Highlights:

- Trump’s new tariff elicits market uncertainty, with BTC dropping below $110,000.

- The US president threatened the EU and Apple with new tariffs effective June 1.

- Santiment warned the crypto market could face more declines as the global trade war between the US and EU escalates.

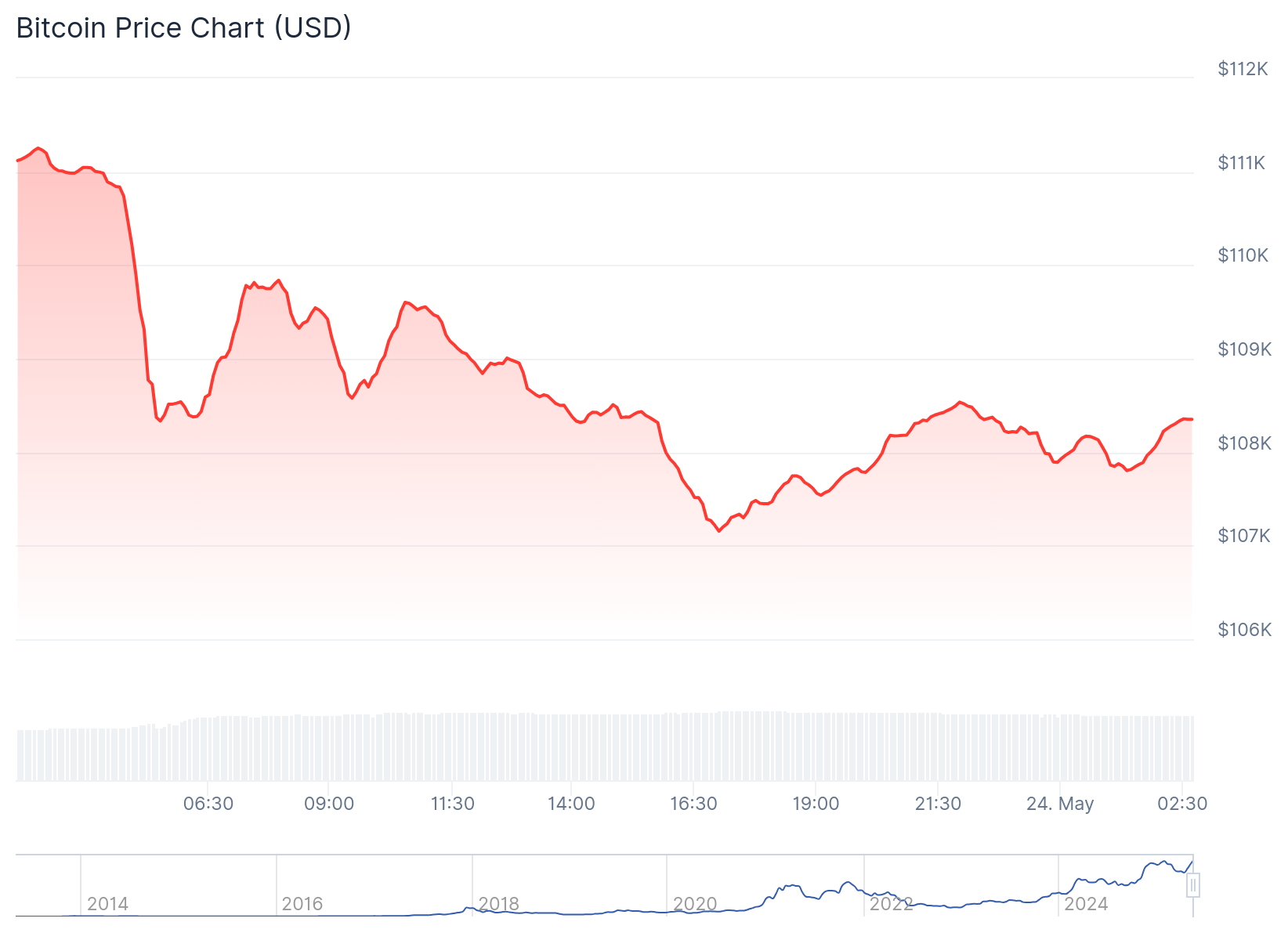

The crypto market has faced significant downward pressure, forfeiting gains from the past few days. CoinGecko’s data showed that the crypto market shed 4.9% of its profits in the past 24 hours, bringing its valuation to $3.528 trillion. As expected, Bitcoin also suffered a similar fate.

