Highlights:

- The price of Jupiter has skyrocketed 11% to $0.61% in the past 24 hours.

- Jupiter Lend by 0xFluid will launch on Solana in the Summer of 2025, offering instant trades, deep liquidity, and no slippage.

- JUP technical indicators show increased confidence among investors as bulls aim to reclaim $1.

Jupiter price is showing bullish signals, as it has risen 11% to $0.61 in the past 24 hours. Fueling the outlook is its daily trading volume, which has soared 125%, indicating heightened market activity. However, further upside could be imminent, as Jupiter is set to launch Jupiter lend.

Jupiter Lend: A New DeFi Milestone on Solana

Jupiter Lend, which uses 0xFluid, will lead the way in the Solana blockchain’s money market. It is expected to launch in Summer 2025. Its users benefit from instant token trades, a deep liquidity pool, and no slippage. Jupiter Lend aims to transform Solana’s decentralized finance services into a super app. This is through offering perpetuals, a mobile experience, and aggregation across chains.

Jupiter Lend, powered by @0xfluid.

The most advanced money market on @Solana.

Coming Summer, 2025. Be early: https://t.co/VRD1DRcCSf pic.twitter.com/v6c8TM2Htv

— Jupiter (🐱, 🐐) (@JupiterExchange) May 22, 2025

Jupiter Price Outlook

Technical Indicators are indicating that Jupiter’s native token, JUP, may break out soon. A recent push above the falling wede upper trendine can be seen on the daily price chart. This marked a key event after a prolonged downtrend. Priced at $0.61 for now, the Jupiter price is getting close to its 200-day moving average of $0.77, which tends to cushion the bulls against upward movements.

Strong buying pressure is indicated by the Relative Strength Index (RSI) at 68, but the market is still below the point where buying reaches its peak. Also, using MACD, we see a bullish crossover that signals a good chance of continued price rise. The market believes that already high investor confidence will reach a new high with the introduction of Jupiter Lend.

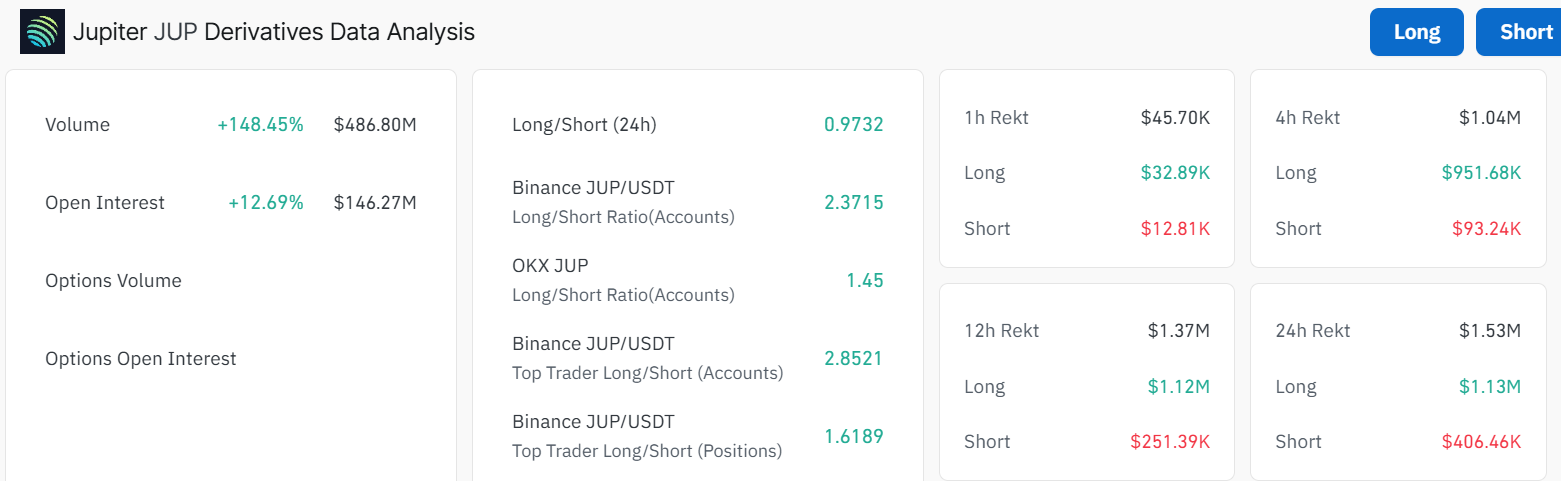

JUP Derivatives Market Shows Gaining Trading Confidence

JUP derivatives markets have seen strong growth, and most traders are expressing optimistic views. Its volume has soared 148%, while the open interest is almost 13% up. The rise is due to higher involvement in options and futures trading, meaning investors are trying to get ahead of upcoming price changes.

On Binance and OKX, traders are at least four times more optimistic about a rise in price than a fall in price, since the index is higher than 1.4. The market’s positive attitude toward these trend indicators suggests that Jupiter is expected to see benefits for its DeFi projects on Solana.

Jupiter Price Positioned for Major Growth in DeFi Space

Thanks to its new partnership with 0xFluid and the upcoming Jupiter Lend platform, Jupiter is set to transform decentralized finance in the Solana blockchain. To serve the fast-changing DeFi community, Jupiter offers spot trading, leveraged trading, and the ability to use its platform through mobile apps.

The rising RSI and MACD reflect the high enthusiasm of investors. This could see further gains towards $0.86 if the $0.76 barrier is broken. Intense bullish activity and the recent partnership could push Jupiter’s price to $1.02, $1.08, and $1.15 resistance marks.

If the bears step into the market, the Jupiter price could drop. In such a case, the $0.57, $0.52, and $0.47 support zones will be in line to absorb the potential selling pressure. Meanwhile, anyone trading or investing in the crypto market should focus on Jupiter, since it stands to play a more important role in the ongoing growth of decentralized finance.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.