Highlights:

- Ethereum price soars 6% to $3479 as of writing.

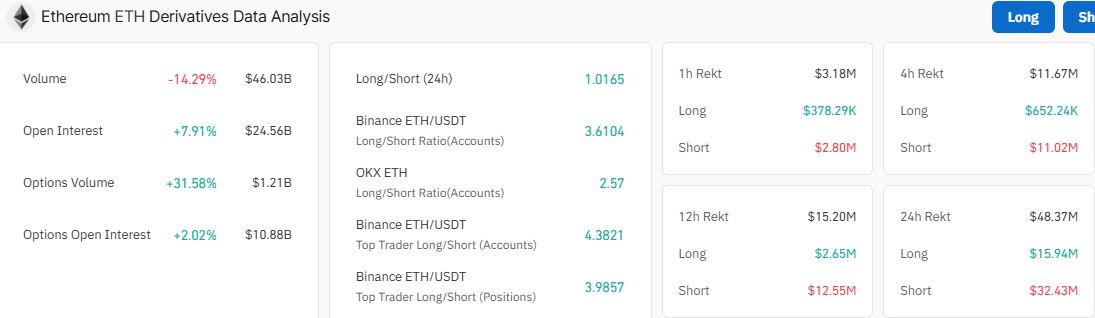

- ETH’s open interest has surged despite a slight plunge in volume, according to Coinglass data.

- If the bulls gain momentum at this level, the bulls could rally to $3720 in the short term.

The Ethereum price has bottomed out, skyrocketing 6% to $3479 at press time. The growing interest in the token has seen the market cap spike by more than 6% to $419.8 billion, despite a plunge in its daily trading volume. ETH is now up 5% in a month, 52% in a year, despite an 11% drop in the past week.

Meanwhile, ETH’s Open interest has soared 7% to $24.56 Billion, despite a slight fall in volume by 14% to $46.03 billion. This suggests that there are many open contracts, but few are being actively traded. This could indicate a lack of recent interest in the security, which may lead to reduced liquidity in the ETH market.

Elsewhere, a renowned analyst, Ali Charts, has predicted that Ethereum’s most significant support level is between $3,030 and $3,130. Further, the most significant resistance wall is $3,640 – $3,740. A sustained close outside of this no-trade zone will determine the direction of ETH’s trend.

The most significant support level for #Ethereum $ETH is between $3,030 – $3,130, and the most significant resistance wall is $3,640 – $3,740. A sustained close outside of this no-trade zone will determine the direction of #ETH's trend. pic.twitter.com/YCGKucGvjt

— Ali (@ali_charts) December 23, 2024

Ethereum Statistical Data

Based on CoinmarketCap data:

- ETH price now – $3,479

- Trading volume (24h) – $28.12 billion

- Market cap – $419.8 billion

- Total supply – 120.45 million

- Circulating supply – 120.45 million

- ETH ranking – #2

Ethereum Price Bottoms Out – Is $3720 the Next Reach?

The Ethereum price has recently bottomed out, showing that the bulls are gaining momentum. This is evident as the ETH price has risen 13% from its recent low, currently trading at $3,466. Further, Ethereum holds above most bullish indicators in the short term, with the 50-day SMA (green) and the 200-day SMA (blue) in line to offer support.

However, to be safe, bulls must uphold higher support at $3720 to encourage already sidelined investors to join the uptrend without worrying about sudden corrections. Moreover, any significant increase in the buying pressure could result in a strong comeback for the altcoin, allowing it to retest the $4087 mark.

The rising RSI momentum shows that the bulls are persisting in their efforts to gain control. Meanwhile, the Relative Strength Index (RSI) is hurtling towards the 50-mean level, currently sitting at 45.81. Furthermore, its position below 70 indicates that there remains significant room for the upside before ETH is considered overbought.

However, the moving average convergence divergence (MACD) has introduced a new bearish outlook. This is manifested as the blue MACD line crossed below the orange signal line. This suggests that it is pulling away from the MACD line, which means it is delaying the buy signal.

That said, if the sellers persist and eventually gain control, bolstered by the bearish MACD indicator, Ethereum’s price could breach the $3459 support, coinciding with the 50-day SMA. Nevertheless, the bullish sentiment for the Ethereum price would only be invalidated below the $3044 support. Such a move would also indicate a change in market structure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.