Highlights:

- Semler Scientific added 185 BTC with a new investment worth $20 million.

- The medical diagnostic firm currently owns 185 BTC, purchased for approximately $410 million.

- Semler Scientific ranked among the top 20 largest corporate holders of BTC, according to The Block statistics.

Medical diagnostic firm Semler Scientific has expanded its Bitcoin (BTC) holdings with new investments worth about $20 million. The company’s chairman, Eric Semler, announced the latest purchase in a June 4 X post. According to the chairman, the company added 185 BTC, increasing its holdings to approximately 4,449 BTC, worth around $410 million at $92,158 per token.

Semler stated:

“Between May 23, 2025, and June 3, 2025, Semler Scientific acquired 185 Bitcoin for $20.0 million with an average purchase price of $107,974 per Bitcoin, inclusive of fees and expenses.”

$SMLR acquires 185 #Bitcoins for $20 million and has generated BTC Yield of 26.7% YTD. Now holding 4,449 $BTC. 🚀

— Eric Semler (@SemlerEric) June 4, 2025

BTC Yield Continues to Soar

Semler Scientific also noted that its BTC holdings have generated yields of about 26.7% in 2025. Per the investment firm, the BTC yield serves as a Key Performance Indicator (KPI) to assess the performance of its Bitcoin accumulation strategy. It also helps investors understand the significance of the company’s acquisition approach.

For context, Semler Scientific’s accumulation strategy entails using funds from share issuances and convertible instruments to accumulate more BTC. The investment firm believes that this approach will add value to shareholders.

Also, the company’s BTC holdings valuation showed $472.9 million at the time of drafting the report. Semler Scientific based this valuation on BTC’s price reported on the Coinbase exchange as of 4:00 p.m. ET on June 3, 2025. This implies that the company has unrealized profits worth approximately $62.9 million.

Aside from the new purchase, Semler Scientific also updated users on shares issuances. The company stated: “As of June 3, 2025, Semler Scientific has issued and sold 3,544,588 shares of its common stock for an aggregate net proceeds of approximately $136.2 million under this sales agreement.”

Semler Scientific just added $20M in Bitcoin, bringing their total to 4,449 BTC—worth ~$467M.

A small-cap company with a half-billion dollar Bitcoin treasury. This is the way. 💪 pic.twitter.com/QA3fsn7FBu

— Swan (@Swan) June 4, 2025

Semler Scientific Ranks Among the Top 20 Companies with the Highest BTC Holdings

According to “The Block’s” corporate BTC holders rankings, Semler Scientific is the fifteenth-largest owner of BTC. The company ranks below firms like Strategy, which is currently the largest corporate holder of BTC, with over 580,000 BTC stores. Other top BTC investment firms include MARA Holdings, Riot Platforms Inc., Galaxy Digital, Hut 8, Square, Metaplanet, and Coinbase.

Notably, MARA Holdings recently published its Bitcoin mining operations report for last month. The publication showed that the mining firm had a record-breaking month with 282 in number of blocks won and 950 mined BTC, bringing the company’s total holdings to about 49,000 coins. On June 2, Metaplanet announced a fresh BTC accumulation worth $117.3 million for 1,088 BTC. The Japanese crypto investment firm noted that it paid an average of $107,771 for each token and has achieved a 225.4% year-to-date (YTD) yield.

Strategy also disclosed its latest BTC acquisition on the same date. The American company bought 705 BTC for $75.1 million. Each token costs an average of $106,495. On June 3, France’s crypto investment firm, Blockchain Group, announced a $68.7 million investment in 624 BTC, increasing its holdings to about 1,471 tokens, valued at roughly $154 million.

