Highlights:

- Bitcoin Price slumps 1% to trade at $98,216 despite rising trading volume.

- Coinglass data suggests a potential shift in sentiment in the Bitcoin price direction in the near term.

- Amazon Receives a Proposal to add Bitcoin to its treasury at shareholders’ request.

Bitcoin price has opened trade at $101,602, despite decreasing 1% to trade at the time of writing. Currently, BTC is down 1% to trade at $98,216, as the trading volume rises, which has soared 68% to $63.75 billion. Despite the recent fall in BTC price, the ‘’King of Crypto’’ is still showing signs of rising above the $100K level this week.

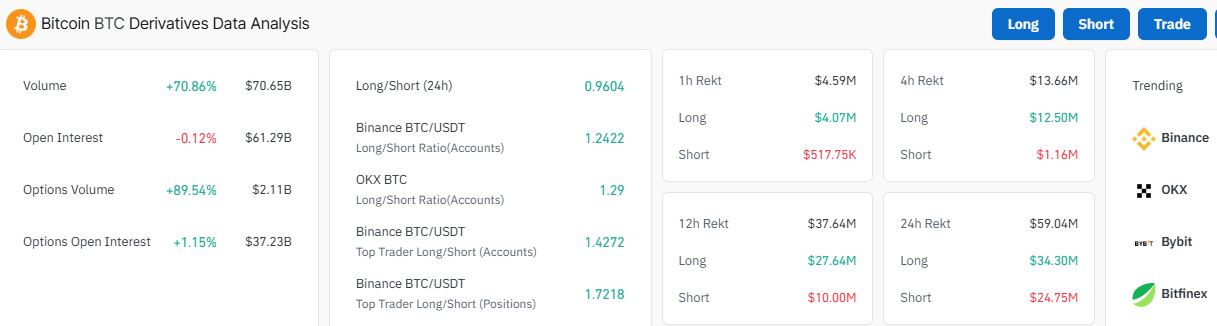

Meanwhile, according to Coinglass data, there have been at least $59.04 million in BTC liquidations in the last 24 hours. The lion’s share, approximately $34.30M, was accounted for by longs, with shorts taking up the rest, at least $24.75M.

Furthermore, data signals investors may be preparing for a potential move soon. The Open Interest in the Derivatives analysis has slumped 0.12%. However, the volume has surged 70% to $70.65 billion. This suggests a potential shift in sentiment in the Bitcoin price direction in the near term.

Amazon Shareholders Petition to Add Bitcoin to the Company’s Treasury

Bolstering the bullish sentiments are the recent developments in Amazon’s receipt of a proposal to add Bitcoin to its treasury at shareholders’ request. In a recent post on X, prominent Bitcoin Treasuries journalist Tim Kotzman revealed that Amazon shareholders petitioned the board to consider adding Bitcoin to the company’s treasury at the 2025 shareholders meeting.

The National Center for Public Policy Research has submitted the attached shareholder proposal to https://t.co/Lve7Kg1nVI, Inc. for consideration at the 2025 annual shareholder meeting.

Shareholders request that the Board assess adding #Bitcoin to the Company’s Treasury pic.twitter.com/lsgHC0aGrt

— Tim Kotzman (@TimKotzman) December 8, 2024

According to the Shareholder’s supporting document, Amazon has $585 billion in total assets, $88 billion of which is cash, cash equivalents, and marketable securities, including US government bonds, foreign government bonds and corporate bonds.

Meanwhile, speculation is growing that the U.S. government may establish a Bitcoin strategic reserve as early as 2025. This may be a significant factor that could sway the Amazon board to adopt the Bitcoin purchase strategy.

Bitcoin Statistical Data

Based on CoinmarketCap data:

- BTC price now – $98,216

- Trading volume (24h) – $63.75 billion

- Market cap – $1.93 trillion

- Total supply – 19.79 million

- Circulating supply – 19.79 million

- BTC ranking – #1

After rallying above the $100,000 physiological level in the past week, Bitcoin’s price is consolidating as the crypto market cools off. Currently, the pioneering cryptocurrency is oscillating between $91,810 and $101,602, which might act as an accumulation period before a strong leg up above ATH.

The BTC price has increased since 5 Nov, following the establishment of support at $84,753. Bulls took the reins entirely after BTC dispersed the seller congestion at $90,000. Trading above all the above moving averages, including the 200-day SMA (blue) and 50-day SMA (green), reduced the sellers’ influence, leaving Bitcoin’s price on a resistance-free uptrend.

Based on the Relative Strength Index (RSI), it sits at 65.08, tilting the odds in favor of the buyers. However, with the falling momentum, the RSI has plunged from the overbought regions, allowing traders to buy BTC tokens at a lower price. Increased pressure in either direction will see the RSI rise or fall.

Bitcoin Price Outlook

Based on the daily chart timeframe, the BTC bulls have put their best feet forward, quashing their seller counterparts. However, as the BTC price is consolidating, traders should rush to buy the lower-priced BTC tokens before the substantial rally.

This is because the consolidation phase may act as an accumulation period, initiating a strong upward trajectory and obliterating its recent ATH at $104,000 to $110,000. On the flip side, if the sellers step into the market, a breach and break below the 91,810 support level will see the BTC price chase the $87,023 mark.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.