Highlights:

- Crypto liquidations soared to $2.16 billion amid Trump’s tariff plans, triggering heightened volatility.

- Bitcoin price dropped below $94k as inflation fears and market uncertainty intensified.

- Analyst Jeff Park forecasts tariffs to boost Bitcoin long-term despite volatility and turbulence.

Crypto market liquidations soared to $2.16 billion as Bitcoin hit its lowest point since early January. The decline followed President Trump’s tariff announcement, raising inflation fears. On Feb 1, Trump revealed plans to enforce a 25% tariff on imports from Canada and Mexico, alongside a 10% tariff on Chinese goods. These tariffs, aimed at the US’s three biggest trading partners, are set to take effect on Tuesday.

Tariffs may drive inflation higher, possibly triggering interest rate hikes. This often pushes investors away from volatile assets like crypto, favoring safer options such as bonds and term deposits.

— Donald J. Trump (@realDonaldTrump) February 1, 2025

Following Trump’s announcement, Canadian Prime Minister Justin Trudeau declared in a press conference that a 25% tariff would be placed on $106.5 billion worth of US goods.

Meanwhile, China’s Ministry of Commerce stated it plans to file a complaint with the World Trade Organization (WTO) and implement countermeasures in response. Mexican President Claudia Sheinbaum shared in a detailed X post that she has directed the Secretary of Economy to activate “plan B,” which involves both tariff and non-tariff measures to safeguard Mexico’s interests.

Rechazamos categóricamente la calumnia que hace la Casa Blanca al Gobierno de México de tener alianzas con organizaciones criminales, así como cualquier intención injerencista en nuestro territorio.

Si en algún lugar existe tal alianza es en las armerías de los Estados Unidos…

— Claudia Sheinbaum Pardo (@Claudiashein) February 2, 2025

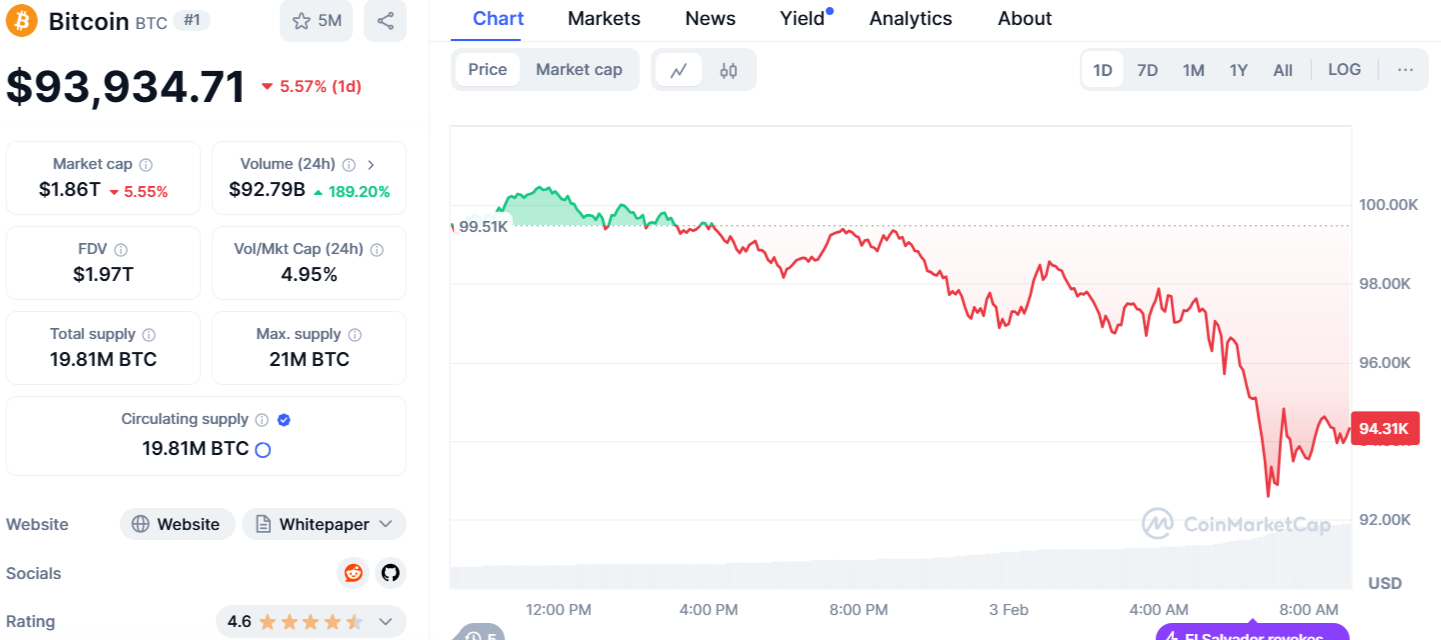

The tariff announcement has stirred volatility in the crypto market as investors responded to growing inflation concerns. Bitcoin slipped under $100,000 on Feb 2. As of writing, BTC is trading at $93,924, showing a 5.57% decline in the last 24 hours, while Ethereum has dropped 19% to $2,491, according to CoinMarketCap data.

