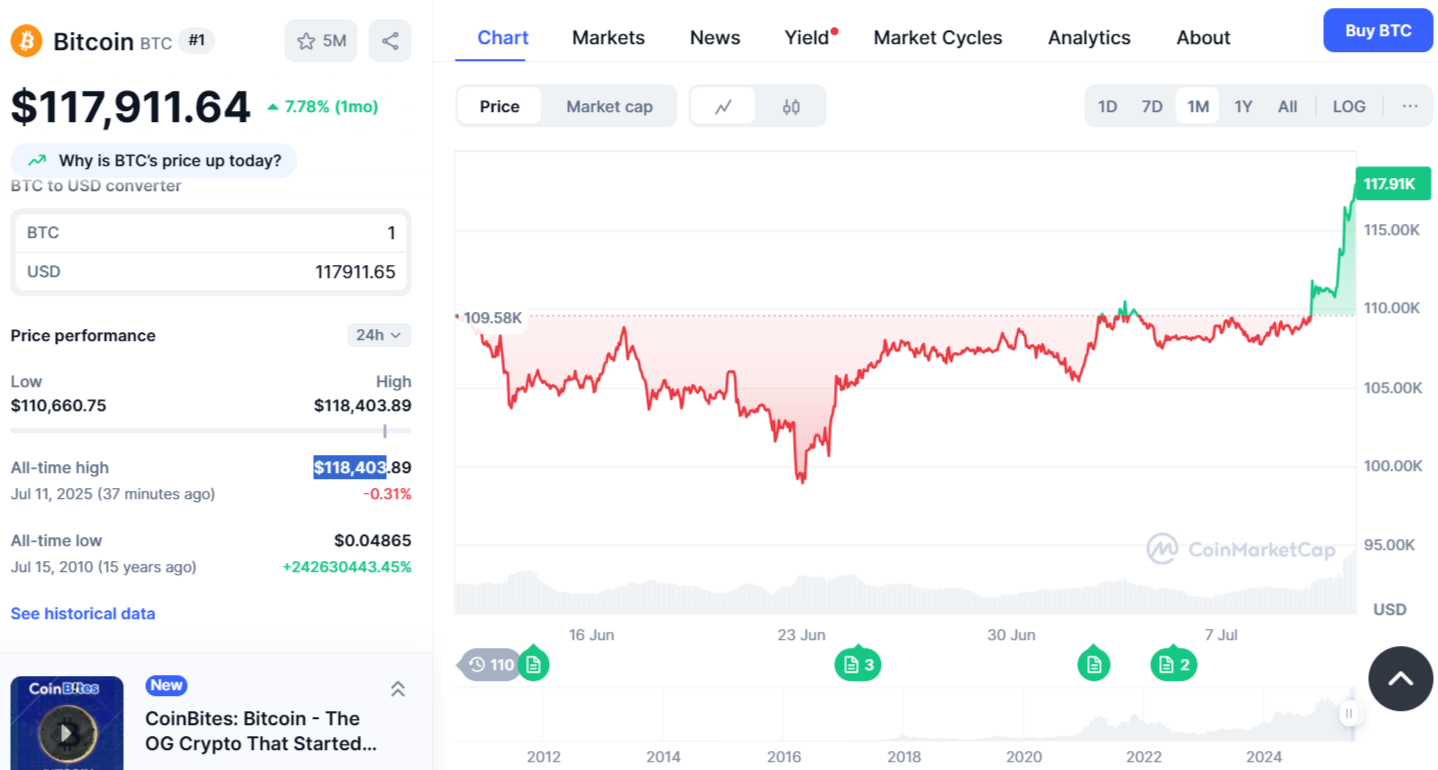

Bitcoin set a new all-time high of $118,403 early Friday, according to CoinMarketCap data. The rally was fueled by increasing institutional demand and encouraging signals from the crypto industry. At the time of writing, Bitcoin was up 7.78% in the past 24 hours, trading at $117,911. Broader market momentum also pushed other major cryptocurrencies into positive territory. The total crypto market capitalization has jumped 5.1% in the last 24 hours, reaching $3.65 trillion.

