Highlights:

- Kiyosaki encourages investors to reject centralized control and turn to Bitcoin and precious metals instead.

- He warns that central banks’ control over prices leads to corruption and wealth loss.

- Kiyosaki predicts Bitcoin could reach $1M by 2035, driven by inflation and tariffs.

Robert Kiyosaki, Author of Rich Dad Poor Dad has again slammed the corrupt centralized system. In a recent X post, he urged investors and the public to resist it by turning to Bitcoin. Kiyosaki highlighted Ron Paul’s warning that central banks fix prices by controlling interest rates. He called it Marxist central planning. Paul argued that such systems aim to take away wealth and reduce individual freedom.

Kiyosaki wrote:

“Fake money leads to dishonest money, dishonest statistics, dishonest accounting, dishonest balance sheets, dishonest compensation, dishonest relations, dishonest leaders, and corruption in everyday life.”

He called on Americans to fight back by leaving fiat systems and choosing decentralized options like BTC and precious metals instead. “Get on your own decentralized gold, silver, and Bitcoin standard”, Kiyosaki said.

He warned that central bank policies may push society toward socialism and corruption. Kiyosaki suggested these systems are designed to control people through money. He urged others not to let left-wing socialists win and to fight back.

WORDS of WISDOM from former US Congressman Ron Paul: Author of “End the Fed” and advocate for ending the Fed, all Central Banks, and getting back to a sound honest money system.

Ron Paul states:

“A central bank setting interest rates is price fixing and a form of central…

— Robert Kiyosaki (@theRealKiyosaki) May 10, 2025

Kiyosaki Predicts BTC Could Reach $1M by 2035 Amid Inflation and Tariffs

In an April 18 post, Kiyosaki forecasted that Bitcoin might reach $1 million by 2035 due to the US dollar losing value from inflation. He expressed strong belief that one BTC could surpass $1 million by 2035, while silver might reach $3K a coin and gold $30K. Kiyosaki is not the only one with this outlook.

MAKES ME SAD: In 2025 credit card debt is at all time highs. US debt is at all time highs. Unemployment is rising. 401 k’s are losing. Pensions are being stolen. USA may be heading for a GREATER DEPRESSION.

I get sad because as I stated in an earlier X….Tweet….I warned…

— Robert Kiyosaki (@theRealKiyosaki) April 18, 2025

In February 2025, ARK Invest CEO Cathie Wood suggested that Bitcoin could hit $1.5 million by 2030 if demand for the digital asset continues to rise.

Earlier this week, Kiyosaki posted a tweet about major Japanese companies changing their plans for car sales and production in the U.S. The tweet focused on Honda, Toyota, and Nissan. Nissan and Honda are canceling part of their U.S. production plans due to tariffs imposed by President Trump on China. Trump’s tariffs on Chinese imports are around 145%, with China responding similarly.

OMG: Toyota, Honda, and Nissan have decided to stop selling cars in US.

This will mean massive unemployment and crash of many towns dependent upon Japanese cars.

As pilots say, strap in tight and prepare for crash.

US automakers like Ford, GM, and Stellantis may boom…. If…

— Robert Kiyosaki (@theRealKiyosaki) May 8, 2025

Analyst Prefers Bitcoin for Its Fixed Supply

Kiyosaki posted on platform X on May 6, explaining why Bitcoin is superior to gold or silver. He trusts Bitcoin because its supply is capped at 21 million. Kiyosaki emphasized that while he owns gold and silver mines and oil wells, increasing their supply is possible if their prices rise. In contrast, Bitcoin’s supply is fixed at 21 million, and nothing can change that. Despite his direct involvement in mining and drilling, he prefers Bitcoin for its unchangeable scarcity.

WHY BITCOIN is a better asset than gold or silver:

One reason why I trust Bitcoin is there are only to ever be 21 million.

I own gold and silver mines and oil wells.

If the price of gold, silver, or oil goes up, I will simply mine or drill for more, expanding supply.

I…

— Robert Kiyosaki (@theRealKiyosaki) May 7, 2025

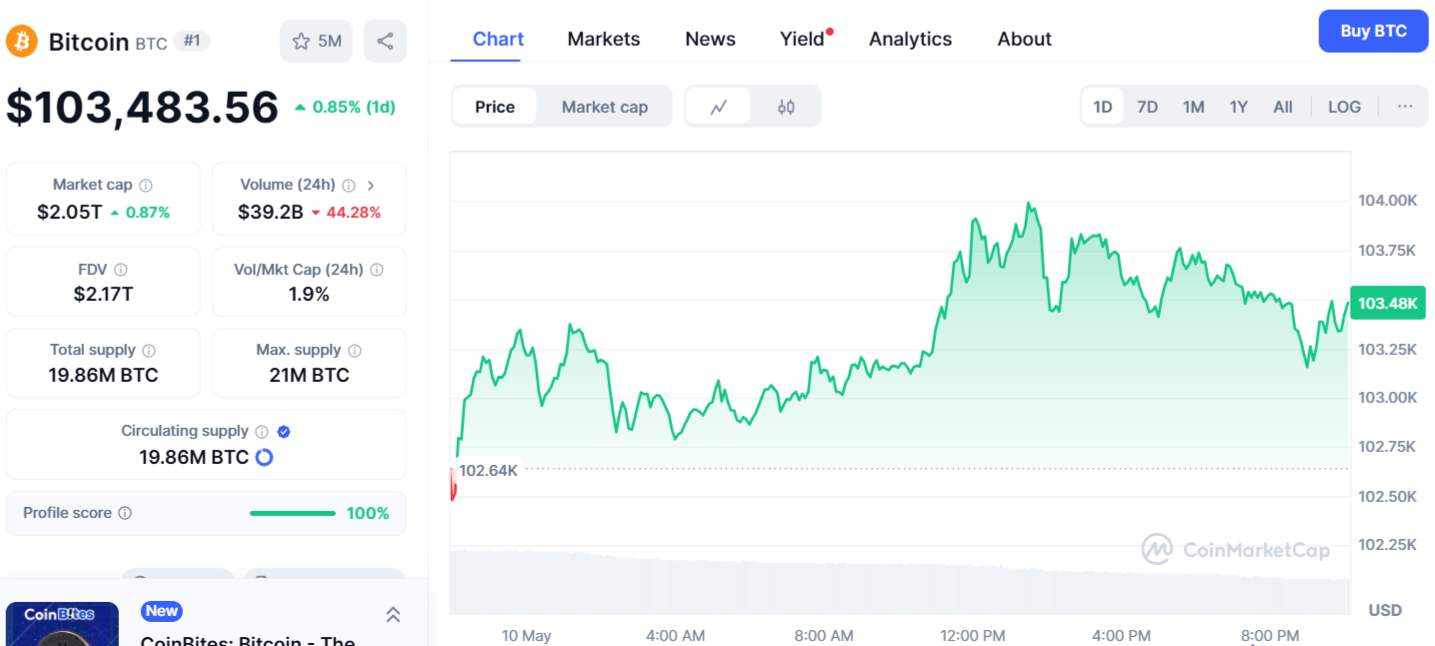

Bitcoin, the world’s top cryptocurrency, was trading at $103,483, marking a 0.85% rise over the past 24 hours. This price recovery follows a steep drop to $76,273 in early April, reflecting a substantial rebound in recent weeks.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.