Bitcoin Drops Slightly

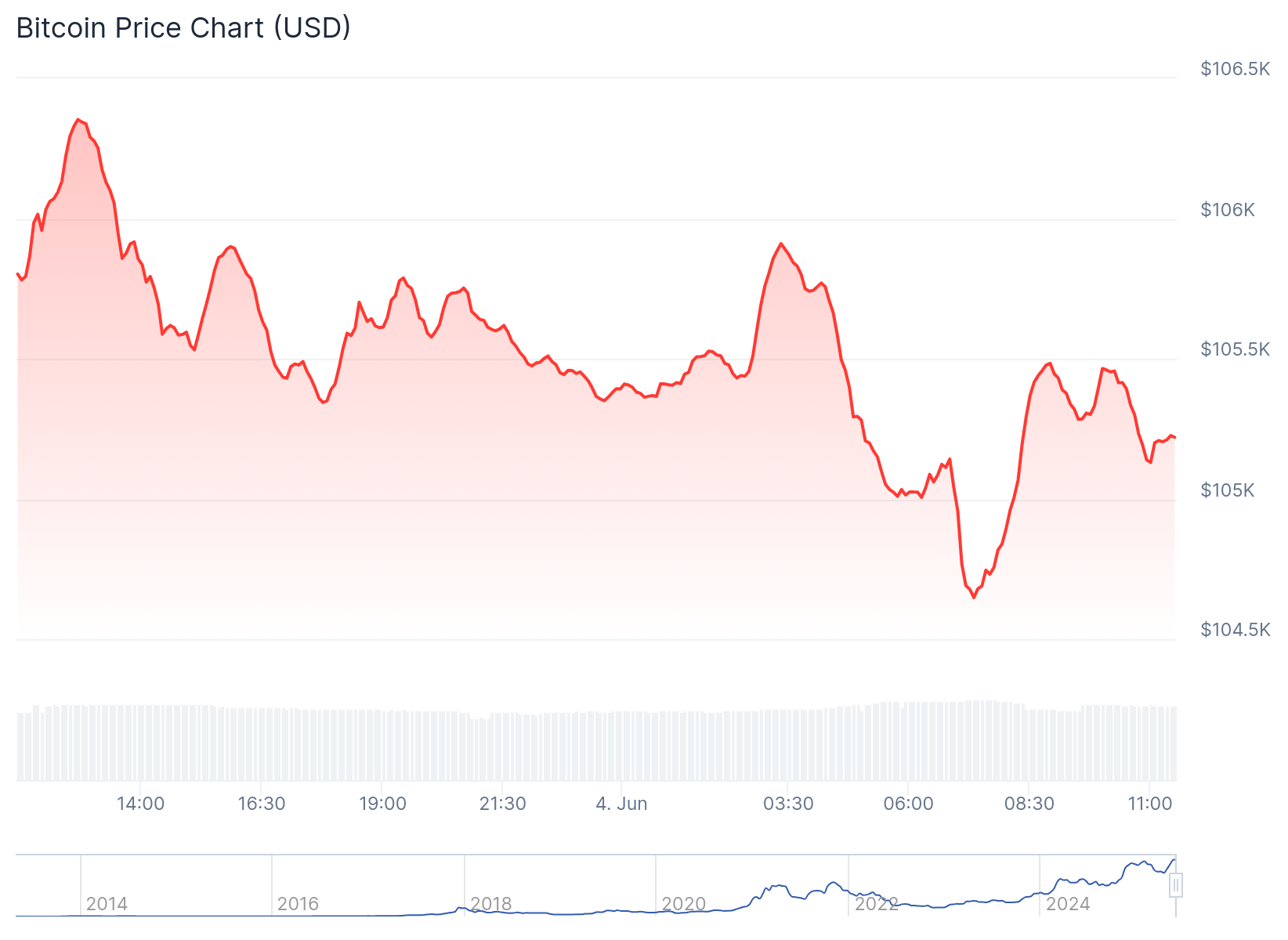

At the time of writing, BTC price is down 0.6% in the past 24 hours, trading at about $105,400 and fluctuating between $104,648 and $106,353. In its 7-day-to-date and 14-day-to-date price change variables, BTC has also dropped 1.8% and 3.7%, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.