Highlights:

- Bitcoin ETFs attracted over $100 million, as Ethereum ETFs succumbed to net outflows.

- BTC ETFs saw their second consecutive gains, while ETH ETFs’ two-day winning streak ended.

- Only BlackRock witnessed inflows among Bitcoin and Ethereum ETFs.

On May 15, Bitcoin (BTC) Exchange Traded Funds (ETFs) recorded $114.96 million in net inflows, marking the funds’ second consecutive gains after forfeiting $96.14 million on May 13. In contrast, Ethereum succumbed to net outflows worth $39.7 million. This ended the ETFs back-to-back gains, eliciting price decline concerns.

On May 15 (ET), spot Bitcoin ETFs saw a total net inflow of $115 million, with BlackRock’s IBIT being the only ETF to record a net inflow. Spot Ethereum ETFs experienced a total net outflow of $39.7859 million, with BlackRock’s ETHA being the only one to post a net inflow.…

— Wu Blockchain (@WuBlockchain) May 16, 2025

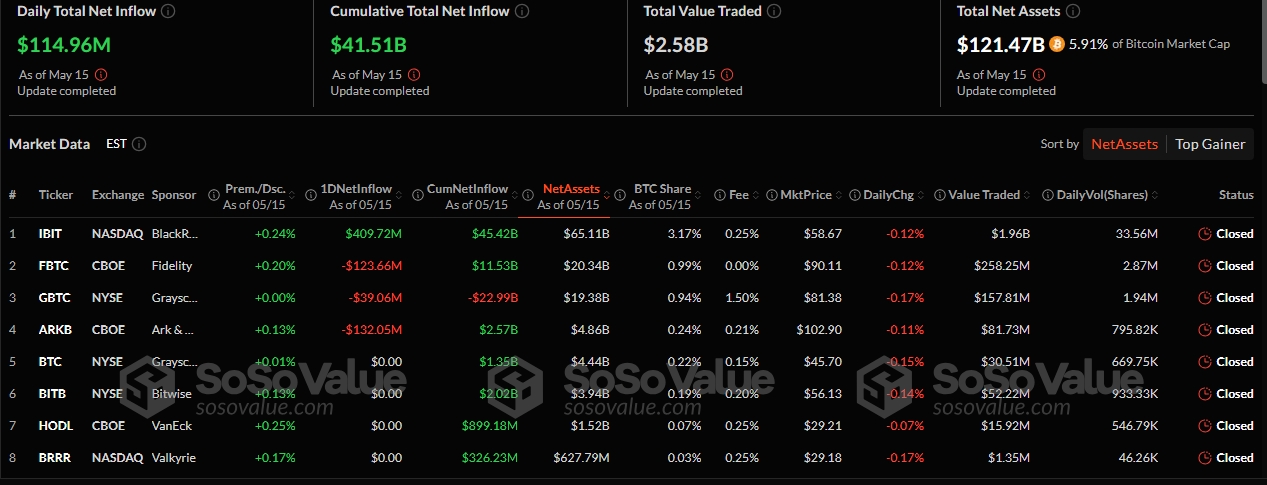

BlackRock Inflows Couldn’t Salvage Bitcoin ETFs

Only four Bitcoin ETFs were active yesterday. Three funds witnessed losses, while BlackRock Bitcoin ETF (IBIT) recorded the only inflows worth $409.72 million. Ark 21Shares Bitcoin ETF (ARKB) had the highest outflows worth $132.05 million. Fidelity Bitcoin ETF (FBTC) also forfeited over $100. The fund lost $123.66 million, while Grayscale Bitcoin ETF (GBTC) forfeited $39.06 million.

Yesterday’s losses reduced Bitcoin ETFs total value traded from $2.74 billion to $2.58 billion. The net assets also dropped from $121.84 billion to $121.47 billion. The new net assets valuation represents 5.91% of Bitcoin’s 2.07 trillion market capitalization. Despite the outflows, Bitcoin ETFs cumulative net inflows slightly appreciated from $41.40 billion to $41.51 billion.

The State of Wisconsin Dumps BlackRock Bitcoin ETF Shares

Earlier today, Crypto2Community reported that the State of Wisconsin Investment Board (SWIB) has sold off all its stake in IBIT. SWIB disclosed the sell-offs in a new filing presented to the United States Securities and Exchange Commission (SEC) on May 15.

