Highlights:

- The price of Kaia rises 3% to $0.16, accompanied by a 65% increase in daily trading volume.

- Kaia rewards users for feedback on Mini Dapps, with 1,000 KAIA for top posts.

- Bullish technical indicators suggest a potential price surge toward $0.18.

The Kaia price has increased by 3% to $0.16, as daily trading volume has risen 65% over the past 24 hours. Meanwhile, Kaia is a user-powered platform that rewards the community. As such, Kaia is asking those who use its innovative Mini Dapps to share their experience using the @dapp_portal.

We’re building Kaia for real users and your feedback matters!

Tried Mini Dapps on the @dapp_portal?

Tell us what you liked, what confused you, or what could be better.This is your chance to shape what comes next!

• 10 feedback posts with the highest impression will share…

— Kaia (@KaiaChain) June 17, 2025

This effort will also encourage users to provide valuable input. This can be used to develop the platform’s future in exchange for rewards. Kaia team would provide a KAIA reward of 1,000 to the top 10 posts receiving the most impressions, along with a KAIA reward of 1,000 to 10 of the posts that are chosen by the Kaia team.

Kaia Price Shows Robust Strength

The KAIA/USD has demonstrated strong resilience after rebounding from a low of $0.14 to the $0.16 mark. As shown on the 4-hour chart, a sharp cup-and-handle potential pattern could be formed, which can be regarded as a potential positive signal according to technical interpretation. This implies that the possibility of the Kaia price breaking through some major points of resistance is likely to cause a further increase in prices. Furthermore, the bulls have established a support zone at $0.1635, which aligns with the 50-day moving average, tilting the odds in favour of the bulls.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) allow more insights. As the RSI of 55.28 is now in no-man’s land, it shows that the objective zone has not been reached. In that, the token has ample space to move higher without being overbought. In the meantime, the MACD exhibits bullish strength, as the blue line is above the orange one, lending confidence to the bulls.

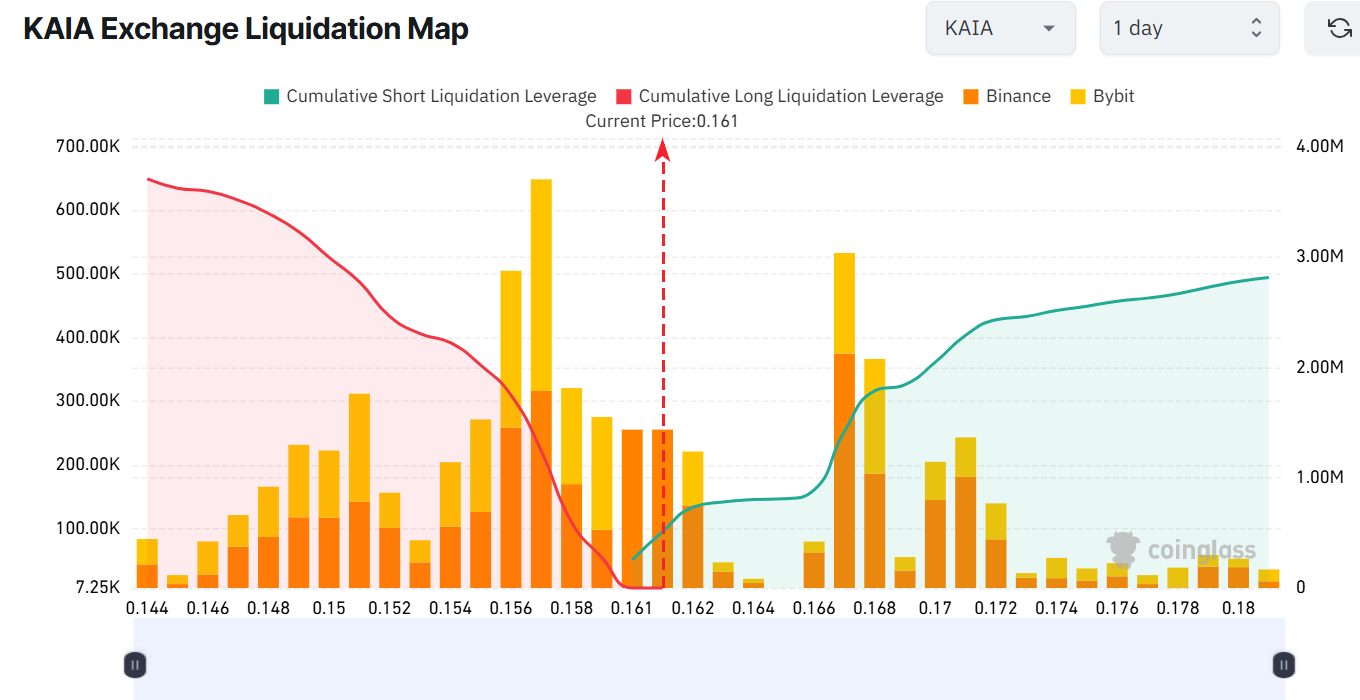

On the other hand, the Coinglass liquidation map of KAIA shows more cumulative long liquidation leverage ($3.71 million) compared to shorts ($2.82 million) in the last 24 hours. This imbalance suggests that bullish sentiment currently dominates the Kaia market, as traders anticipate a further price surge in the future.

KAIA Poised for Further Upside

The recent outlook from the Kaia market indicates growing confidence among traders, as they anticipate a price surge. Based on the technical indicators and the Kaia liquidation map, if the bulls gain strength, the Kai price could rally towards $0.17 and $0.18. In a highly bullish scenario, the bulls may target the $0.2 mark soon.

On the other hand, if the bulls lose grip and the bears step in, the Kaia price may drop. In such a case, the $0.16 support will act as a safety net against further downside. If the support zone gives way, further downside towards $0.15 and $0.14 may be plausible. In the meantime, technical indicators, combined with user-based feedback, position Kaia to succeed in the future. A combination of community feedback and healthy price behaviour introduces a rare chance to engage both investors and users in future development on this platform.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.