Highlights:

- The Hashgraph Association partners with Taurus to enhance HBAR custody, staking, and tokenization.

- Taurus integrates Hedera’s ecosystem to enhance digital asset accessibility in Europe, Asia, the Middle East, and Africa.

- Hedera leverages fast, secure, and sustainable DLT for global institutional adoption.

The Hashgraph Association has entered into a partnership with Taurus, a leading digital asset infrastructure provider. As outlined in the blog post, the collaboration will see HBAR cryptocurrency and Hedera Token Service (HTS) offered on Taurus platforms. The move aims to expand the offering of custody, staking and tokenization solutions for financial services providers across the globe.

The technology stack of Taurus will allow banks and enterprises to have a secure way of storing and staking HBAR. It will also enable them to create tokenized assets on the Hedera network. These services will meet high standards of the regulatory framework and security. Furthermore, the integration will provide Hedera’s fast, sustainable, and secure distributed ledger technology.

The partnership focuses on high-growth areas, such as Europe, Asia, the Middle East and Africa. It is well placed to take advantage of the regulatory certainty in these areas, enabling institutional adoption of decentralized enterprise-grade solutions.

🤝 We’re excited to partner with @The_Hashgraph Association to drive global adoption of Hedera’s DLT in fast-growing regions. This strategic collaboration will bring HBAR and the Hedera Token Service (HTS) to Taurus’ platform.

Read more: https://t.co/U1tDvnr22z pic.twitter.com/mx5W9r3CoB

— Taurus (@taurus_hq) January 20, 2025

Global Expansion into Financial Markets

This partnership between The Hashgraph Association and Taurus coincides with the rise in demand for digital assets. This partnership will let financial institutions interact with the Hedera ecosystem with confidence. This is especially the case in regions where legal frameworks are already quite clear – for instance, in Europe with the help of MiCA.

Hedera’s distributed ledger technology is based on the Hashgraph consensus algorithm. Its carbon-negative footprint and low fees make this network suitable for the business world. This is because its governance by 32 global organizations provides a secure and scalable business infrastructure.

Integrating HBAR into Taurus platforms reflects the company’s dedication to embracing advanced blockchain technologies. This integration will enhance secure asset management and staking solutions for institutions, stepping up Hedera’s business in the fundamental markets globally.

Addressing Tokenization Challenges

Tokenization of real-world assets (RWAs) has its own challenges, such as fragmentary regulation and ownership concerns. The Hashgraph Association and Taurus are working to overcome these challenges. They intend to build systems that improve the consistency and reliability of tokenization processes.

Tokenization investments are becoming popular in the Middle East and North Africa (MENA). For instance, tokenized real estate and Islamic finance point to the potential of the region. The Hashgraph Association has been engaged in Qatar, considering business applications such as equity tokenization and carbon credits.

The Hashgraph Association explores five tokenization use cases in Qatar.@The_Hashgraph & @QFCAuthority will explore five digital asset use cases, boosting Qatar's Web3 ecosystem with a $50 million initiative.

Learn more: https://t.co/e374Ly0qdB

Source: @laraonzeblock pic.twitter.com/iHPTGIHlNH

— Inacta Ventures (@InactaVentures) September 20, 2024

The partnership also aligns with Hedera’s commitment to innovation in distributed ledger technology. The association will partner with stakeholders to minimize risks and endorse policies and laws guaranteeing secure and smooth tokenization for investors and companies.

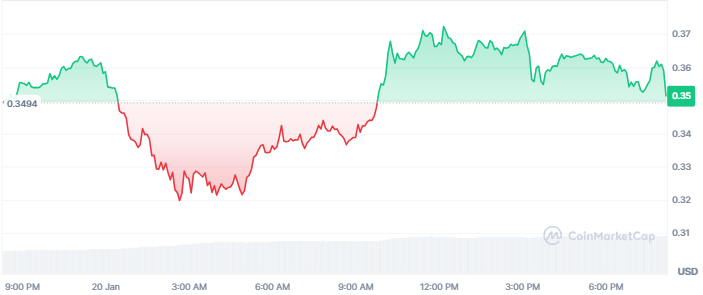

The partnership announcement did not significantly influence Hedera’s native token (HBAR) price. As of press time, HBAR is exchanging hands at $0.35, with a modest gain of 0.20% in the past 24 hours.

The altcoin has surged 30% and 37% on the weekly and monthly charts, respectively. Furthermore, its market cap and trading volume have climbed to $13.4 billion and $1.6 billion, respectively.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.