Highlights:

- John D’Agostino told CNBC that Sovereign wealth funds are purchasing BTC as retail investors exit the market.

- Bitcoin is viewed as an inflation hedge, much like gold and other assets.

- Bitcoin adoption grows globally, with countries and companies adding it to reserves.

Sovereign wealth funds are increasingly accumulating Bitcoin (BTC) as retail investors exit the market. John D’Agostino, head of strategy at Coinbase Institutional, provided these insights during a CNBC interview on April 23. He said retail traders are withdrawing from the market through exchange-traded funds (ETFs) and spot markets.

The Coinbase executive highlighted three main factors driving institutional interest in Bitcoin in April. These include the shift away from the dollar, a reassessment of Bitcoin’s role compared to tech stocks, and its increasing use as an alternative inflation hedge, similar to gold.

JUST IN: Sovereign wealth funds and institutions have been piling into Bitcoin in April while retail has been selling – Coinbase Head of Institutional Trading pic.twitter.com/FJE8AQVS5W

— Bitcoin Archive (@BTC_Archive) April 23, 2025

D’Agostino noted that the US tariff announcement on April 2 by President Donald Trump’s administration sparked fresh debates over the US dollar’s status as the leading reserve currency. He pointed out that some sovereign wealth funds began reevaluating their strategies in response. Instead of holding US dollars through gold or other assets, they decided to buy Bitcoin directly in their local fiat currencies.

D’Agostino explained:

“Bitcoin is trading on its core characteristics, which again are similar to gold. “You’ve got scarcity, immutability, and non-sovereign asset portability. So it’s trading the way people who believe in Bitcoin would like it to trade.”

The executive emphasized that after thorough analysis, only a few assets truly reflect gold’s key traits — and Bitcoin is among them. Governments and financial institutions are increasingly turning to BTC. Their goal is to protect purchasing power and preserve treasury value. This shift comes amid rising economic uncertainty and growing geopolitical tensions.

Bitcoin ETF flows were mostly negative in April, but there was a big surge in inflows on April 21, 22, and 23. Still, institutional buying continued directly. D’Agostino pointed out that Coinbase saw steady buying from long-term investors. He noted that ETF data doesn’t show the full picture, especially for sovereign buyers who keep their positions private. He also mentioned that long-term holders buying Bitcoin during market dips explains the gap between ETF outflows and Bitcoin’s strong price. Despite retail selling, BTC saw a 13% gain in April.

Bitcoin Adoption Grows: From National Reserves to Corporate Holdings

Countries such as El Salvador and Bhutan have integrated Bitcoin into their national reserves, actively adding it to their holdings. Michael Saylor and Strategy, formerly MicroStrategy, played a crucial role in popularizing the corporate Bitcoin treasury model. This concept has since been embraced by an increasing number of companies, including MARA, MetaPlanet, and Semler Scientific.

The executive transformed the software company into a Bitcoin-focused firm, functioning like a BTC hedge fund. Regulatory clarity could boost this institutional shift. Many in crypto welcomed Paul Atkins as SEC Chairman, a known crypto supporter, promising a “rational, coherent, principle-based” approach to digital asset regulation.

BTC Price Movement

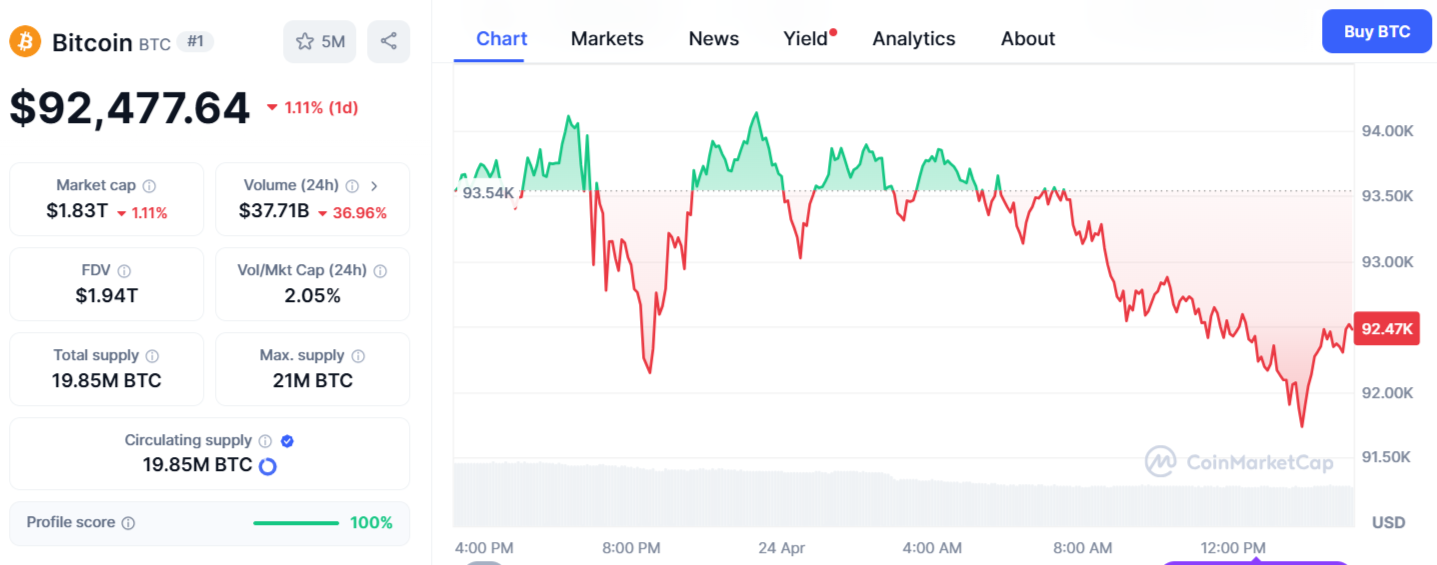

Bitcoin is currently priced at $92,477, showing a slight 1.11% dip in the last 24 hours. However, it has gained 9% over the past week, according to Coinmarketcap data. Bitcoin has recently overtaken Google in market capitalization, positioning itself among the top five assets globally. This achievement highlights Bitcoin’s remarkable growth since 2009, surpassing major assets like Amazon and Silver.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.