Highlights:

- The Litecoin price has rallied 13% to $127 as the market reacts positively to the Fed’s holding interest rates steady.

- The recent rally comes as the SEC has officially acknowledged Canary Capital’s application for their Litecoin ETF.

- Coinglass data indicates further upside as the open interest and volume spike.

The Litecoin price has surged 12% to $127 as the market reacted positively to the Fed holding interest rates steady. Accompanying the price movement is its daily trading volume, which has skyrocketed 131% to $1.29 billion, indicating heightened market activity. LTC is now up 14% in a week, 27% in a month, and a whopping 89% in a year.

Meanwhile, the SEC is expected to approve Canary’s Litecoin (LTC) Exchange Traded Fund (ETF) soon, fueling LTC’s bullish bias. This now opens the 21-day window for public comments. If approved, investors could buy LTC through brokerage accounts.

SEC FINALLY CONSIDERS LITECOIN ETF – IS ALTCOIN SEASON HERE?

The SEC just acknowledged Canary Capital’s spot Litecoin ETF filing, meaning it’s now open for public comment.

If approved, investors could buy LTC through brokerage accounts—no wallets, no stress.

Nasdaq will list… pic.twitter.com/ZzUUqrqbRT

— Mario Nawfal’s Roundtable (@RoundtableSpace) January 30, 2025

LTC Statistical Data

Based on CoinmarketCap data:

- LTC price now – $127

- Trading volume (24h) – $1.29 billion

- Market cap – $9.6 billion

- Total supply – 84 million

- Circulating supply – 75.47 million

- LTC ranking – #18

Litecoin Price Poised for a Bullish Continuation

LTC/USD currently shows considerable strength, positioning itself as one of the top-performing cryptocurrencies. Against USD, LTC demonstrates significant upward momentum, fueled by positive market sentiment and technical indicators. Historically, Litecoin price struggles to break the $135-$140 resistance levels without strong market conditions and higher trading volumes. At present, the bulls are showing strength, forming a stable base for potential upward movements.

Looking at the daily chart, the Litecoin price reveals a continuation of bullish momentum as the price trades at $127, comfortably above both the 50-day Moving Average (MA) at $111 and the 200-day MA at $83.

The cup and handle pattern supports the upward trend, with the next significant resistance levels at $132, $135, and $140, respectively. If the price sustains this upward trajectory, a breakout above this resistance could signal further gains, potentially leading toward $150 in the medium term.

On the downside, if the bulls lose momentum, the price may retest the immediate support level at $115, near the 50-day MA. A break below this level could push the price further down to $111, $107, and $101, which represents a strong support zone. For now, the price action remains bullish as long as the LTC price stays above the moving averages.

Technical Indicators Show Further Upside

A closer look at the RSI, it sits above the 50-mean level at 59.06. Its northbound position suggests intense buying activity in the Litecoin market. Moreover, there is still more room for the upside until LTC is considered overbought.

The MACD indicator also upholds a buy signal, calling for traders to rally behind LTC. This is evident as the blue MACD line(2.5975)has crossed above the orange signal line(2.5731), reinforcing a bullish sentiment.

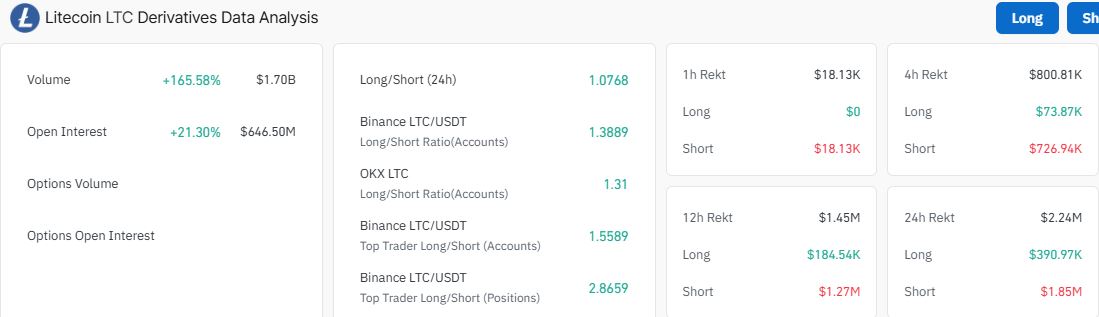

Elsewhere, Coinglass data shows a rise in open interest by 21% to $646.50M, while the volume is up 165% to $1.70B. This signals increased market activity, with more traders entering positions and actively buying and selling Litecoin. This may cause a strong upward movement in Litecoin price potentially to $150 levels.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.