Highlights:

- XDC Network price has increased by 1.5% to $0.065, as trading volume spikes 8.84%.

- The recent rise comes as XDC Network partnered with LoopFi.

- Technical indicators suggest a potential breakout towards the $ 0.10 mark in the short term.

The XDC network is showing a strong upward movement, surging 1.5% in the past 24 hours to $0.065. Its daily trading volume is up 8.84% signalling intense market activity. XDC is now up 12% over the past week and 10% over the past month, indicating increased interest among XDC investors and traders. This comes following the highly successful partnership between XDC Network and LoopFi. This partnership enables users to stake XDC and earn rewards, offering early access to the expanding XDC ecosystem.

Loop × XDC Network Integration Now Live

As @XDC_Network_ accelerates DeFi adoption, LoopFi is proud to be the first platform enabling LP smart collateral lending and borrowing yield on XDC through slpXDC and slpUSDCe.

Early Access Opportunity: Users depositing now will earn… pic.twitter.com/hNEWd5TTL1

— Loop (@loopfixyz) July 7, 2025

LoopFi offers a significant benefit in that XDC tokens can be converted at a 1:1 ratio. This enables more users to become neighborhood investors upon entering DeFi. This new feature makes XDC one of the first movers in the DeFi implementation space. It also enables an increase in users engaging with the ecosystem’s staking and crypto-earning opportunities.

XDC Network Aims for a Breakout

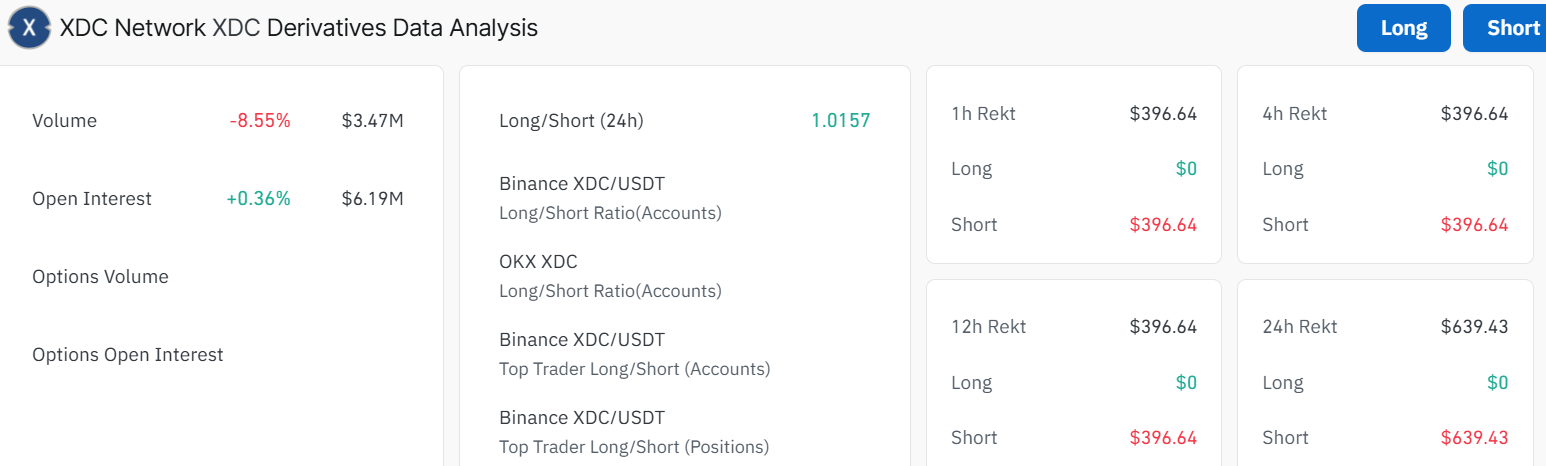

Although the price has been volatile in recent times, the XDC Network still exhibits positive technical indicators. On July 8, the XDC price stands at 0.0654, corresponding to a 1.5% surge in the past 24 hours. The volume of trades has decreased by 8.55%, indicating a decline in market activity.

However, the open interest in the network has increased by 0.36%, indicating that significant investor interest remains, despite the low trading volume. The long-to-short ratio is 1.0157, indicating a good balance between long and short positions, which suggests that XDC remains relatively bullish.

Technically, the daily chart outlook of XDC/USD indicates that the token has been experiencing a modest rally over the past few days. The price action sits between its 50-day and 200-day MAs and has a price resistance at around $0.0779 and a support at $0.0618.

The Relative Strength Index (RSI) has a value of 64.38, implying that the market is tilted towards the bullish side. However, there is still room for the token to move higher before it is considered overbought. If the price of XDC surpasses its current resistance of $0.079, it may experience upward price action. In such a case, the token could rally towards the next resistance level of $0.10 and beyond.

Is $0.1 Imminent in the XDC Market?

The rising trading volume and positive technical indicators suggest that the XDC Network price is poised for a bullish breakout. Meanwhile, the bulls have established a strong support zone at $0.0618, providing them with wings for further upside towards the $0.0779 resistance. If the bulls overcome the key barrier at $0.077 mark, a rally toward $0.1 mark could be plausible. In a highly bullish scenario, the bulls could target $0.12 to $0.14 in Q3.

On the other hand, if the resistance remains strong, the token may undergo short-term consolidation within the support range of $0.061 to $0.055. In the meantime, traders monitor the key support and resistance zones, as a breakout in either direction will determine the next move in the XDC market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.