Highlights:

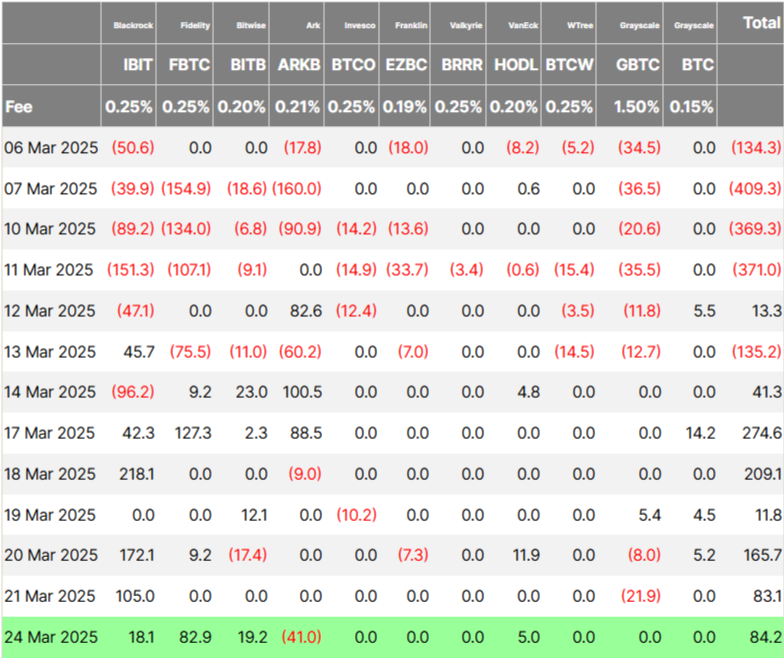

- Bitcoin spot ETFs recorded $84.2 million net inflows on March 24, continuing a bullish trend.

- Fidelity’s FBTC led inflows with $82.9 million, pushing its total to $11.465 billion.

- Bitcoin’s market cap reached $1.73 trillion, with a 46% spike in daily trading volume.

U.S. spot Bitcoin (BTC) exchange-traded funds (ETFs) recorded their seventh consecutive day of net inflows on Monday after weeks of heavy outflows. This marks the longest inflow streak since January 24. Data from Farside shows that these products recorded total daily net inflows of $84.2 million on March 24. This shows increasing interest and investment in Bitcoin through ETFs.

U.S. spot Bitcoin ETFs saw $84.2M worth of total net inflows on March 24

U.S. spot Bitcoin $BTC ETFs experienced a combined net inflow of $84.2 million on March 24, marking the seventh consecutive day of inflows, according to Trader T (@thepfund) on X. Specifically, Fidelity’s…

— CoinNess Global (@CoinnessGL) March 25, 2025

The Fidelity Bitcoin ETF (FBTC) was the leader with the highest net inflow in a single day, reaching $82.9 million. This large inflow increases FBTC’s total historical net inflow to $11.465 billion, highlighting its strong position in the Bitcoin ETF market. The Bitwise ETF (BITB) followed closely with a net inflow of $19.2 million, bringing its total historical net inflow to $2.043 billion.

On the other hand, the ARKB ETF from ARK Invest and 21Shares saw the highest net outflow in a single day, reaching $41.0 million. Despite this outflow, ARKB still holds a significant total historical net inflow of $2.633 billion. All other ETFs, including BTCO, EZBC, BRRR, GBTC, and BTC, remained unchanged on March 24.

According to the latest data, the net asset value of Bitcoin spot ETFs is $99.314 billion. The net asset ratio of the ETFs, which shows their market value as a percentage of the total Bitcoin market value, is 5.7%. The total cumulative net inflow for these ETFs has grown to $36.133 billion.

Last week, IBIT saw strong inflows, reaching $218 million on March 18. ARKB and BTCW had occasional outflows. By March 21, net inflows totaled $83.1 million. March 24’s $84.2 million inflow continued the bullish trend. The steady inflow into Bitcoin spot ETFs shows that investors are feeling positive about Bitcoin and see it as a valuable and appealing investment.

Bitcoin Recovery on Track as ETFs See Renewed Inflows

Markus Thielen, founder of 10X Research, expects a Bitcoin price rebound. In his March 23 report, he suggested Bitcoin may have already bottomed and could recover soon. He believes the Fed’s soft stance on inflation could ease market concerns. Trump’s flexibility on tariffs may also help. These factors could boost investor confidence.

Thielen noted that a stable political climate and positive economic outlook have made Bitcoin’s price indicators bullish. He pointed to key factors driving this trend. One is that most large Bitcoin holders are long-term investors. Another is the renewed inflows into U.S. spot Bitcoin ETFs, reducing selling pressure from short-term arbitrage traders.

At the time of this report, Bitcoin was trading at $87,405, reflecting a 0.17% increase in the past 24 hours. Its market capitalization surged to $1.73 trillion, while its daily trading volume spiked to $32.28 billion. This marks a sharp 46.60% rise within a single day, according to CoinMarketCap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.