Highlights:

- Missouri, Kentucky, and Iowa introduced bills to establish Bitcoin reserves for state funds.

- Utah and Arizona advance Bitcoin reserve bills, nearing final approval in their legislatures.

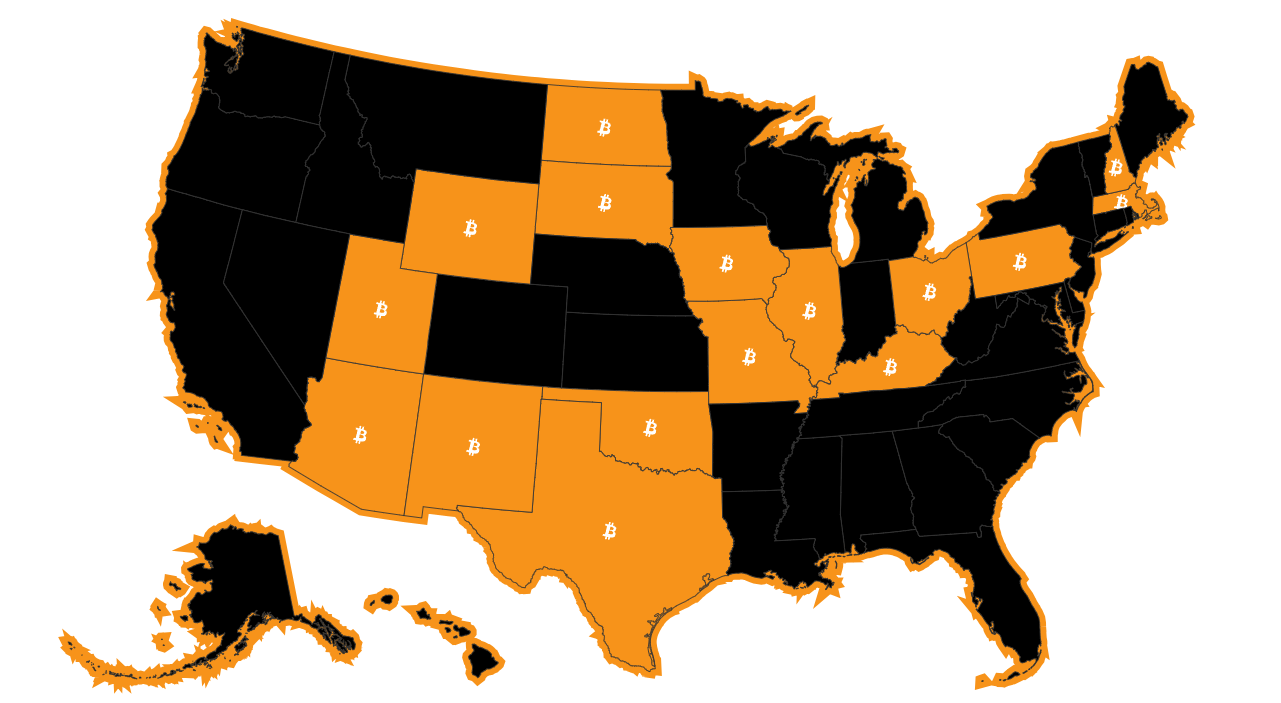

- 17 U.S. states are actively discussing Bitcoin as part of public financial strategies.

On February 6, Missouri, Kentucky, and Iowa introduced bills to establish Bitcoin reserve funds, joining a growing list of states exploring BTC in public finance. These developments coincide with Utah’s House Bill 230, which passed the House yesterday and is now headed to the Senate. As of February 7, 17 out of 50 U.S. states are discussing Bitcoin strategic reserves, per bitcoinlaws.io.

Missouri’s HB 1217 Seeks to Establish a Bitcoin Reserve Fund

On Thursday, Keathley introduced HB 1217, advocating for Missouri to add Bitcoin to its investment portfolio as a hedge against fiat inflation. If enacted, the bill will permit Missouri’s state treasurer to acquire, invest in, and hold Bitcoin under specific conditions.

Today I filed HB 1217 which would authorize Missouri to hold and accept Bitcoin for state payments. This will help diversify our state’s portfolio while hedging against inflation. #moleg https://t.co/tokLpGlWMJ

— Rep. Ben Keathley (@benKeath) February 7, 2025

This marks Missouri’s second Bitcoin-related proposal, following Senate Bill 614, introduced on Feb. 3, which seeks to allocate 10% of public funds to Bitcoin. Unlike SB614, HB 1217 has no investment cap, requires the government to accept crypto payments, and mandates a minimum 5-year holding period for Bitcoin. Keathley’s bill also outlines a long-term Bitcoin holding strategy for the state.

The bill states:

“The treasurer shall store all Bitcoin collected under sub-section 2 of this section for a minimum of five years from the date that the Bitcoin enters the state’s custody.”

Iowa’s HF 246 Paves the Way for Bitcoin and Digital Asset Reserves

Meanwhile, Iowa lawmakers have proposed House File 246 (HF 246), allowing the state treasurer to allocate up to 5% of public funds to digital assets, precious metals, and stablecoins. Sponsored by Representative Collins, the bill applies to assets with a market cap over $750 billion and permits investments from the general fund, cash reserve fund, and economic emergency fund.

The bill considers Bitcoin a valid investment since its market cap exceeds $750 billion. If approved, Iowa would join other states in integrating BTC into their public finance plans.

🚨 NEW: IOWA BITCOIN RESERVE BILL

HF 246 would allow investment of 5% of public monies in digital assets of $750b+ market cap (i.e. Bitcoin) pic.twitter.com/rxOFswvVEO

— Julian Fahrer (@Julian__Fahrer) February 6, 2025

Kentucky Proposes Bitcoin Reserve Bill HB 376 for State Funds

As Bitcoin gains traction in state-level finance, Kentucky also proposed a Bitcoin reserve bill yesterday. Kentucky State Representative TJ Roberts has introduced Bill HB 376, proposing up to 10% of state funds be invested in digital assets with a market cap of over $750 billion. While not limited to Bitcoin, it remains the only qualifying cryptocurrency under this criterion.

🚨 NEW: KENTUCKY BITCOIN RESERVE BILL

HB376 would allow Kentucky to invest up to 10% of state funds in digital assets with $750b+ market cap.

Kentucky is now the 16th state to introduced a Bitcoin Reserve bill. pic.twitter.com/ZbffwtgDNV

— Julian Fahrer (@Julian__Fahrer) February 6, 2025

Utah and Arizona Push BTC Reserve Bills Toward Final Approval

Utah is moving closer to becoming the first US state with a Bitcoin reserve as its strategic Bitcoin reserve bill advances to the Senate. “The ‘Strategic Bitcoin Reserve’ bill has officially passed the House in the state of Utah,” said Satoshi Action Fund founder and CEO Dennis Porter on Feb. 6. “The bill now moves onto the Senate,” he added.

On Jan. 28, the Utah House Economic Development Committee approved HB 230, the Blockchain and Digital Innovation Amendments bill, with an 8-1 vote. Proposed by Representative Jordan Teuscher on Jan. 21, the bill allows the state treasurer to allocate up to 5% of certain public funds to “qualifying digital assets,” including Bitcoin, top cryptocurrencies, and stablecoins.

Arizona is the only other US state with a similar bill nearing approval. The Strategic Bitcoin Reserve Act (SB 1025), backed by Senator Wendy Rogers and Representative Jeff Weninger, cleared the Senate Finance Committee on Jan. 27 and now awaits a House vote.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.