Highlights:

- Basel Medical Group will become the latest medical company to invest in Bitcoin.

- The healthcare institution has started discussing plans to purchase $1 billion worth of BTC.

- BMGL said buying BTC will diversify its treasury while providing financial flexibility for other strategic partnerships.

Nasdaq-listed company, Basel Medical Group Ltd (BMGL), has announced plans to venture into Bitcoin (BTC) investments. The medical services provider has opened talks on the possibility of a $1 billion BTC acquisition, according to a May 16 press release.

This initiative will diversify BMGL’s treasury reserve and protect the company against market volatility. Notably, BMGL will maintain its medical services. However, the Bitcoin investment strategy will aid in expanding the company’s healthcare services.

In addition, it will enhance BMGL’s expansion and position in Asia’s highly competitive healthcare market. Beyond purchasing BTC, the company said the $1 billion capital will provide financial flexibility for sealing strategic partnership deals.

Nasdaq-listed company Basel Medical Group (BMGL) has announced that it is in exclusive negotiations for a $1 billion bitcoin acquisition, with plans to complete the transaction through a share-swap arrangement in collaboration with institutional investors and high-net-worth…

— Wu Blockchain (@WuBlockchain) May 16, 2025

Plans to Raise the Capital

In the press release, BMGL said it has begun talks with wealthy and highly influential people in the crypto space. Their discussions have centered around purchasing $1 billion worth of BTC via an innovative share-swap arrangement.

BMGL’s management expressed confidence in its proposed BTC purchase arrangement. “If successful, it will represent one of the largest corporate balance sheet enhancements in the Asia-Pacific healthcare sector,” the management added.

The company also confirmed that discussions have progressed smoothly and agreement details could be finalized in the current quarter. However, it will be subject to the appropriate regulatory bodies’ approval and standard closing guidelines.

Dr Darren Chhoa, the Chief Executive Officer (CEO) of BMGL, spoke about the proposed Bitcoin investment strategy. He described it as an unprecedented opportunity to execute BMGL’s Asia growth strategy while ensuring the company maintains a prudent spending culture.

Dr Chhoa added:

“Our expanded balance sheet will allow us to move quickly on strategic opportunities as we build a premier healthcare platform across high-growth Asian markets.”

BMGL is not the only medical services provider that has ventured into Bitcoin investments. Semler Scientific, a digitalized clinical diagnostic firm, was the second US-based company to start buying BTC after Strategy. In a recent tweet, Eric Semler shared Semler Scientific’s 2025 first quarter (Q1) financial report.

The report showed the company purchased 894 BTC for $90.7 million in the just-concluded quarter. In addition, Semler Scientific generated a 22.2% year-to-date BTC yield and holds 3,808 tokens.

$SMLR reports first quarter 2025 financial results and acquires 174 #Bitcoins for $17.8 million and has generated BTC Yield of 22.2% YTD. Now holding 3,808 $BTC. 🚀

— Eric Semler (@SemlerEric) May 13, 2025

Asian Companies Drive Crypto Adoption

Lately, Asian firms have been making waves in the crypto space. Many have sealed strategic partnerships with crypto-related firms, while others have continued to acquire BTC. Metaplanet recently invested $119 million in 1,241 BTC as part of its efforts to meet its long-term target of owning 10,000 BTC by the end of 2025. The company’s BTC holdings have soared to 6,796 BTC, exceeding El Salvador’s 6,173 BTC stores.

On May 12, Crypto2Community reported that Hong Kong-based crypto investment company, HashKey Group, has expanded its services in Dubai after obtaining a VASP license from the appropriate body. HashKey Group’s local subsidiary, HashKey MENA FZE, will operate with the license under the name HashKey Global MENA.

In April, HashKey Capital launched an XRP tracker fund. The company plans to convert the tracker into an Exchange Traded Fund (ETF), allowing traders to invest XRP via the stock market. Meanwhile, HashKey Capital also partnered with Ripple to drive real-world asset tokenization and Decentralised Finance (DeFi) projects.

