Highlights:

- Dogecoin price plunges 9% to trade at $0.39 as trading volume declines.

- The broader market decline, led by Bitcoin, adds to Dogecoin’s pullback challenges.

- With the falling RSI momentum, the Dogecoin price may experience potential short-term downward pressure.

The Dogecoin price is down 9%, trading at $0.3961 at press time. Its daily trading volume has notably plunged 7% to 9.72 billion, showing a fall in market activity. Despite the fall, DOGE is up 1% in a week, 184% in a month, and 401% in a year.

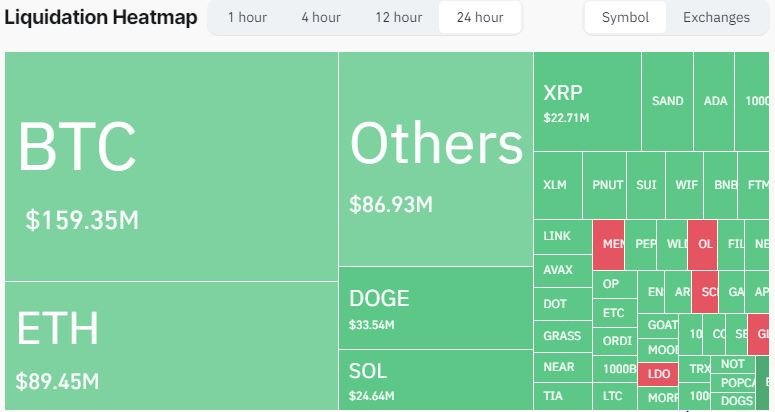

In the past 24 hours, 177,523 traders were liquidated, for a total of $569.97 million. The largest single liquidation order was on Binance—BTCUSDT, valued at $4.67M. Meanwhile, the Dogecoin market witnessed a major shakeup as a $6.07M short position was liquidated, and the long position took the more significant liquidation of $27.47M. Fueled by excessive optimism, the over-leveraged market appears to have exacerbated DOGE’s decline as traders were forced to sell during the broader downturn.

Dogecoin’s decline aligns with a market-wide pullback led by Bitcoin (BTC). After nearing the critical $100,000 threshold, Bitcoin dropped to $93,633, triggering liquidations across the cryptocurrency market. In the past 24 hours, total liquidations reached $490 million, with altcoins accounting for most of these positions.

Dogecoin Statistical Data

Based on CoinmarketCap data:

- DOGE price now – $0.3961

- Trading volume (24h) – $9.72 billion

- Market cap – $58.20 billion

- Total supply – 146.95 billion

- Circulating supply – 146.95 billion

- DOGE ranking – #7

Dogecoin Price Enters a Consolidation Phase

Dogecoin’s recent rally may be taking a breather as the meme coin pushes into a consolidation phase. The leading meme coin is down almost 20% from its $0.48 high at press time. However, this short-term cooling off may allow investors and traders to enter the market as they rush to buy lower-priced DOGE tokens.

However, despite the slight pullback, the bulls still have the upper hand in the market. They have flipped the 50-day MA at $0.225 and the 200-day MA at $0.148 into immediate support levels, steadying the positive outlook. Moreover, if the support levels stay intact, the bulls might initiate a strong leg up, reclaiming the $0.48 mark.

The RSI has notably plunged from the 70-overbought zone, currently at 67.62. With the falling momentum, if the bulls don’t step in at this level, the bears could take the reigns dwindling the RSI below the 50-mean level. However, if the bulls gain momentum at this level, the RSI could rise to the overbought region.

The MACD indicator introduces a new bearish outlook. While traders sought exposure to DOGE as the blue MACD line crossed above the orange signal line, they were likely to close positions if the opposite happened. In other words, traders will be inclined to sell as the blue MACD line has flipped below the orange signal line.

Dogecoin Price Outlook

Dogecoin’s recent price action shows a consolidation phase. The meme coin price oscillates between $0.35 and $0.43, with resistance around $0.44. A breakout above this level, supported by rising trading volume, could potentially push toward $0.53, representing a 36% gain. In a highly bullish case, DOGE could hit $1.

However, the lack of a confirmed breakout raises the likelihood of a further pullback. If selling pressure continues, Dogecoin could test support at around $0.35, a critical level determining whether the token enters a more significant correction.