For context, SWIB controls the assets of the Wisconsin Retirement System. It realized about $321 million from selling its entire 6,060,351 IBIT shares in this year’s first quarter (Q1). Based on present market conditions, the sold stakes have appreciated to over $350 million. Moreover, before now, SWIB had dumped all its $63.7 million stakes in Grayscale’s Bitcoin Trust (GBTC).

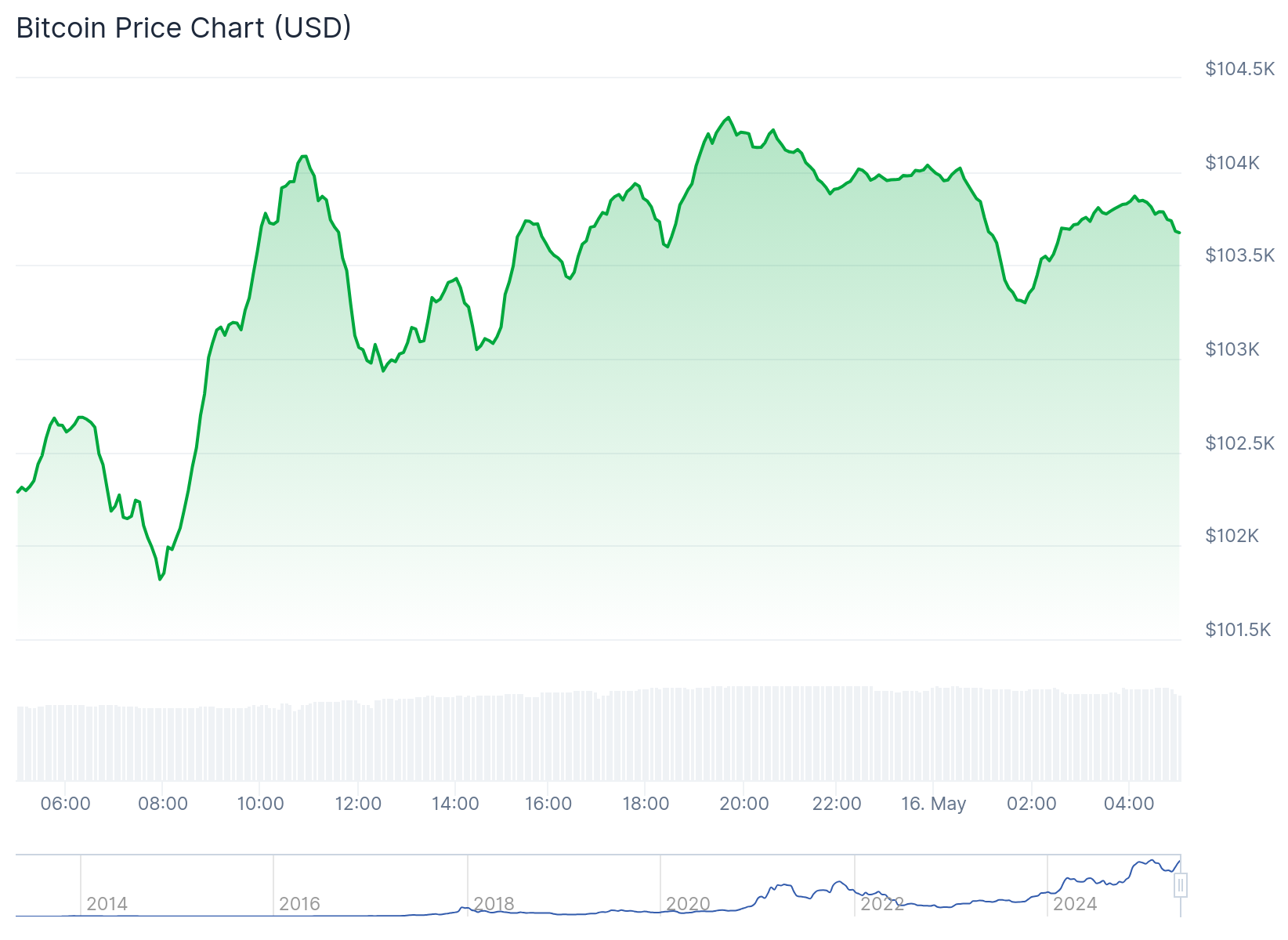

Bitcoin’s Price Stabilises Above $100,000

At the time of writing, Bitcoin’s price is up 2% in the past 24 hours with a $103,840 market value. The token has fluctuated between $101,820 and $104,291, highlighting a significant jump in the short timeframe. Other extended period data, including Bitcoin’s 7-day-to-date, 14-day-to-date, month-to-date, and year-to-date variables reflected increments of about 1%, 7.4%, 24.1%, and 56.8%, respectively.

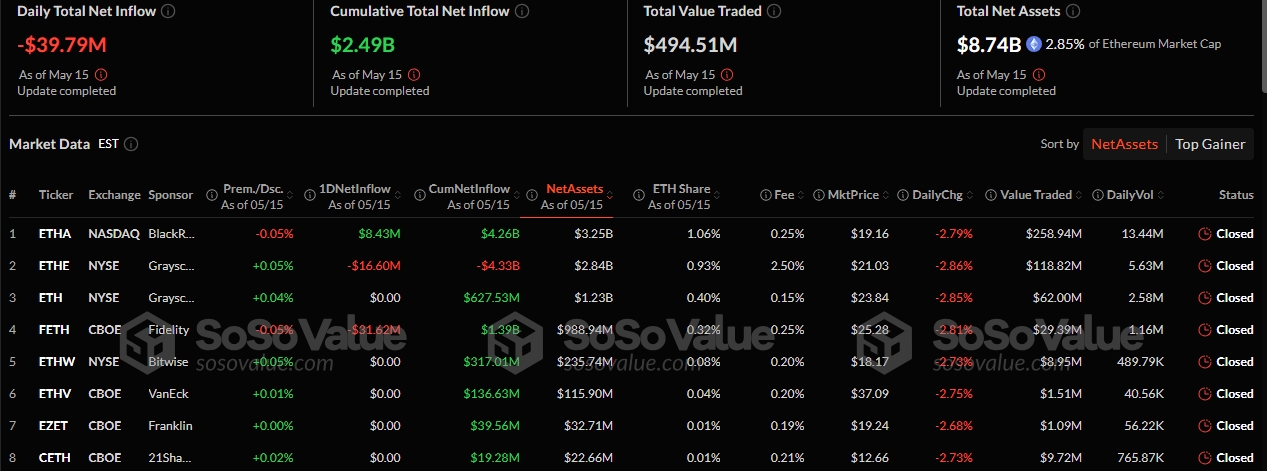

Ethereum ETFs Flow Statistics

On May 15, only three Ethereum ETFs were active. Like Bitcoin, only BlackRock’s Ethereum ETF ( ETHA) contributed gains worth $8.43 million. Fidelity Ethereum ETF (FETH) forfeited $31.62 million, while Grayscale Ethereum ETF (ETHE) lost $16.60 million.

As a result of yesterday’s outflows, Ethereum ETFs recorded a decline in their cumulative variables. Notably, the funds net asset valuation dropped from $9.04 billion to $8.74 billion. The cumulative net inflow depreciated from $2.53 billion to $2.49 billion. However, the total value traded increased from $447.94 million to $494.51 million.

While Ethereum ETFs flow might seem unimpressive, institutions have shown strong interest in the token. For example, Abraxas Capital spent roughly $84.7 million on 33,842 ETH on May 13. Within six days, the company bought 211,030 ETH for $477.6 million.

