Highlights:

- Moo Deng surges 42% as trading volume spikes 760% following Upbit listing.

- Bullish flag pattern and RSI indicate room for bullish continuation in Moo Deng.

- Moo Deng’s price is poised for a 70% rally if support holds.

As of July 3, the Moo Deng price has gained a spot among the top gainers, soaring 42% to the $ 0.20 mark in the past 24 hours. The trading volume has notably soared by over 760%, indicating heightened market activity. The spike comes following a recent listing on the Upbit exchange. The Asian-based crypto exchange has listed MOODENG/KRW, MOODENG/BTC, and MOODENG/USDT pairs, which significantly enhances the coin’s visibility.

신규 디지털 자산 무뎅(MOODENG) 거래지원 안내

✅ 지원 마켓: KRW, BTC, USDT 마켓

📅 거래지원 개시 시점 : 2025-07-03 17:00 KST 예정🔗공지 바로가기:https://t.co/mnLtihhxjO#Upbit #MOODENG@MooDengSOL pic.twitter.com/zBPqES1vh0

— Upbit Korea (@Official_Upbit) July 3, 2025

The listing is designed to increase liquidity and expand the asset’s market reach. With increasing awareness of MOODENG in the large markets, there is a possibility that the increased capital will further fuel its bullish momentum.

Moo Deng Price Poised For a Bullish Continuation Above The Bullish Flag Pattern

The daily chart outlook in MOODENG/USD shows some bullish prospects in the market. Moreover, the bullish flag pattern reinforces the current potential upside. The bulls have already established a support level at $0.1933, aligning with the 50-day MA. This also gives the bulls the hind wing for a further bullish breakout, with an eye on $0.34 in the short term.

Moreover, the Relative Strength Index (RSI), currently at 59.43, indicates that there is still room to rise until the price reaches the overbought value. Its position above the 50-day moving average level tilts the odds in favor of the bulls. Along with the flag pattern, the MACD (Moving Average Convergence Divergence) indicator demonstrates positive momentum. This affirms the idea that MOODENG can move even further.

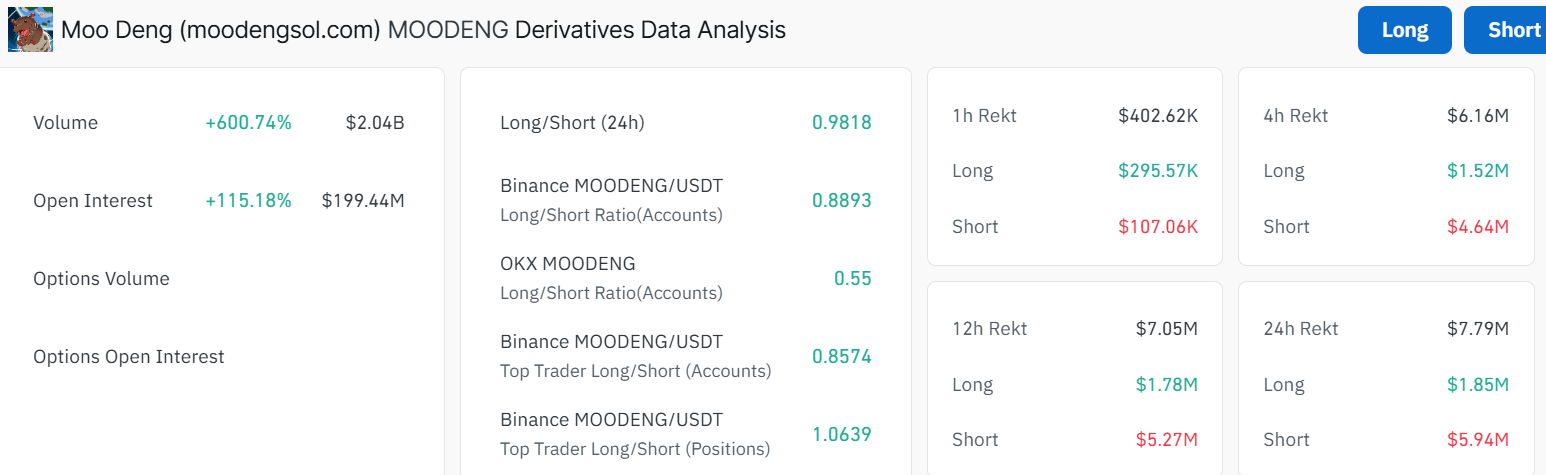

The derivatives market of MOODENG has experienced remarkable growth, with a 600.74% increase in trading volume, currently standing at $2.04 billion. Notably, there has been a 115.18% increase in the open interest, which has risen to $199.44 million. The 24-hour long/short ratio also has a value of 0.9818, which is positive but not high, indicating small bullishness.

Such volatility is also reflected in the market liquidations, which totaled $7.79 million over the past 24 hours. The lion’s share was accounted for by the shorts with $5.94 million, as the longs took the rest ($1.85 million). This is a clear indication that MOODENG is likely to undergo a short squeeze, which might increase the price in the coming days.

MOO DENG Poised For 70% Rally In the Short Term

The zoomed view of the Moo Deng price affirms a bullish continuation in the coming days. If the support zone holds and the conviction in the market remains, the price could reclaim the $0.30-$0.34 resistance within the next 48 hours, marking a 70% gain from the current level.

On the downside, if the bears step in and the crypto market turns negative, a slip towards the $0.19 safety net would be imminent. However, only a close below the $0.12 support zone will trigger panic sell-offs. In the meantime, traders should monitor the increasing volume and whether the RSI will enter the overbought region to avoid falling into a bull trap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.