Highlights:

- Bitcoin ETFs faced significant outflows on Nov. 25, with BITB and GBTC seeing their largest withdrawals.

- BlackRock’s iShares Bitcoin Trust (IBIT) remained a standout performer, attracting $267.8 million in net inflows.

- BTC’s drop triggered widespread liquidations, totaling $520 million, impacting numerous traders.

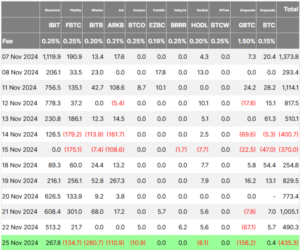

Spot Bitcoin (BTC) exchange-traded funds (ETFs) in the United States saw net outflows totaling $435.3 million, ending a five-day streak of net inflows. The significant outflows on Nov. 25 coincided with Bitcoin’s 6% drop, falling from $98,850 to $92,775 during early Asian hours. The leading cryptocurrency is now trading around $94,545, down 3.74% in the past 24 hours.

Six Bitcoin ETFs recorded net outflows on Monday. Bitwise’s Bitcoin ETF (BITB) and Grayscale’s Bitcoin Trust (GBTC) experienced significant investor withdrawals. BITB saw its largest-ever outflow of $280.7 million, while GBTC faced its biggest daily redemption in three months, totaling $158.2 million. Fidelity’s Wise Origin Bitcoin Fund (FBTC) and ARK Invest’s Bitcoin ETF (ARKB) experienced outflows of $134.7 million and $110.9 million, respectively. Invesco and Valkyrie’s funds together saw a loss of $19 million.

Positive Flows for BlackRock, Grayscale Bitcoin ETFs

Only two spot Bitcoin ETFs recorded positive flows. BlackRock’s iShares Bitcoin Trust (IBIT), with $31.6 billion in cumulative inflows, saw $267.8 million in net inflows. Grayscale’s Bitcoin Mini Trust (BTC) gained modest inflows of $420,460.

On Monday, the Bitcoin ETFs traded $5.6 billion, a slight increase from Friday’s $5.4 billion. Their total net inflow reached $30.4 billion, with cumulative assets valued at $102.2 billion, representing approximately 5.4% of the total bitcoin market capitalization.

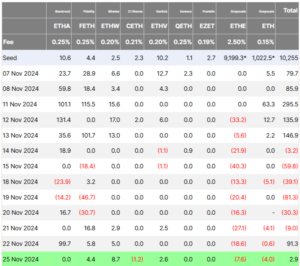

Spot Ethereum ETFs See Modest Inflows

On Nov. 25, the nine spot Ethereum ETFs saw a sharp decline in inflows, with only $2.83 million entering compared to $91.21 million the day before. Bitwise’s ETHW led the way with $8.75 million, followed by Fidelity’s FETH at $4.36 million, and VanEck’s ETHV with $2.55 million in inflows.

Grayscale’s ETHE saw the largest outflows of the day, with $7.65 million exiting the fund. The Grayscale Ethereum Mini Trust and 21Shares’ CETH saw outflows of $3.96 million and $1.22 million, respectively. The other Ethereum ETFs remained neutral.

The total trading volume of the Ether ETFs rose to $711.2 million, up from $373.9 million last Friday. Their cumulative flow reached $109 million. At the time of writing, Ethereum was up 0.15%, trading at $3,398.

Bitcoin’s Drop Leads to $520M in Crypto Liquidations

According to cryptocurrency analytics firm CoinGlass, $520.15 million in crypto was liquidated within the last 24 hours. This included $391.63 million in long positions and $128.52 million in short positions. This widespread liquidation activity has affected 160,206 traders. Most liquidations occurred on Binance and Bybit, totaling $225 million and $123 million, respectively.

Bitcoin saw liquidations totaling $146.65 million, with $117.84 million from long positions and $28.81 million from short positions. ETH recorded liquidations amounting to $86.23 million, comprising $52.58 million from long positions and $33.64 million from short positions. Dogecoin and Solana experienced the liquidation of $31.89 million and $51.52 million, respectively, in the past 24 hours.

Despite the recent market pullback and Bitcoin ETFs outflows, sentiment remains optimistic, with the Fear and Greed Index at 83, indicating “extreme greed.” This strong confidence among traders signals optimism but warrants caution. Historically, such extreme levels may signal a trend reversal or correction. Traders should watch for profit-taking signs, as they could prompt further price declines.