Abraxas Capital bought another 33,482 $ETH($84.7M) in the past 12 hours, bringing their total purchases over the last 6 days to 211,030 $ETH($477.6M).https://t.co/qZZkGndZEd pic.twitter.com/mOIdthyWUG

— Lookonchain (@lookonchain) May 13, 2025

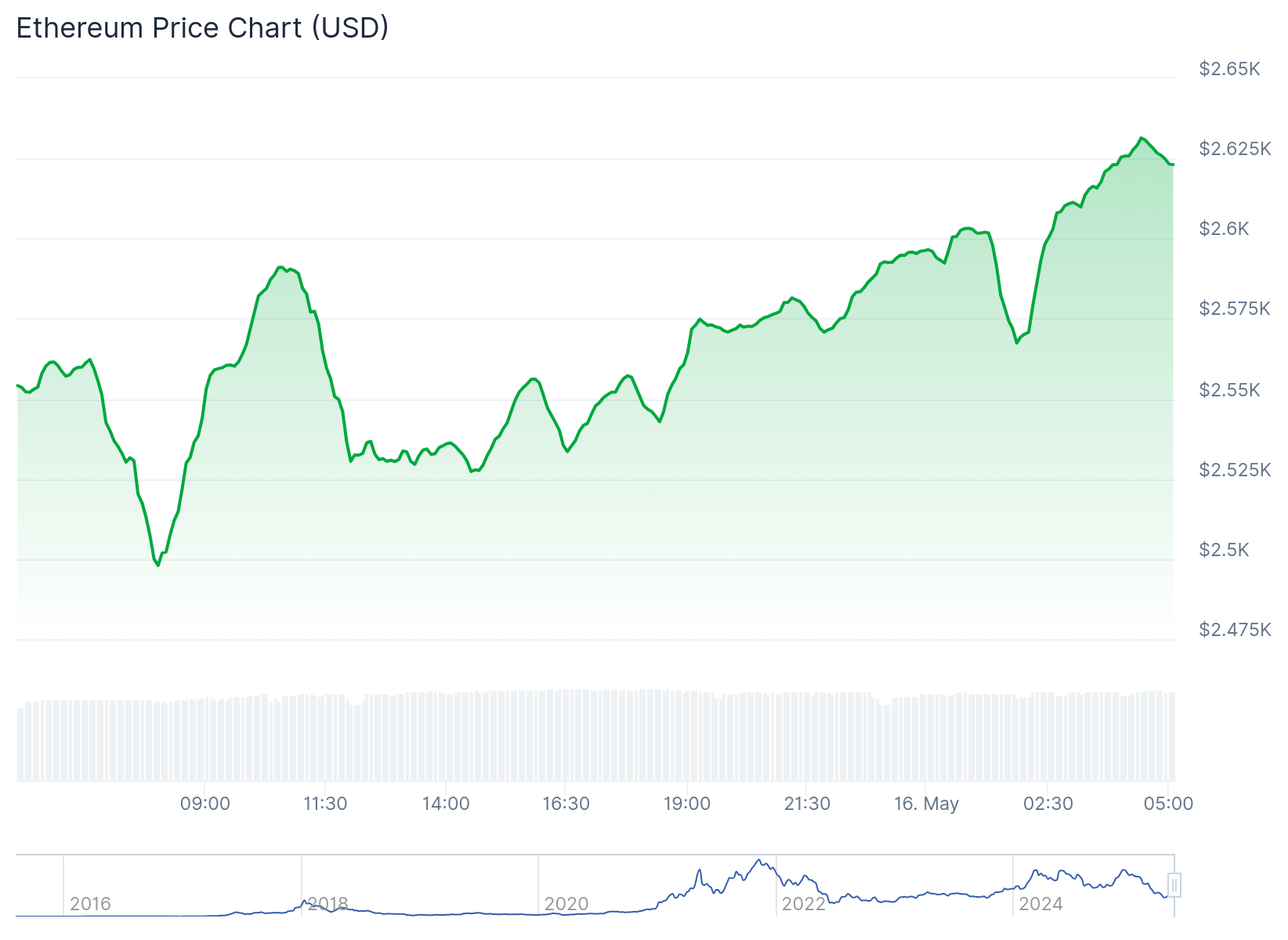

Ethereum Targets $3,000 with Stellar Price Actions

Ethereum jumped 2.8% in the past 24 hours, trading at approximately $2,620. Despite trading significantly below $2,000 in the last few weeks, the token has bounced back and could be on the verge of reclaiming $3,000. Ethereum’s year-to-date price change variable reflected a 12.4% decline, implying that the token has not fully recovered from past dips. However, ETH’s 24-hour trading volume soared 9.66% to about $25.7 billion, while its market cap reflected $316.87 billion.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.