Highlights:

- Canary Capital’s spot Litecoin ETF gets DTCC listing, boosting hopes for SEC approval.

- CFTC previously classified Litecoin as a commodity, easing regulatory pressure compared to other tokens.

- Bloomberg analysts see a 90% chance of Litecoin ETF approval, lifting investor confidence.

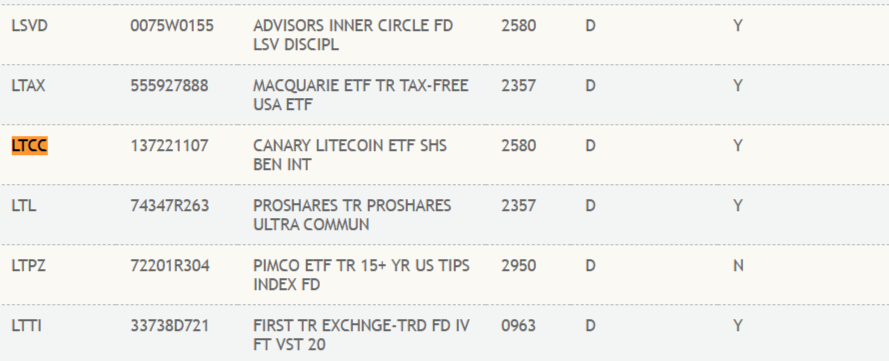

Crypto fund manager Canary Capital’s spot Litecoin (LTC) exchange-traded fund (ETF) has been listed on the Depository Trust and Clearing Corporation (DTCC) system under the ticker symbol LTCC. The DTCC listing, seen late Thursday, February 20, doesn’t ensure approval but shows trading infrastructure is being prepared.

The DTCC is a key organization in the U.S. financial system that makes sure trades in the U.S. market are safe and go smoothly. It checks that buyers and sellers complete their deals, handles the movement of money and shares, and keeps the shares secure. When an ETF is listed on the DTCC, it means the trading system is ready. However, the ETF still needs approval from the SEC to officially start trading.

The official website stated:

“This file includes both active ETFs that may be processed at DTCC and ETFs that are not yet active (pre-launch) and, therefore, are not able to be processed at DTCC, unless and until such securities have received all necessary regulatory and other approvals.”

Canary Capital filed for a LTC ETF in October last year before Grayscale and CoinShares. If approved, it would be the first United States spot ETF for a cryptocurrency other than Bitcoin and Ethereum, which could lead to more altcoin ETFs in the future.

