Highlights:

- Solana ETF SSK launched on Cboe with $33M volume and $12M inflows on day one.

- Anchorage Digital handles custody and staking under stricter Investment Company Act rules.

- SEC allowed launch after concerns, but is still reviewing other crypto ETFs like Grayscale.

The United States’ first Solana staking exchange-traded fund (ETF) launched on July 2 on the Cboe exchange with a strong debut. Bloomberg’s Senior ETF Analyst Eric Balchunas shared that SSK, the REX-Osprey Solana + Staking ETF, recorded $12 million in inflows and $33 million in trading volume on its first day. He noted that based on the day’s trading activity, the fund’s assets could grow to $10 million by its second day.

$SSK ended day with $33m in volume. Again, blows away the Solana futures ETF and XRP futures ETFs (or the avg ETF launch) but it is much lower than the Bitcoin and Ether spot ETFs. pic.twitter.com/t6LkQwDXLc

— Eric Balchunas (@EricBalchunas) July 2, 2025

REX-Osprey ETF Follows Stricter 1940 Act Rules

Unlike past SEC-approved crypto ETFs, the REX-Osprey Solana + Staking ETF is structured under the Investment Company Act of 1940, requiring tighter oversight and a qualified custodian. Anchorage Digital, a federally regulated crypto bank, manages both custody and staking. Anchorage Digital co-founder Nathan McCauley called the launch of crypto staking ETFs a major milestone for the industry. He called it an important move toward broader access to the digital asset ecosystem.

He said:

“Staking is the next chapter in the crypto ETF story. This launch marks a major step forward in giving institutions full access to the crypto ecosystem in a regulated package.”

Bloomberg analyst James Seyffart described the ETF’s launch as a solid beginning, pointing out it hit $8 million in volume within just 20 minutes. Eric Balchunas also emphasized the strong opening, saying it far outperformed the initial trading volumes of both Solana and XRP futures ETFs. However, he noted that it still falls well below the launch volumes of spot Bitcoin and Ether ETFs. When U.S.-listed spot Bitcoin ETFs launched in January 2024, they saw a combined $4.6 billion in trading volume on their first day.

First spot solana staking ETF is officially live. Healthy start to trading for a new ETF with ~$8 million in trading in first 20 min. pic.twitter.com/HBl7zzVv1F

— James Seyffart (@JSeyff) July 2, 2025

SEC Caution Lingers Despite Solana ETF Approval

The ETF finally launched after several months of discussions with the U.S. Securities and Exchange Commission. The regulator had earlier raised concerns about how the fund would be classified and how its staking process would function. However, by June 28, the SEC had no additional objections, allowing the ETF to move ahead with its debut.

Although the U.S. Securities and Exchange Commission is reportedly exploring broader guidance to simplify ETF approvals, concerns remain. On Wednesday, SEC Deputy Secretary J. Matthew DeLesDernier sent a letter to the New York Stock Exchange indicating that the recently approved Grayscale ETF is still under “review.” This suggests the agency is still cautious about easing its usual strict standards for listing crypto-related funds.

Solana Price Jumps After REX-Osprey Solana + Staking ETF Launch

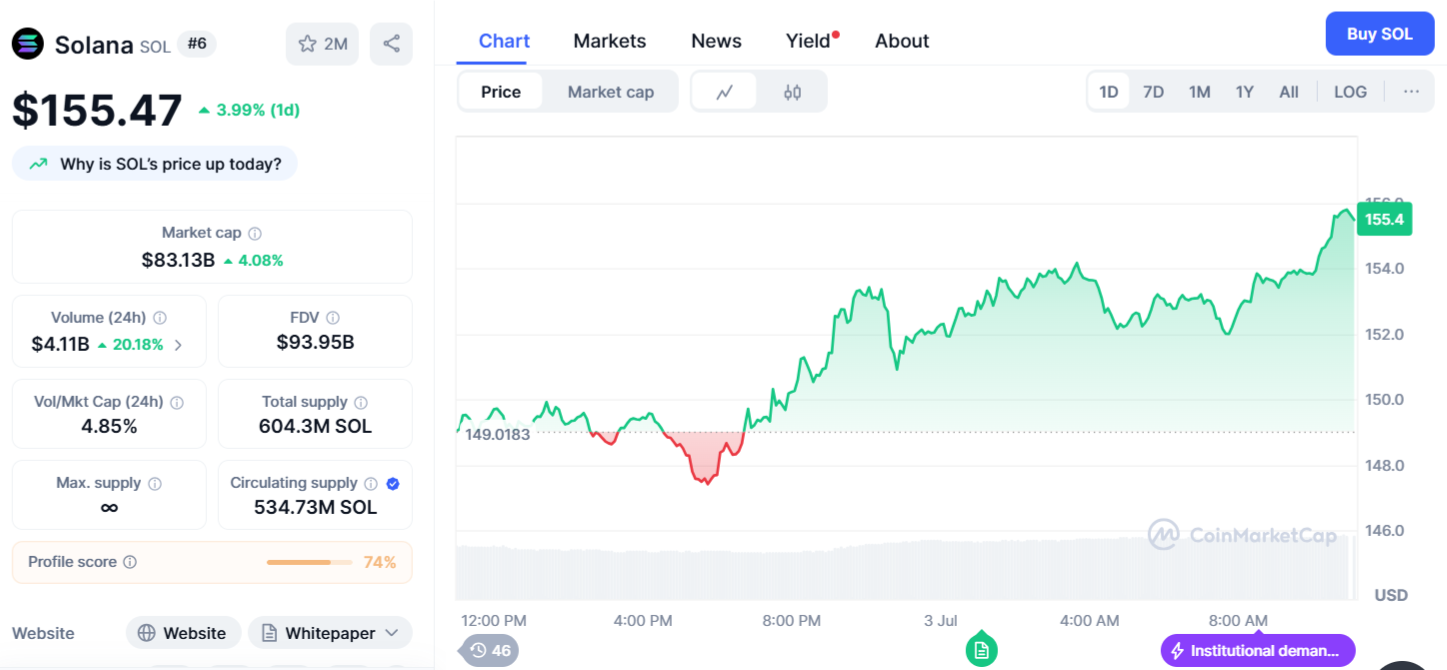

Solana’s price moved up following the ETF launch news. At the time of writing, it was trading around $155, showing a 3.99% gain over the past 24 hours. The token is also up 7% on the week, though still 47% below its January peak.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.