Highlights:

- The Bitcoin price has elevated by 1% today to trade at $93,487 as trading volume soars.

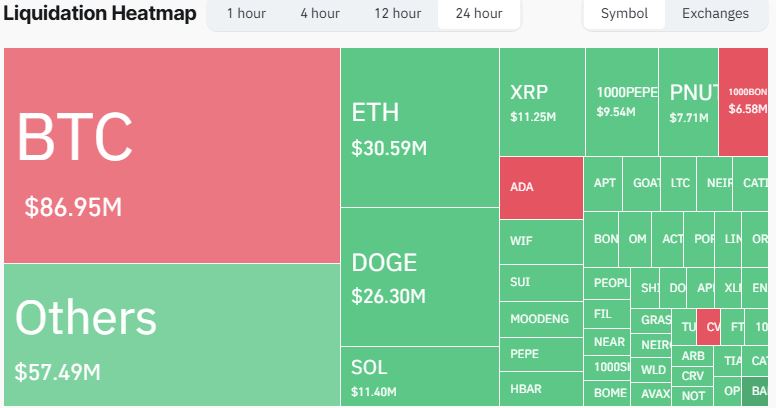

- Coinglass data shows investors are on the edge as $329M in BTC positions are liquidated.

- The launch of options trading for spot Bitcoin ETFs has notably sparked a market frenzy, pushing Bitcoin’s price to $94,000 at its peak.

The Bitcoin price has surged 1% today to trade at $93,487 on Nov 20. Its 24-hour trading volume has notably elevated 7% to 76.57 billion, signaling a rise in market activity. BTC is now boasting a 6% surge in the past week, 37% in a month, and 152% in a year.

Bitcoin is going wild. On-chain metrics show that in the past 24 hours, $328.91 million in Bitcoin positions got liquidated, with longs taking the biggest hit at $208.03 million. The short positions took the remaining $120.87 million. Prices swung between $89,700 and $93,000, according to Coinglass. This volatility shows investors are on edge.

Elsewhere, the launch of options trading for spot Bitcoin ETFs has notably sparked a market frenzy, pushing Bitcoin’s price to $94,000 at its peak. The first day of options trading saw substantial volumes, highlighting traders’ enthusiasm.

🚀 #Bitcoin Hits a New All-Time High! 🚀

$BTC has smashed past $93,900, driven by the launch of options trading for spot Bitcoin ETFs! 🎉

The first day of options trading saw strong volumes, highlighting the enthusiasm from traders. These ETF options provide flexible strategies… pic.twitter.com/7fCr5Odh19

— Sonu (@Sonupatel2000) November 20, 2024

These ETF options provide flexible strategies, such as hedging and leveraging positions, making Bitcoin more appealing to retail and institutional investors.

Bitcoin Statistical Data

Based on CoinmarketCap data:

- BTC price now – $93,329

- Trading volume (24h) – $76.57 billion

- Market cap – $1.85 trillion

- Total supply – 19.78 million

- Circulating supply – 19.78 million

- BTC ranking – #1

Bitcoin Technical Indicators Flash Bullish

The Bitcoin price reached an all-time high of $94,057 on Tuesday, November 19. At the time of writing on Wednesday, November 20, the pioneering cryptocurrency is slightly down around $93,487. If BTC continues its upward momentum, it could extend the rally to retest the anticipated psychological level of $100,000 before 2024 draws the curtains.

Moreover, the BTC price has formed a bullish triangle that shows a potential bullish breakout soon. In the meantime, the Golden Cross in the BTC market suggests a long-term bullish thesis. The bulls have notably established strong support at $75,817 and $90,290, steadying the upward momentum.

Moreover, the Relative Strength Index (RSI) momentum indicator stands at 61.94, tilting the odds towards buyers. Furthermore, its position below 70 indicates significant upside potential before BTC is considered overbought. Increased buying appetite at this level could cause the BTC token to surge to $96,000.

Bitcoin Price Aims for the $100,000 Mark

The BTC bulls have taken the reigns in the market, targeting the $100,000 psychological level. If the support levels stay intact, the bulls could increase their buying appetite and reach the $96,000 mark. In a highly bullish scenario, the BTC price could hit the $100,000 mark before 2024 closes.

Conversely, if the Bitcoin price drops below the $90,290 support level, the $87,014 mark will act as a cushion against further downside. While the levels between $90,290 and $75,817 remain critical to watch, only a slip below $73,450 would invalidate the bullish thesis.