Highlights:

- Bitnomial introduces CFTC-regulated XRP futures with physical settlement in the United States.

- Bitnomial ends SEC lawsuit after new rules, following Ripple’s legal win.

- Garlinghouse expects XRP spot ETF approvals in the year’s second half.

In a March 19 statement to X, the Chicago-based crypto derivatives exchange Bitnomial announced the launch of the first U.S. Commodity Futures Trading Commission (CFTC)-regulated XRP futures contract. The exchange stated that existing clients can access XRP futures from March 20.

In contrast, new clients can access XRP futures through Futures Commission Merchant (FCM) partners like R.J. O’Brien, Marex Capital Markets, and Bitnomial Clearing. A key feature of Bitnomial’s XRP futures contract is physical settlement, meaning traders receive actual XRP upon contract expiration instead of cash.

XRP futures contracts enable traders to speculate on the asset’s future price and hedge against potential market fluctuations. Although multiple offshore exchanges already provide XRP derivatives, Bitnomial will be the first CFTC-regulated platform in the U.S. to offer these contracts.

🚀 XRP futures are here! 🚀

Bitnomial is launching the first-ever CFTC-regulated $XRP futures in the U.S. — physically settled for real market impact. Plus, we’ve voluntarily dismissed our case against the SEC as regulatory clarity improves. pic.twitter.com/ARkSanjFNU

— Bitnomial (@Bitnomial) March 19, 2025

Bitnomial Drops Lawsuit Against SEC Following Ripple Case Resolution

Additionally, the Chicago-based firm decided to withdraw its lawsuit against the U.S. Securities and Exchange Commission (SEC). Bitnomial submitted a self-certification to the CFTC in August last year to list XRP futures. However, the SEC blocked the move. The regulator insisted that Bitnomial must register as a securities exchange before offering the contracts. In response, Bitnomial sued the SEC and its five commissioners on October 10. The exchange accused the agency of overstepping its authority by classifying XRP as a security.

However, Bitnomial dropped the lawsuit, stating the rules are now clearer. Its lawyers filed a “notice of voluntary dismissal” on Wednesday in the United States District Court for the Northern District of Illinois.

This comes after Ripple CEO Brad Garlinghouse’s March 19 announcement that the SEC dropped its appeal against Ripple. The SEC filed the lawsuit in December 2020, alleging Ripple raised $1.3 billion by selling XRP as an unregistered security.

This is it – the moment we’ve been waiting for. The SEC will drop its appeal – a resounding victory for Ripple, for crypto, every way you look at it.

The future is bright. Let's build. pic.twitter.com/7WsD0C92Cm

— Brad Garlinghouse (@bgarlinghouse) March 19, 2025

Under the Trump administration, the SEC has softened its strict stance on crypto. It has dismissed several enforcement actions taken under Gary Gensler’s leadership. Mark Uyeda became acting chair after Gensler resigned on January 20. He plans to remove a Biden-era rule that tightens crypto custody standards. On March 10, Uyeda also asked SEC staff to explore dropping parts of a proposal that would require crypto firms to register as exchanges.

XRP Soars as SEC Drops Lawsuit, ETF Hopes Rise

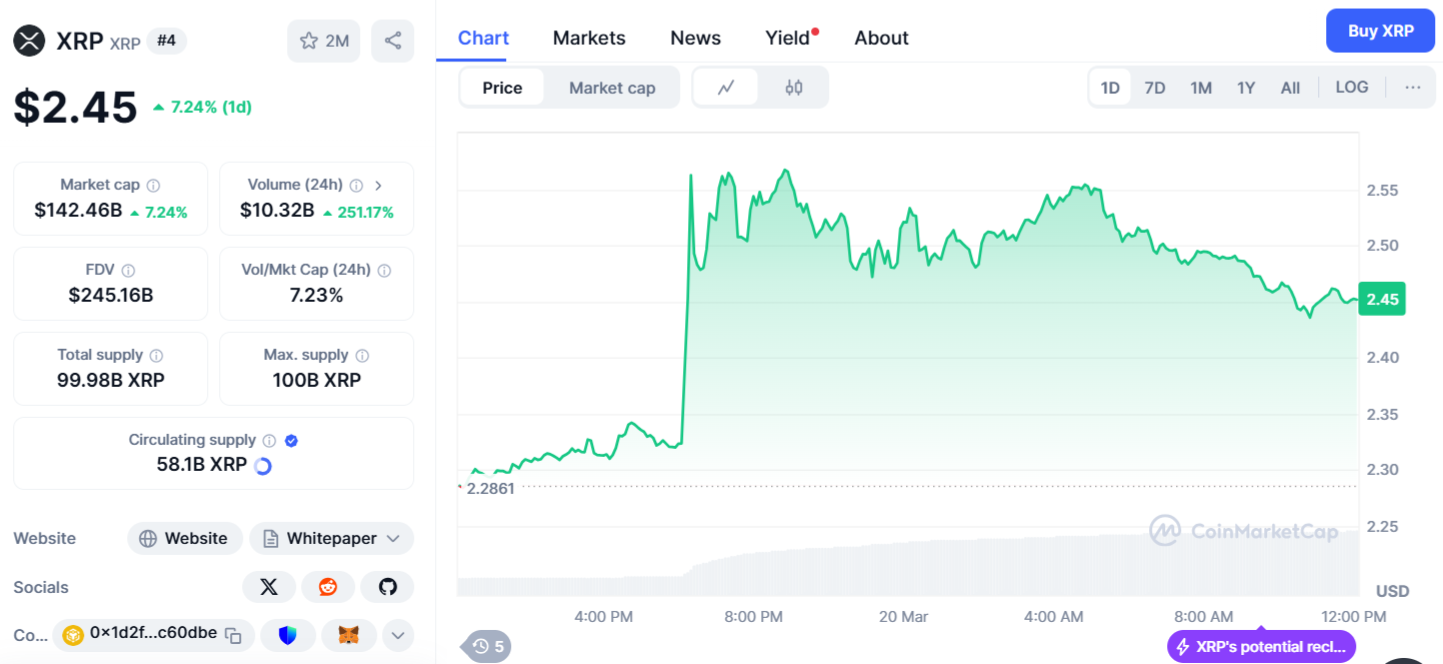

XRP spiked over 14% to $2.57 after the SEC dropped its lawsuit against Ripple. It later settled at $2.45. The market cap stands at $142.46 billion, and the trading volume has increased by 251.17% to $10.32 billion.

Many believe an XRP spot ETF approval is now likely. In an interview with Bloomberg Crypto, Ripple CEO Brad Garlinghouse said about 10 XRP ETF filings are under SEC review. He expects approvals in the second half of the year.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.