Highlights:

- Ethereum ETFs saw net outflows as their loss streak entered a tenth consecutive day.

- Bitcoin ETFs gained $209.12 million to extend their profitable outing to the third straight day.

- BlackRock topped the losses chart for Ethereum ETFs but salvaged Bitcoin ETFs with over $200 million in gains.

On March 18, Ethereum Exchange Traded Funds (ETFs) recorded $52.82 million in net outflows, extending their loss streak to a tenth consecutive outing. On the other hand, Bitcoin ETFs attracted $209.12 million in cash inflows to mark their third straight gain.

On March 18, Ethereum spot ETFs recorded a total net outflow of $52.8156 million, marking the 10th consecutive day of net outflows. Meanwhile, Bitcoin spot ETFs saw a total net inflow of $209 million, led by BlackRock’s IBIT ETF with a net inflow of $218 million.…

— Wu Blockchain (@WuBlockchain) March 19, 2025

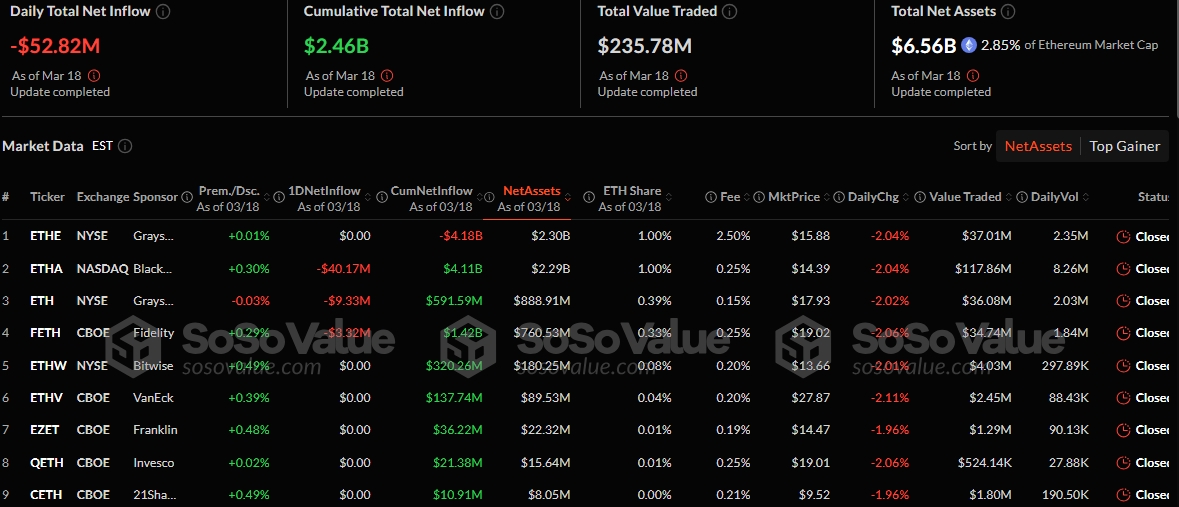

According to SosoValue’s ETF flow data, only three Ethereum funds were active on Tuesday. The remaining six funds recorded neither inflows nor outflows. BlackRock Ethereum ETF (ETHA) topped the losses chart with a $40.17 million outflow. Grayscale Mini Ethereum ETF (ETH) and Fidelity Ethereum ETF (FETH) forfeited $9.33 million and $3.32 million, respectively.

As a result of the outflows, Ethereum ETFs’ cumulative net inflow dropped from $2.51 billion to $2.46 billion. Similarly, the total net assets depreciated from $6.77 billion to $6.56 billion. The net assets valuation represents 2.85% of Ethereum’s $233.5 billion market capitalization. Despite these outflows, the total value of ETH funds traded increased from $150.71 million to $235.78 million.

