Highlights:

- Strong institutional buying and ETF growth drive Bitcoin’s surge and fuel interest in whether Bitcoin is a buy.

- Pro-crypto policies and a potential U.S. Bitcoin reserve boost Bitcoin’s credibility and adoption.

- High levels of greed and leverage raise risks, while diversification can help reduce investment risk in Bitcoin.

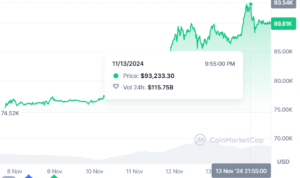

Bitcoin hit a new all-time high of $93,445 on November 13, 2024. Today, it is trading at around $89,900, a drop of about 3.8% from that peak. Trading volume remains high, with about $134 billion in activity over the last 24 hours showing strong interest.

Most of this recent surge comes from institutional buying and FOMO (fear of missing out). According to analysts, Bitcoin’s future is looking bright. According to Changelly, the coin could hit $95,685 by the end of the year. Data from Tradingview indicate support is around $88,000 and resistance is near the recent high of $93,445. With these numbers in mind, investors are asking, “Is Bitcoin a buy?”

The Driving Forces Behind Bitcoin’s New High

Bitcoin’s recent surge is fueled by heavy buying from large institutions. MicroStrategy and Metaplanet have both pulled in impressive Bitcoin reserves. These corporations see Bitcoin as a solid store of value and their accumulation will drive the prices higher.

Nations like Bhutan and El Salvador have held Bitcoin as part of their reserves and have enjoyed the recent price peak. Bhutan’s investment arm holds over 12,000 bitcoins, while El Salvador, the first country to adopt Bitcoin as legal tender, has seen its Bitcoin reserves grow in value.

Bhutan's 12.57k BTC holdings are now over $1.1bn, over a third of the country's GDP.#Bitcoin #StockMarket #Bhutan #Trending #treasure #GDP #India #Crypto #market pic.twitter.com/OI1dyho7QQ

— Nikhil Chaturvedani 🇮🇳 (@Nikhillism_) November 14, 2024

The approval of Bitcoin exchange-traded funds (ETFs) has also sparked institutional interest. U.S. Bitcoin ETFs recently reached the $7.22 bn trading mark. This shows the increase in demand from traditional institutional investors to invest in Bitcoin. Some of the biggest investors and pension funds have now accepted Bitcoin as a real and valid investment instrument increasing the credibility of the market.

What Trump’s Influence Could Mean for Bitcoin

Trump’s pro-crypto policies could lead to a surge in the market. He has recently appointed members who are friendly to crypto into his key cabinet positions. The Department of Government Efficiency proposed by Trump will deal with efficiency in federal systems. He has recently hired Elon Musk and Vivek Ramaswamy to head this new department, indicating a positive inclination towards cryptocurrencies.

Trump announces new Department of Government Efficiency: What is it?

US President-elect Donald Trump has selected Tesla CEO Elon Musk and former GOP presidential candidate Vivek Ramaswamy to head the new Department of Government Efficiency (DOGE).

What is DOGE?

🔘 DOGE is a… pic.twitter.com/hgULBEovkN

— World News Express (@WorldNewsExprex) November 14, 2024

Recently, Bitcoin surpassed silver to become the eighth most valuable asset in the world by market capitalization. Recently, Senator Cynthia Lummis proposed the idea of forming a U.S. Bitcoin reserve to strengthen stock holdings. As the value of Bitcoins increases and it gains recognition, having a reserve at the national level would go a long way in stabilizing the economy and attracting more institutions to invest.

Why Bitcoin May Not Be a Safe Bet

Although Bitcoin has reached its ATH and analysts are predicting further growth, it might not be the best option right now. Diversifying investment choices can reduce risk in a highly volatile market.

The Crypto Fear & Greed Index reached a record high of ‘extreme greed’, which is generally perceived to be bearish and hence a sign of a possible correction soon. In the past, Bitcoin plummeted after it reached such high levels of optimism.

Another issue is high leverage in the market, which means most investors are using borrowed money. In case of a decline in Bitcoin’s price, leveraged positions may lead to liquidation of positions, which in turn may worsen the situation.

There is also more speculation with recent trends such as the rise of new meme coins. Moreover, changes in the regulation that are expected in the future also contribute to uncertainty. Tighter measures would restrain the adoption of Bitcoin, particularly among institutional investors. Based on these factors, it would seem that diversification looks more like a safer approach to investing in Bitcoin.