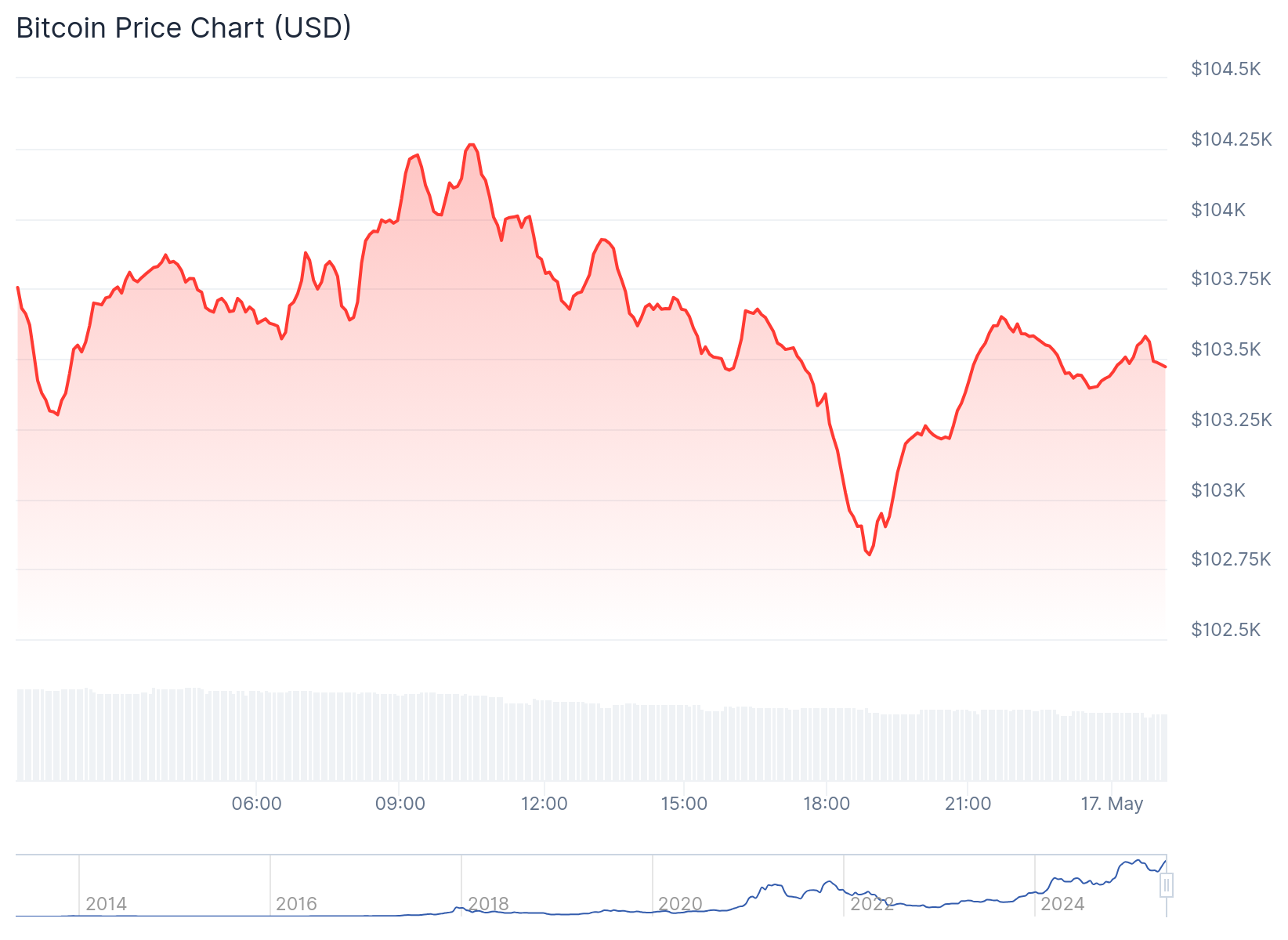

Bitcoin Records Slight Price Drop

At the time of press, BTC has lost 0.6% in the past 24 hours, trading at approximately $103,424. The flagship crypto boasts a market capitalization and fully diluted valuation worth over $2 trillion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.