Ethereum ETFs Bearish Trend Sparks Ethereum Price Actions Concern

Before hitting their tenth consecutive outflow streak, Ethereum funds posted eight straight losses between February 20 and March 3. On March 4, the ETFs registered their only gain this month. Following the ETF losses, ETH faced significant downward pressure, with its price dropping to around $1,800 at some point.

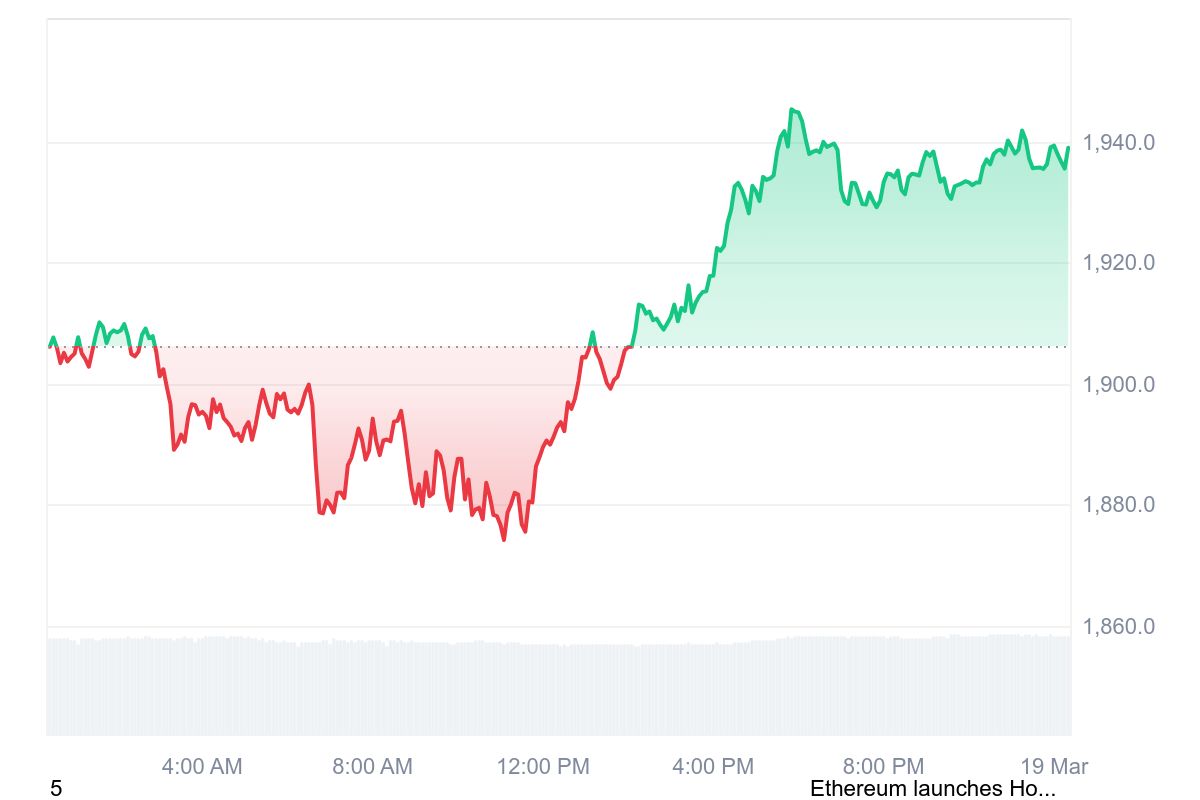

At the time of press, Ethereum is changing hands at approximately $1,630, reflecting a 1.6% surge in the past 24 hours. In its 7-day-to-date price change data, Ethereum has surged by about 3.8%, oscillating between $1,833.70 and $1,949.59. The price extremes underscore ETH’s recent struggles to reclaim price levels above $2,000.

Over longer periods, ETH has depreciated 27.3% month-to-date and 42.9% year-to-date. These price actions and the bearish ETF trend continue to worry ETH traders. Some analysts attributed the downtrend to a lack of institutional interest. Optimists believe the token will soon recover, citing now as a good Ethereum buying opportunity.