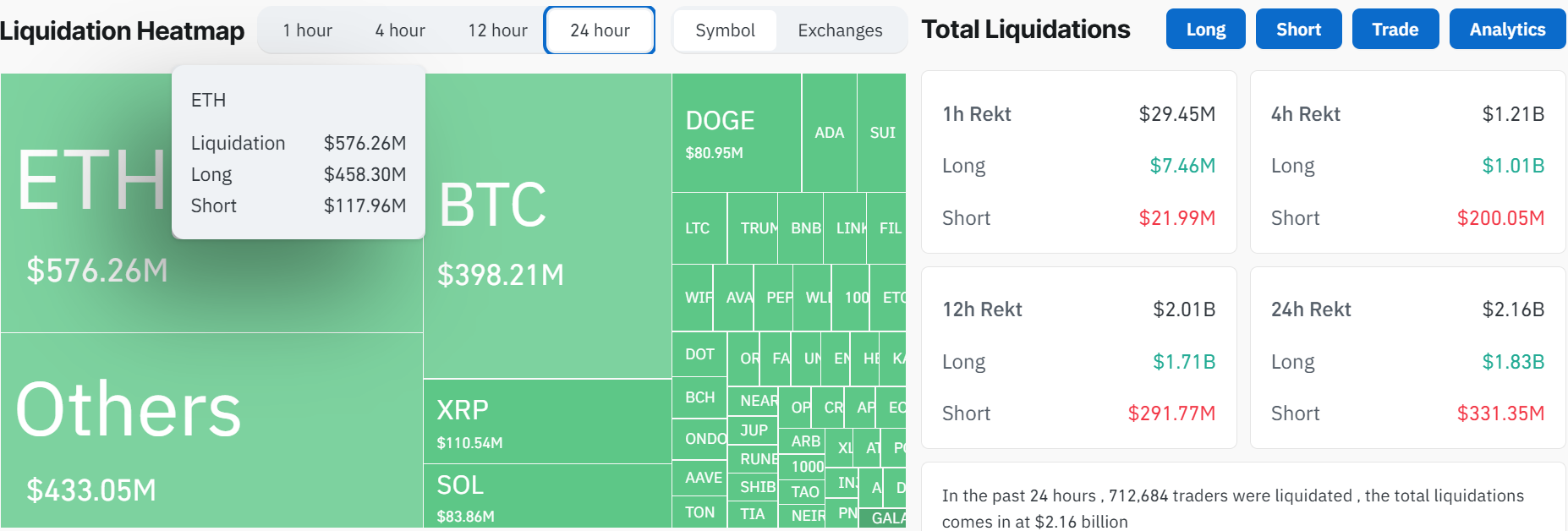

Crypto Market Sees $2.16 Billion in Liquidations

The market-wide downturn led to $331.35 million in short and $1.83 billion in long liquidations. This wave of liquidations impacted 712,684 traders, with Binance and OKX seeing the highest figures at $809 million and $459 million, respectively.

Bitcoin faced $398.21 million in liquidations, including $335.78 million from longs and $62.43 million from shorts. Ethereum recorded $576.26 million in liquidations — $458.30 million from longs and $117.96 million from shorts.

The total crypto market cap contracted by nearly 10.7%, with many assets experiencing double-digit losses in a single day. XRP and DOGE plunged 22%, ADA tumbled 27%, while SOL and BNB dropped 8% and 16%, respectively.

Trump’s Trade War Could Push BTC Price ‘Violently Higher,’ Says Analyst

Experts suggest that Trump’s newly imposed tariffs might drive higher demand for Bitcoin as a hedge against inflation. However, many warn that persistent market turbulence could keep prices under pressure in the near term.

Jeff Park, head of alpha strategies at BitWise, argues that President Donald Trump’s tariffs will drive the BTC price “violently higher” in the long term. This is due to a weaker US dollar in global currency markets and lower yields on US government securities. The analyst suggests that the tariffs are part of a broader strategy to weaken the dollar in international trade. The goal is to correct trade imbalances and make US exports more competitive.

Park stated that “Plaza Accord 2.0 is coming,” referring to the 1985 agreement between the US, Japan, West Germany, France, and the UK to weaken the US dollar. He further explained that the tariffs will drive up inflation, hitting US trading partners hardest. This, in turn, will lead to greater currency debasement worldwide, prompting citizens in those countries to seek alternative store-of-value assets such as Bitcoin.

This is the only thing you need to read about tariffs to understand Bitcoin for 2025. This is undoubtedly my highest conviction macro trade for the year: Plaza Accord 2.0 is coming.

Bookmark this and revisit as the financial war unravels sending Bitcoin violently higher. pic.twitter.com/WxMB36Yv8o

— Jeff Park (@dgt10011) February 2, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.