Highlights:

- Analyst forecast that Ethereum could drop to $1,060 if it fails to recover $2,500.

- ETH/BTC downtrend and low RSI signal ongoing weakness for Ethereum compared to Bitcoin.

- Ether ETFs outflows and lower network usage show the Ethereum network’s ongoing struggles.

Ethereum price has been in a long bearish trend, which raises concerns among both analysts and investors. Multiple factors, like a weak market structure, lack of bullish momentum, and negative on-chain data, are driving the decline.

Price analysis by Mags shows that Ethereum has failed to break the $4,000 resistance level three times in this cycle. Each rejection has caused the price to drop further. The most recent drop has taken Ethereum below its middle price range.

Additionally, the price is now under a support trendline, which had been holding since the last market bottom. Analysts caution that Ethereum may keep declining if it fails to regain the $2,500 level soon. A further drop could lead ETH toward $1,060, where the range low is.

#Ethereum – Unbiased Analysis

ETH has one of the worst charts of all time. The price attempted to break above the range high of $4,000 three times in this cycle but failed.

On the last rejection, price broke down even below the mid-range and is also trading below the… pic.twitter.com/iXkg8THiFy

— Mags (@thescalpingpro) March 18, 2025

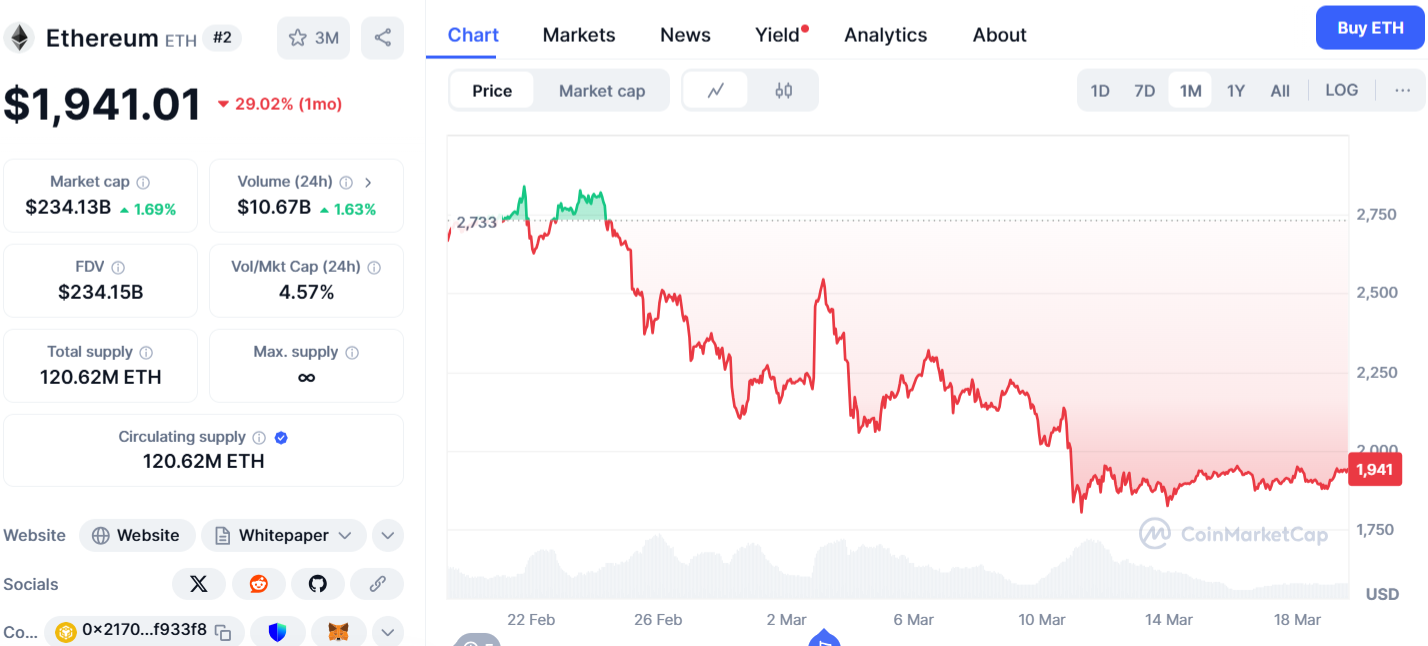

As of now, the altcoin is priced at $1,941.01, reflecting a 29.02% decrease from last month. Despite a market cap of $234.13 billion, the persistent downward trend indicates ongoing selling pressure.

ETH/BTC Downtrend and Declining Network Activity Highlight Ethereum’s Struggles

The ETH/BTC pair is performing poorly, showing that Ethereum is weaker compared to Bitcoin. The three-day chart’s RSI is below 30, which usually means Ethereum might be oversold. However, in the past, when Ethereum’s RSI has been this low, it hasn’t always meant the price has reached its lowest point, so it could continue to drop before hitting a true bottom.

Since mid-last year, the ETH/BTC pair has faced several drops, losing 13%, 21%, 25%, and 19.5% in a short time. This shows Ethereum has been weakening compared to Bitcoin over time. The 50-day and 200-day moving averages (EMAs) are both trending lower, which suggests there isn’t enough bullish momentum to push prices higher.

Market analyst @CarpeNoctom pointed out that ETH’s performance is negative. Specifically, the ETH/BTC pair hasn’t shown a “bullish divergence” on the weekly chart. A bullish divergence happens when the price makes lower lows (drops in price), but the Relative Strength Index (RSI) makes higher lows. This would usually signal that selling pressure is weakening, and the price could reverse. However, since ETH hasn’t shown this pattern, it suggests continued weakness in Ethereum’s price compared to Bitcoin.

ETH/BTC breathtaking bearishness continues

– no weekly bull div yet

– still below the 20WMA

– TK c-clamp trying to form but nullifies on LL

– took over a year to bottom at this level previously pic.twitter.com/wya395EeQ2— #333kByJuly2025 (@CarpeNoctom) March 12, 2025

Declining Network Activity and ETF Outflows

The “cursed” ETH/BTC downtrend stands out in the crypto market. This includes continued outflows from U.S. ETH ETFs and negative on-chain data. Net flows into spot Ether ETFs dropped by 9.8% in March, totaling $2.54 billion. In contrast, spot Bitcoin ETF net flows decreased by 2.35% to $35.74 billion during the same period.

Meanwhile, Ethereum network usage is dropping, with median gas fees on the mainnet falling to around 1.12 GWEI in March. This indicates fewer transactions compared to last year.

$BTC ETF inflow of $274,600,000 and $ETH again outflow of $7,300,000.

Look like Ethereum is cursed. pic.twitter.com/hjKZKF5x9y

— Ted (@TedPillows) March 18, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.