Highlights:

- Singapore Gulf Bank reportedly plans to raise $50 million to acquire a stablecoin payments firm next year.

- The bank also aims to speed up product development, enhance payments, and acquire new talent.

- Stablecoins are gaining popularity for their speed, cost-efficiency, and accessibility over traditional banking systems.

The crypto-friendly digital bank Singapore Gulf Bank is planning plans to raise at least $50 million in a new funding round to acquire a stablecoin payments firm next year, Bloomberg reported on November 25, citing sources familiar with the matter. The bank is now in advanced talks with investors, including a major Middle Eastern sovereign wealth fund, to sell less than 10% of its equity by early next year.

First target for $FTM is 3$

If shit get's crazy then 10-15$

Buying FANTOM right now is literally free money

— Anglio (@CryptoAnglio) November 24, 2024

Gulf Bank Expands Digital Asset Focus with New Funding Round

Gulf Bank, established by the Singaporean family office Whampoa Group, has held a Bahrain license since February. This funding round underscores the bank’s dedication to connecting traditional banking with digital assets.

The funds will be used to speed up product development, improve the bank’s payment network, and strengthen talent acquisition. The bank also plans to acquire a stablecoin-focused payments company in the Middle East or Europe. This move aims to enhance its digital asset payment capabilities. While the bank has not disclosed its valuation or acquisition specifics, the expansion reflects the growing global interest in stablecoins and blockchain-based payment solutions.

Stablecoins and the Expanding Digital Asset Market

Stablecoins, backed by fiat currencies such as the US dollar, are becoming increasingly popular. They offer speed, cost-efficiency, and accessibility compared to traditional banking. Abu Dhabi, Bahrain, and Dubai are positioning themselves as crypto-friendly hubs. Digital asset businesses are taking advantage of increased regulatory clarity and more expansion opportunities.

The timing of this funding coincides with renewed optimism in the crypto sector. This optimism is driven by industry-friendly regulatory prospects in the US under President-elect Donald Trump. Since Trump’s election, the cryptocurrency market has grown by $1 trillion, reaching a market value of $3.35 trillion as of Monday. This growth has raised expectations of a wave of deals in the coming months.

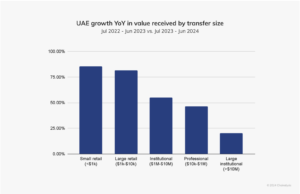

A September report by Chainalysis revealed that the Middle East and North Africa (MENA) region represents 7.5% of global cryptocurrency transactions. The report revealed that 93% of transactions involved amounts of $10,000 or more. This dwarfed small retail investors, who make up only 1.8% of transaction volume. Most on-chain traffic was conducted through centralized exchanges (CEXs). However, the report noted a strong interest in decentralized platforms (DEXs) in Saudi Arabia and the United Arab Emirates.

In a related move, ZA Bank, Hong Kong’s largest virtual bank, has become the first in Asia to offer crypto trading services to retail users. Starting today, the bank’s app will allow users to buy and sell Bitcoin (BTC) and Ethereum (ETH) using US dollars or Hong Kong dollars (HKD).

Hong Kong residents must open an investment account with ZA Bank and complete a risk assessment, along with other required procedures, to qualify for cryptocurrency trading. Wu Zhonghao, interim CEO of ZA Bank, is confident the new service will increase the bank’s revenue through transaction fees.

Hong Kong Bank Just Bridged TradFi And The Blockchain

Hong Kong’s ZA Bank is officially the first in Asia to let retail users trade Bitcoin and Ethereum straight from their app using fiat.

No DEX, no swapping, just seamless, bank-backed crypto trading thanks to their hookup… pic.twitter.com/O2hoZh6T51

— Mario Nawfal’s Roundtable (@RoundtableSpace) November 25, 2024