Highlights:

- XRP price has spiked 8% to $2.28 as the crypto market upholds a bullish outlook.

- The recent rally comes as President Trump softens on tariffs and Fed Chair Powell.

- On-chain metrics point to a potential uptrend in the XRP market

The XRP price (XRP) trades above support at $2.00, at $2.28 on Wednesday. With risk-on sentiment returning to the market after a massive drawdown, the cross-border money transfer token shows signs of a sustainable uptrend.

Trump Stands behind Fed Chair Powell but Still Calls for Rate Cuts

On April 22, United States (US) President Donald Trump made clear he had no plans to fire Federal Reserve (Fed) Chair Jerome Powell. Trump also slammed the press for ‘running away with things.’ Nevertheless, the President recommended that Powell act proactively by lowering interest rates. He said, “Never did. The press runs away with things. President Trump clarified to reporters that he did not intend to fire him.’’

Trump has just folded on Powell and China!

Not going to fire Powell and China tariffs to come down substantially….

This man is running a circus. This daily flip-flop is disgraceful and a joke.

— Puru Saxena (@saxena_puru) April 22, 2025

President Trump criticised Powell for being fast enough to lower interest rates. The President wrote on Truth Social (his social media platform) that Powell’s termination must happen ‘fast enough.’

After several cuts of a whole percentage point in 2024, the Fed has allowed interest rates to stay at their current level since early 2025. Powell warned in recent remarks that the central bank would stay cautious, adding that tariffs could hurt the economy more and cause a spike in inflation that could be bigger than expected. Moreover, Trump softened his stance on China tariffs, causing a spike in the crypto market.

Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) rallied, keeping the markets stable. President Trump’s comments during the American session on Tuesday also signalled that the US and China had made progress in tariff negotiations.

XRP Price Outlook

The XRP price boasts bullish muscle, as it has flipped the key moving averages at the 50-day and 200-day levels into immediate support keys. Further, the bulls have completely taken the reins. This is evident as they have broken out of a falling wedge pattern. They currently aim at the $3 key resistance zone.

The stakes are raised if the Relative Strength Index (RSI) indicator’s ascent above the centre line and north at 59.71 in favour of bulls. If the uptrend continues towards the overbought territory, the chances of XRP breaching the descending trendline resistance and closing the gap at $3.00 would be significantly high.

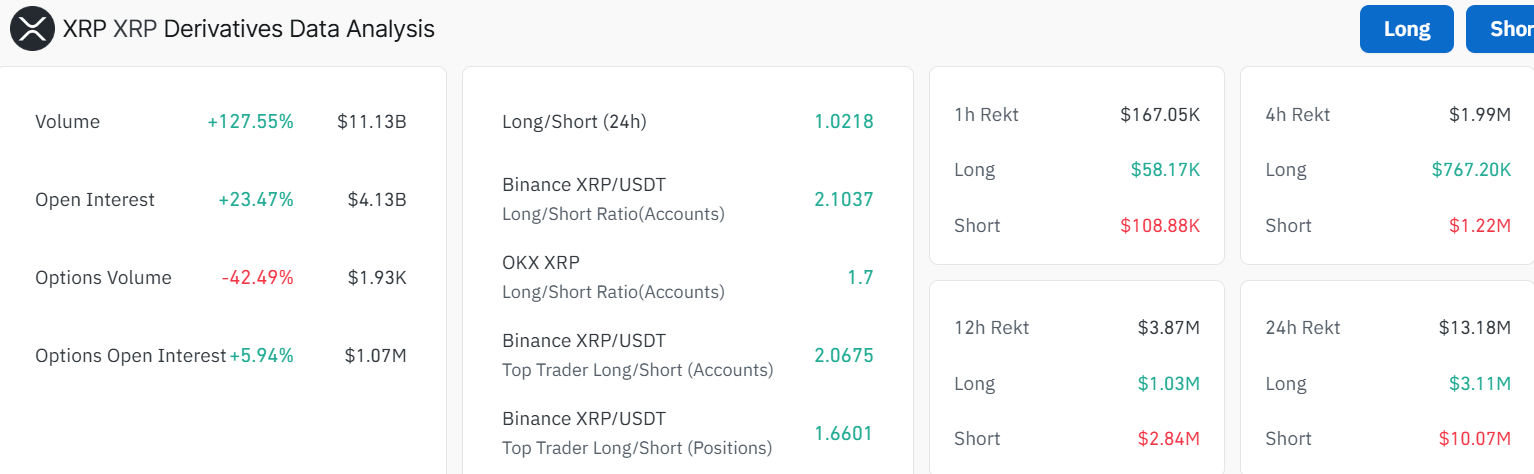

However, Coinglass derivatives data showed that open interest surged more than 20% to $4.13 billion in the past 24 hours, demonstrating that the risk-on sentiment was alive. Long position liquidations were $3.11 million during the same period, while short positions were $10.07 million. The long-to-short ratio of 1.0243 means it is likely more traders think XRP is going up, so they are betting up.

Conversely, such a spike in open interest would be a sharp reversal as traders adjust portfolios and take profit. Going for the XRP price below the moving averages may decline toward the important $2.00 support. After this short-term support zone, losses could speed up and reach the $1.80 demand zone on the 200 EMA line at $1.96.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.