Massive Crypto Liquidations as Bitcoin Hits All-Time High

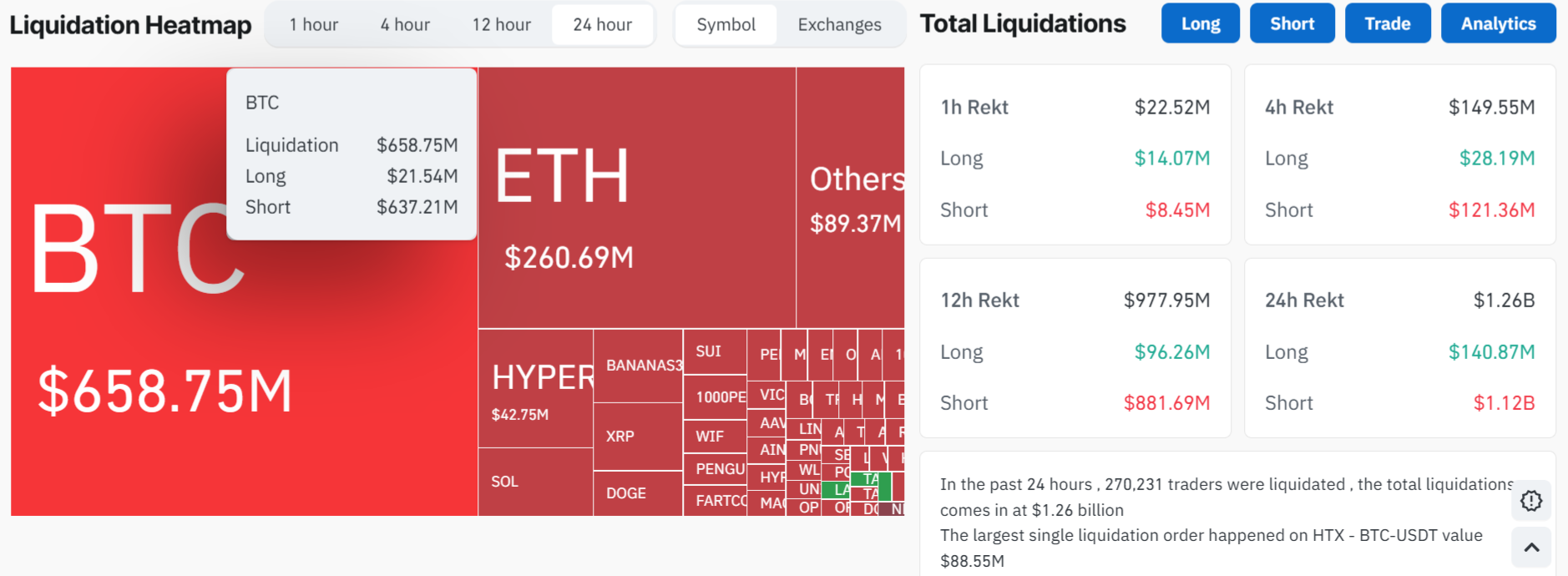

According to cryptocurrency analytics firm CoinGlass, $1.26 billion in crypto was liquidated within the last 24 hours. This included $140.87 million in long positions and $1.2 billion in short positions. This widespread liquidation activity has affected 270,231 traders. Most liquidations happened on ByBit and Binance, with $515.94 million and $230.17 million, respectively.

Bitcoin saw liquidations totaling $658.75 million, with $21.54 million from long positions and $637.21 million from short positions. Ethereum recorded liquidations amounting to $260.69 million, comprising $41.53 million from long positions and $219.16 million from short positions. Dogecoin and Solana saw the liquidation of $12.79 million and $24.75 million, respectively, in the past 24 hours. XRP and HYPE also saw significant liquidations, with $19.18 million and $42.75 million wiped out, respectively.

Spot Bitcoin ETFs See $1.18B Inflows

Institutional interest remains strong across the market. Spot Bitcoin exchange-traded funds saw a total of $1.18 billion in inflows on Thursday, marking their second-largest single-day inflow since inception. BlackRock’s iShares Bitcoin Trust (IBIT) topped the list with $448.5 million in net inflows. Fidelity’s Wise Origin Bitcoin Fund (FBTC) came next, adding $324.3 million. ARK 21Shares Bitcoin ETF (ARKB) ranked third, drawing $268.7 million, while Bitwise Bitcoin ETF (BITB) recorded $77.2 million.

VanEck Bitcoin ETF (HODL) also saw net inflows of $15.2 million. In contrast, Invesco Galaxy, Franklin Templeton, Valkyrie, and WisdomTree all reported no net inflows for the day. Grayscale’s GBTC recorded net outflows of $40.2 million, while its lower-cost Bitcoin fund attracted $81.9 million in net inflows. Collectively, U.S. Bitcoin funds now hold approximately 5.99% of the total Bitcoin supply, amounting to 1,258,143 BTC.

*2nd* best day of inflows since launch for spot btc ETFs…

$1.2bil.

In one day.

— Nate Geraci (@NateGeraci) July 11, 2025

Cardano Founder Predicts BTC Price Could Hit $250K Soon

Cardano founder Charles Hoskinson has repeated his $250K Bitcoin prediction as BTC hits new highs. He believes upcoming U.S. regulatory clarity could trigger a major bull run. In April, he pointed to growing stablecoin use, demand for BTC in treasuries, and possible Fed rate cuts. Hoskinson said lower interest rates could bring more money into crypto.

In a recent X post, Hoskinson said the upcoming GENIUS and CLARITY Acts could spark major growth. He believes these laws will unlock big institutional money and boost crypto adoption. Earlier this year, he predicted Bitcoin could hit $250K within 12 to 24 months. A 100% rally could push BTC’s market cap near $5 trillion, putting it close to Nvidia and just behind Gold.

Remember I said the gigachad bullrun is coming. We are going to see 250k bitcoin and trillions enter the space for the alts. Genius and Clarity acts will be the catalyst. pic.twitter.com/YnCgQDkPjE

— Charles Hoskinson (@IOHK_Charles) July 11, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.