BTC Market Metrics

At the time of writing, the flagship crypto’s market valuation was about $108,200, following a 2.3% drop in the past 24 hours. The current decline minimally impacted BTC’s 24-hour trading volume. The metric is up 9.82%, boasting a $64.2 billion valuation.

In one of its most recent tweets, Santiment attributed the sudden price drops to Trump’s new tariffs. The analytical intelligence firm stated, “Just a day after Bitcoin’s new $112K all-time high was established, tariff drama was quickly brought back onto the menu and has temporarily spoiled the crypto party.”

New Tariffs Increase Global Trade Tensions

On May 23, the United States President threatened new tariffs targeting European Union (EU) importations and all Apple products imported from outside the US. The new tariffs include 50% on all goods imported from the EU and 25% on all imported Apple products. Trump cited slow progress in the US and EU trade negotiations as one of the reasons for the tariff hike. He also criticized Apple for moving most of its production to India.

🇺🇸💸 Just a day after Bitcoin's new $112K all-time high was established, tariff drama was quickly brought back on to the menu and has temporarily spoiled the crypto party. President Trump has announced two new major tariff threats as the U.S. heads into Memorial Day weekend:

🇪🇺… pic.twitter.com/6hgdBqGY6r

— Santiment (@santimentfeed) May 23, 2025

Trump argued that the perceived aggressive tariffs aim to correct trade imbalances between the US and the EU. Also, it will return manufacturing jobs to the US, creating more employment opportunities with positive economic impacts. The US president added that the new tariffs will take effect on June 1, 2025.

Last month, Trump imposed a 20% tariff on all EU-imported goods. However, he later slashed it by 50% until July 8, affording both parties more negotiation time. Santiment warned that the unfolding drama could cause a repeat of the generalized market declines during the US and China global trade unrest.

Santiment stated:

“This new wrinkle has brought back the highest level of tariff discussions since the peak FUD across crypto markets from April 7 to 9.”

The analytical intelligence firm added that the tariffs’ unpredictable nature has forced many traders to hold on to their crypto assets. Santiment also noted that the S&P reaction was quick and negative.

Peter Schiff Shares Insight on the Threatened EU Tariff

Popular BTC critic Peter Schiff reacted to the 50% tariff scare on EU importations. In an X tweet, Schiff criticized the rationale for the increment, citing that it was much higher than what Americans pay for Chinese goods. He added that the move was a political plot to manipulate the crypto market.

Trump just threatened to impose 50% tariffs on imports from Europe, much higher than what Americans pay to import goods from China. The skeptic in me thinks this is just market manipulation, giving insiders opportunities to trade before the tariffs are called off with a fake win.

— Peter Schiff (@PeterSchiff) May 23, 2025

Maroš Šefčovič, European Union Trade Commissioner, also reacted to the threatened tariff via an X post. He argued that the trade relationship between the EU and the US remains unmatched and must be guided by mutual respect. The commissioner also noted that the EU would defend its interests, which might be via a retaliatory tariff on US goods.

Spoke w @jamiesongreer & @howardlutnick. The EU's fully engaged, committed to securing a deal that works for both. @EU_Commission remains ready to work in good faith. EU-US trade is unmatched & must be guided by mutual respect, not threats. We stand ready to defend our interests. pic.twitter.com/RfIo5K4aus

— Maroš Šefčovič🇪🇺 (@MarosSefcovic) May 23, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.