Highlights:

- U.S. spot Bitcoin and Ethereum ETFs saw outflows, ending a six-day streak of positive flows.

- Federal Reserve’s Powell downplays urgent interest rate cuts, leading to Bitcoin and Ethereum price drops.

- BlackRock’s IBIT and Ethereum ETFs show contrasting flows, with significant inflows for ETHA and QETH.

United States-based spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) experienced net outflows on November 14. This ended a six-day streak of positive flows, which had begun after Donald Trump’s election on November 5.

On the same day, Federal Reserve Chair Jerome Powell tempered expectations for an immediate interest rate cut. In a speech in Dallas, Texas, on November 14, Powell noted that the economy’s strength reduced the need for urgent rate cuts. He also emphasized that they would continue monitoring the economy to control inflation.

.@jenniferisms recaps Fed Chair Powell’s speech in Dallas, TX, where he addressed the future of interest rate decisions:

“The economy is not sending any signals that we need to be in a hurry to lower rates,” he said. pic.twitter.com/qBujZg5NRx

— Yahoo Finance (@YahooFinance) November 14, 2024

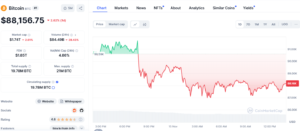

Following this, Bitcoin dropped below the $89,000 mark, trading at $88,156, reflecting a 2.62% decrease over the past 24 hours. Ethereum’s price also dropped, trading at $3,098, reflecting a 2.91% decrease in the previous 24 hours.

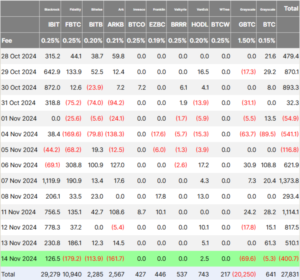

Spot Bitcoin ETFs See Significant Outflows, Led by Fidelity and ARK Funds

According to data from Farside, the 11 spot Bitcoin ETFs saw net outflows of $400.7 million on Thursday. Fidelity Wise Origin Bitcoin Fund (FBTC) led outflows with $179.2 million leaving the fund, its largest daily net outflow since May 1, when it saw $191.1 million in withdrawals. Ark and ARK 21Shares Bitcoin ETF (ARKB) experienced $161.7 million in net outflows, while Bitwise Bitcoin ETF (BITB) recorded withdrawals of $113.9 million, both marking their largest daily withdrawals since inception.

BlackRock’s iShares Bitcoin Trust (IBIT), the largest spot Bitcoin ETF by net assets, was one of only two ETFs to experience positive flows that day. It recorded $126.5 million in net inflows, while VanEck Bitcoin ETF (HODL) saw inflows of $2.5 million. According to Bloomberg analyst Eric Balchunas, IBIT has accumulated more than $40 billion in assets under management (AUM). This milestone was achieved within just 211 days of its launch. The achievement places IBIT in the top 1% of all exchange-traded funds by AUM. Blackrock’s BTC ETF has outperformed all 2,800 ETFs launched over the past decade.

The other five funds experienced no inflows. The total trading volume for these 11 ETFs fell to $4.8 billion on Thursday, down from $8 billion on Wednesday and $5.7 billion on Tuesday.

The BTC ETFs last saw a joint outflow of $116.8 million on election day. This was due to market uncertainty over the presidential race. Polls predicted a tight contest between Trump and Democratic challenger Kamala Harris. Trump’s victory sparked a massive crypto rally, sending Bitcoin soaring about 30% to a peak of nearly $93,500 on November 13.

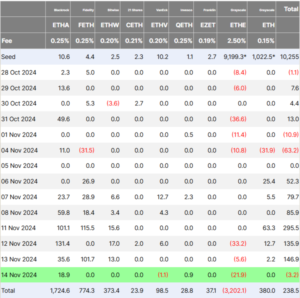

ETH ETFs See $3.2 Million in Outflows After Strong Inflows

Meanwhile, U.S. spot ETH ETFs witnessed $3.2 million in net outflows on Nov. 14. This followed $146.9 million in daily inflows the previous day. Grayscale’s high-fee Ethereum Trust (ETHE) fund experienced $21.9 million in outflows, while VanEck Ethereum ETF (ETHV) saw outflows of $1.1 million. BlackRock’s iShares Ethereum Trust (ETHA) attracted $18.9 million in inflows, and Invesco Galaxy Ethereum ETF (QETH) posted $929,010 in inflows.

The five other ETH ETFs saw no flows. The total trading volume for the nine spot ether ETFs dropped to $439.2 million on Thursday, down from $722.5 million the previous day.