This is the first time in the last 10 years, the first THREE months for $ETH have been straight red. More than 47% in the gutters of Ethereum. pic.twitter.com/llciFc2pln

— Crypto Virtuos (@CryptoVirtuos) March 16, 2025

Bitcoin ETFs Maintains Positive Flows

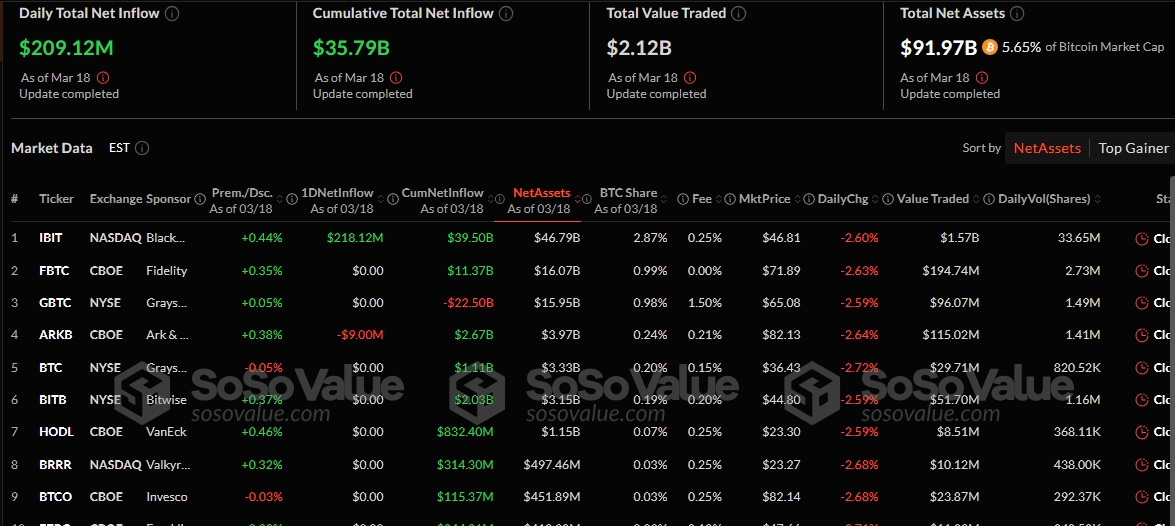

Per SosoValue’s data, only two Bitcoin funds were active on March 18. The remaining ten ETFs experienced zero flows. BlackRock Bitcoin ETF (IBIT) recorded the only gain worth about $218.12 million, while ARK 21Shares Bitcoin ETF (ARKB) forfeited $9 million.

Unlike Ethereum ETFs, the positive outing raised Bitcoin ETFs’ cumulative netflows from $35.58 billion to $35.79 billion. Similarly, the total value traded spiked from $1.87 billion to $2.12 billion. However, Bitcoin ETFs’ total net assets dropped from $94.48 billion to $91.97 billion. The net assets valuation represents 5.65% of Bitcoin’s

Bitcoin Sustains Price Levels Above $80,000 Amid Growing Institutional Interest

Bitcoin is up 0.6% in the past 24 hours, trading at approximately $83,160. In the past seven days, Bitcoin fluctuated between $80,217.84 and $84,727.83, highlighting significant struggles to reclaim price levels above $90,000. Despite the downtrend, Bitcoin institutional interest continues to soar.

On March 18, Japanese crypto investment firm Metaplanet bought 150 BTC for $12.5 million, expanding its Bitcoin holdings to 3,200 tokens. The firm also issued its 9th series of 0% bonds to raise about $13.4 million for more Bitcoin acquisitions.

On the same date, Strategy, the largest Bitcoin corporate holder, announced it plans to raise $500 million through a stock offering to fund more Bitcoin purchases. Strategy’s announcement came a day after it purchased 130 BTC for $10.7 million, increasing its Bitcoin stores to about 499,226 BTC.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.