Highlights:

- Ethereum ETFs saw $428 million in inflows on Thursday, marking record growth.

- BlackRock’s iShares Ethereum Trust led with $295.7 million in daily inflows.

- Bitcoin surged to $104,000, boosting its market dominance and challenging altcoin growth.

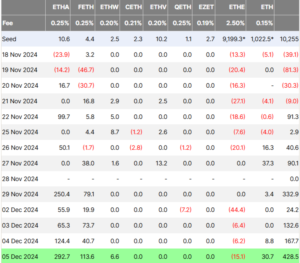

According to data from Farside Investors, the nine Spot Ethereum (ETH) exchange-traded funds (ETFs) in the United States collectively saw $428.5 million in inflows on December 5. This was their ninth straight day of net positive flows, exceeding the previous record of $333 million set on November 29.

The inflow surge aligns with Ether’s price rally. On December 5, Ether reached an eight-month high of $3,946, marking a 14.5% gain over the past two weeks. At press time, it was trading at $3,874, reflecting a %1.12 decrease.

The spot Ethereum ETFs have seen daily net positives since Nov. 21. Over the past two weeks, they have accumulated over $1.3 billion. The recent recovery is partly due to the stabilization of Grayscale’s Ethereum Trust (ETHE), which was previously under pressure. Fidelity’s Ether Fund (FETH) saw inflows of $113.6 million for the day. Grayscale’s Ethereum Mini Trust (ETH) attracted $30.7 million, while the Bitwise Ethereum ETF (ETHW) brought in $6.6 million. Grayscale’s Ethereum Trust (ETHE) experienced an outflow of $15.1 million, and the remaining funds had no inflows or outflows.

BlackRock’s Ethereum ETF Hits New Milestone

BlackRock’s iShares Ether ETF (ETHA) recorded its largest daily inflows on Thursday, totaling $292.7 million. Over the past week, BlackRock’s Ethereum ETF accounted for most of the inflows, bringing in $800 million over the last five trading days. The ETHA currently holds 837.5K ETH, valued at $3.27 billion, solidifying its position as a key player in the market. Since its launch in July, the iShares ETH ETF has garnered about $2.6 billion in inflows. This shows rising investor interest in Ethereum-focused products.

Ethereum ETFs Reach Milestone Despite Challenges, Says Nate Geraci

Nate Geraci, President of ETF Store, stated that the ETFs reached this milestone. This achievement came despite facing significant challenges. These challenges involved limitations on staking capabilities and $3.5 billion in outflows from Grayscale’s ETHE. Additionally, there is a lack of options trading for Ether ETFs.

Spot eth ETFs now w/ over $1.3bil net inflows since July launch…

Have done this despite:

1) Nearly $3.5bil outflows from ETHE

2) No staking allowed

3) No options trading

4) No in-kind creation/redemption

5) Very limited access to major wirehouses (plus Vanguard)

Not bad.

— Nate Geraci (@NateGeraci) December 6, 2024

Strong Growth in U.S. Spot Bitcoin ETFs

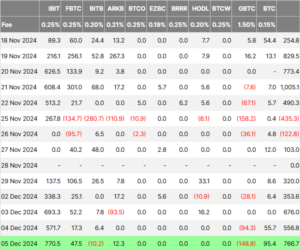

Besides Ethereum ETFs, spot Bitcoin ETFs in the U.S. showed strong growth. On December 5, 11 funds collectively attracted $747.8 million in inflows. BlackRock’s iShares Bitcoin Trust (IBIT) took the lead, bringing in $751.6 million. This offset the $148.8 million outflow from Grayscale’s Bitcoin Trust (GBTC). The BlackRock Bitcoin ETF has accumulated nearly $34 billion in inflows since its launch. The total trading volume for these ETFs surged to $7.1 billion, marking a 50% increase from the previous day’s $4.71 billion.

On Thursday, BTC soared to a record high of $104,000, boosting its market dominance by 4.4% to 57%. This surge challenges the idea of an impending “altcoin season,” where alternative cryptocurrencies typically outperform Bitcoin. On Dec. 6, Bitcoin dropped below $98,000. It recovered slightly to over $98,000 but remains 4% lower over the past 24 hours.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.