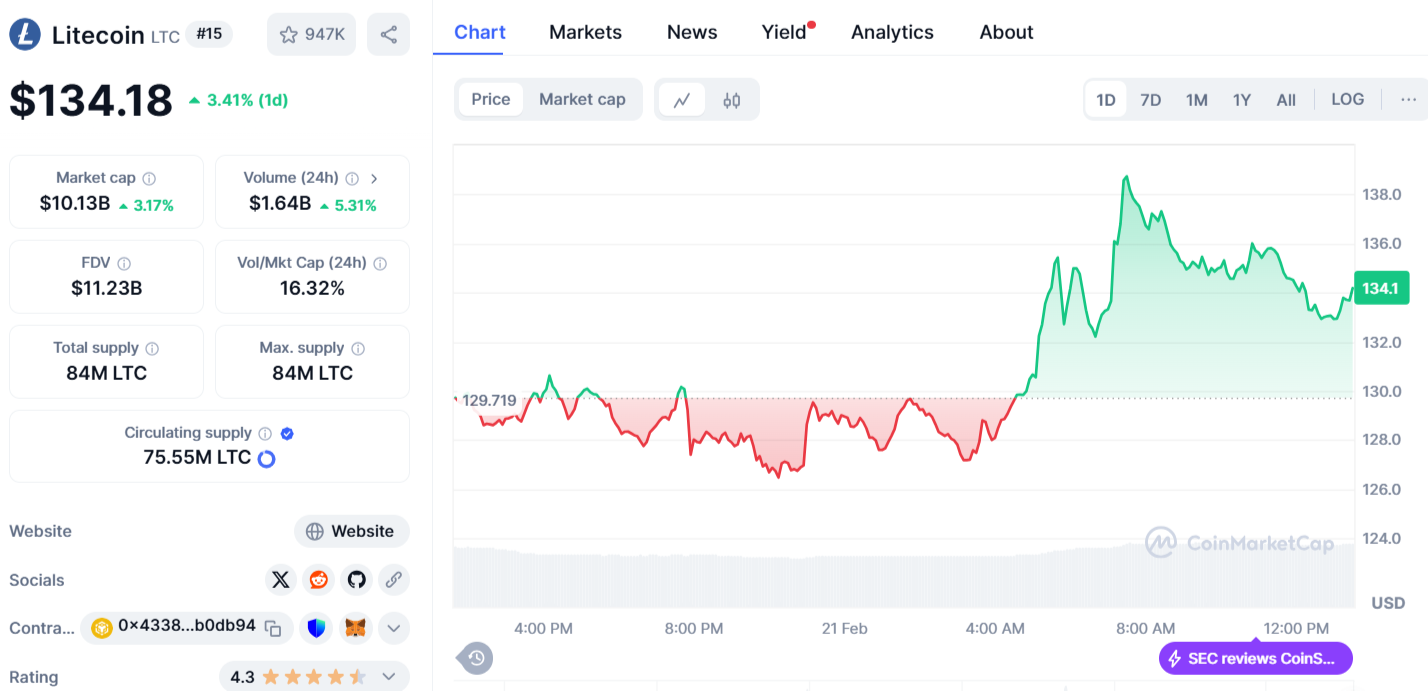

After the listing, Litecoin rose 3.41% in the past 24 hours, reflecting growing investor optimism about the ETF’s approval. At press time, it was trading at $134.18.

CFTC Classifies Litecoin as a Commodity

Bloomberg ETF analysts Eric Balchunas and James Seyffart see a stronger chance of approval for Litecoin-based funds than other crypto asset ETFs. In March 2024, the Commodity Futures Trading Commission (CFTC) classified Litecoin as a commodity in its lawsuit against KuCoin. The case accuses the exchange of operating without proper registration and allowing trades of digital asset commodities like Bitcoin, Ethereum, and Litecoin. This classification places Litecoin under CFTC oversight, excluding it from the SEC’s stricter securities regulations.

Unlike Litecoin, Ripple and Solana have faced direct scrutiny from the SEC. Ripple is currently engaged in ongoing litigation, with the SEC alleging that its native token, XRP, is a security. Similarly, the SEC has labeled Solana’s SOL token as a security in its lawsuits against major cryptocurrency exchanges, including Binance and Coinbase. Both Binance and Coinbase have denied these allegations, and the cases are still pending.

Litecoin’s Market Cap Soars 46% Amid ETF Approval Optimism

Between February 2 and February 19, 2025, Litecoin’s market capitalization experienced a significant 46% increase, as reported by Santiment. This surge is partly attributed to heightened network activity, with the cryptocurrency processing an average daily transaction volume of $9.6 billion over the past week. Notably, this represents a 243% increase from the $2.8 billion daily transaction volume recorded in late August last year.

⚡️ Litecoin doesn’t typically get the social media hype of other top cap cryptocurrencies like XRP, Solana, Chainlink or Cardano. But on the back of some legitimate ETF rumors, it has quietly seen a big jump in value recently. From February 2 to February 19, 2025, Litecoin’s… pic.twitter.com/FSRpoKt2zd

— Santiment (@santimentfeed) February 20, 2025

This growth in market capitalization and transaction volume coincides with increased optimism surrounding the potential approval of a Litecoin spot ETF. ETF analyst Eric Balchunas has estimated a 90% chance of such an approval within this year.

Doesnt mean it’s approved or ready to start trading, but it does show the issuer is making preparations for when it is. We still at 90% odds. $LTCC https://t.co/ugQgsO9fIB

— Eric Balchunas (@EricBalchunas) February 21, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.