Highlights:

- Turkey blocks 46 crypto platforms, including PancakeSwap, for operating without proper authorization.

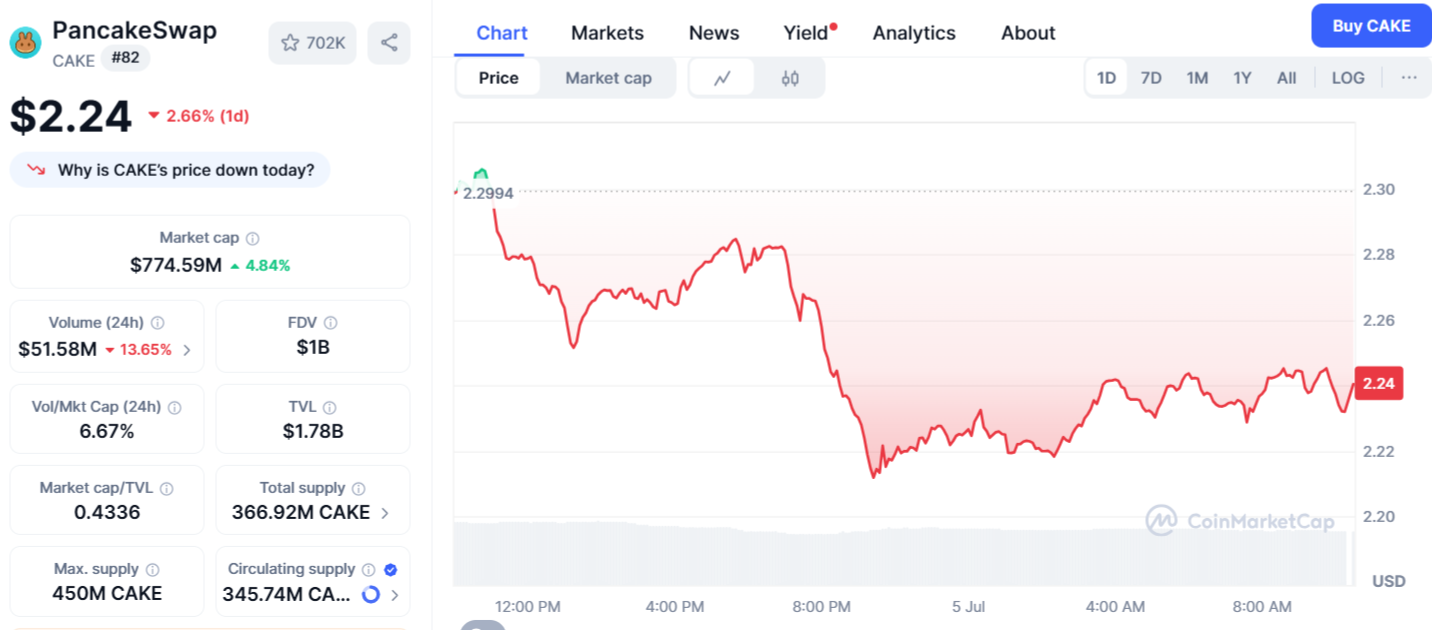

- CAKE token drops 3% in 24 hours as trading volume falls to $51.58 million.

- Crypto use grew in Turkey as inflation pushed people to digital assets.

Turkey’s Capital Markets Board, the country’s main financial regulator, has restricted access to 46 websites for “providing unauthorized crypto asset services.” PancakeSwap, one of the world’s top decentralized exchanges with over $325 billion in trading volume for June, was among the platforms restricted by Turkish authorities. The CMB cited the Capital Markets Law to support the ban, though it remains unclear how the agency concluded these platforms were directly serving users in Turkey. In addition to PancakeSwap, access was also blocked to CryptoRadar, a platform known for comparing crypto prices across different exchanges.

Turkey's financial regulator has blocked 46 crypto-related websites, including major DEX PancakeSwap, as part of a broader crackdown on unauthorized digital asset services. The Capital Markets Board (CMB) said it took legal action under the Capital Markets Law against platforms…

— Wu Blockchain (@WuBlockchain) July 5, 2025

Since March, new regulations have given Turkey’s Capital Markets Board full control over crypto asset service providers offering products to local users. These rules enforce strict compliance and operational standards. Although crypto payments were banned in 2021, people can still buy, hold, and trade digital assets. Earlier this year, authorities also required users to submit identification for crypto transactions exceeding around $425.

Turkey’s Crypto Crackdown Beyond Centralized Platforms

The ban on PancakeSwap marks the first time a decentralized exchange has faced enforcement in Turkey. After the enforcement action, PancakeSwap’s native token CAKE dropped by 2.66% in the last 24 hours and is down 10% over the past month. Its trading volume also fell sharply, declining 13.65% to $51.58 million.

Until now, only centralized platforms like Binance and FTX have been blocked. This move puts other DEXs such as Uniswap (UNI) and Raydium at potential risk. Additionally, other crypto-related services, including DEX aggregators and analytics platforms, may also face restrictions.

Interestingly, the crackdown followed a surge in crypto adoption across Turkey. With inflation persisting since 2022, many citizens turned to digital assets as a more stable alternative to the weakening national currency. This growing interest was also reflected in market data. In June last year, the Turkish lira overtook the Euro to become the third-most-used fiat currency for buying crypto.

Turkey Tightens Crypto Grip Amid Legal Uncertainty

Turkey is now the latest country to join a growing list of nations cracking down on the crypto industry. Russia, Kazakhstan, Venezuela, and the Philippines have all taken steps to block platforms that lack local approval and fail to meet regulatory standards. Critics believe Turkey’s action is also part of broader efforts to stabilize its struggling economy and protect citizens from scams, fraud, and risky assets.

Turkey is drafting new crypto laws to block unlicensed platforms like PancakeSwap. All platforms must follow KYC, and AML rules, and get a local license. The goal is to make crypto safer and more controlled. This week’s move seems to set rules before legal issues get bigger. It’s not clear if banned platforms can reapply or appeal with a local license. For now, Turkish users can’t access them unless they use VPNs, which may be risky legally.

NEW: 🇹🇷Turkey enhances its #crypto oversight, implementing new rules that place exchanges & investors under the full supervision of the Capital Markets Board with heightened compliance standards. 👀 pic.twitter.com/Egl0h76X1k

— CryptosRus (@CryptosR_Us) March 13, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.